Peter Thiel entertains what economists would call a “second-best” argument in favor of raising the minimum wage:

“In theory, I’m against it, because people should have the freedom to

contract at whatever wage they’d like to have. But in practice, I think

the alternative to higher minimum wage is that people simply end up

going on welfare.”“And so, given how low the minimum wage is — and how generous the

welfare benefits are — you have a marginal tax rate that’s on the order

of 100 percent, and people are actually trapped in this sort of welfare

state.”“So I actually think that it’s a very out of the box idea — but it’s

something one should consider seriously, given all the other distorted

incentives that exist.”

Is he right? Maybe. A key insight of welfare economics is that one inefficient policy can counter-act another inefficient policy. But does this insight apply in this particular case? Let’s work through matters step by step.

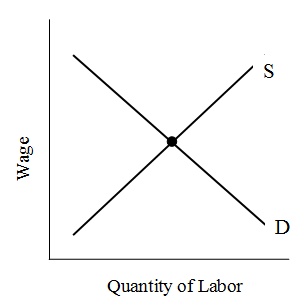

First, imagine laissez-faire. There’s no welfare and no minimum wage. The low-skilled labor market looks just like this:

Figure 1: Low-Skilled Labor Market Under Laissez-Faire

There’s no involuntary unemployment, and the big black dot reveals the wage and quantity of labor.

Now imagine adding a minimum wage – but no welfare – to the mix.

Figure 2: Low-Skilled Labor Market With Minimum Wage But No Welfare

The big black dot still reveals the wage and quantity of labor. Thanks to the minimum wage, though, there’s now a lot of involuntary unemployment, marked in red. This is true despite the fact that the minimum wage increases the incentive to work. Why? Because the minimum wage also reduces the incentive to hire! Since a deal only happens if both demanders and suppliers of labor consent, the quantity of hours worked is the smaller of quantity demanded and quantity supplied.

Under laissez-faire, any able-bodied worker can get a job and stand on

his own two feet. The minimum wage deprives the unfortunate workers

shown in red of their ability to support themselves. Given this involuntary unemployment, the case for welfare is suddenly easier to make. What happens if the government in its mercy puts the unemployed on the dole?

Figure 3: Low-Skilled Labor Market With Minimum Wage and Welfare

With a binding minimum wage, the only clear-cut effect of welfare is to transform involuntary unemployment into voluntary unemployment. That’s why the red line shrinks: Some – though not all – of the workers who craved a job at the minimum wage now shrug, “Eh, now that I’ve got free money, why interview?”

On Thiel’s story, though, Figure 3 doesn’t fit the contemporary labor market. He claims that welfare is now so generous that workers no longer desire minimum wage jobs. Diagrammatically:

Figure 4: Low-Skilled Labor Market With Minimum Wage and High Welfare

Notice: Sufficiently high welfare makes the minimum wage irrelevant. The market now clears at the intersection of the old demand curve D and the new supply curve S”. Since the intersection exceeds the minimum, the minimum has no effect. Thanks to welfare, employment is low. But whatever unemployment you see is voluntary.

OK, now we’re ready to see if Thiel’s story makes sense. Figure 4 roughly describes the world he thinks we’re in. What would happen if, swayed by Thiel’s argument, government raises the minimum wage to counteract welfare’s disincentive effects?

Figure 5: Low-Skilled Labor Market With High Minimum Wage and High Welfare

The answer, as Figure 5 clearly shows, is utterly orthodox: wages rise, employment falls, and involuntary unemployment revives. How is this possible? Simple. Generous welfare benefits do nothing to vitiate the truism that the minimum wage simultaneously raises the incentive to work and cuts the incentive to hire. And as usual, a deal only happens if both demanders and suppliers consent. The market therefore goes to the intersection of quantity demanded and the new minimum wage, with unemployment shown in red.

The lesson: When the minimum wage causes involuntary unemployment, raising welfare can serve as a band-aid for the labor market. Workers deprived of the right to provide for themselves can subsist on government money. Yet when welfare convinces people to abandon honest toil, raising the minimum wage is no band-aid. Instead, raising the minimum wage salts the wounds. The reason, to repeat: While a higher minimum wage does indeed make workers more eager to work, it also automatically makes employers less eager to hire.

I have great respect for Peter Thiel, but his concession to minimum wage advocates is confused. While some inefficient policies can offset the effects of other inefficient policies, the minimum wage is not such a policy. It doesn’t matter if welfare is high, low, or non-existent. The minimum wage causes unemployment by making marginal workers unprofitable to employ.

READER COMMENTS

Jameson

Feb 24 2014 at 2:11am

Wouldn’t a more rational welfare policy shift the supply curve here to the right? You give a subsidy to everyone with low revenue. Then the overall level of employment goes up along with real income of the poor. The only downside is lower wages, which isn’t a real downside if you stop to count both wages and subsidies. It’s labor-side economics.

Vipul Naik

Feb 24 2014 at 2:56am

My diagnosis is that Thiel somehow believed that in the Figure 4 scenario, the minimum wage would act as a maximum wage (employees would be unwilling to pay more than the minimum wage even though the market refuses to clear). Therefore, the solution is to raise the minimum wage until the point that it equals the market-clearing wage of Figure 4.

That’s not a belief consistent with free markets, but at least it’s consistent with Thiel’s logic.

Jamaal

Feb 24 2014 at 3:01am

Isnt this assuming that the demand for labor is relatively elastic?

If we look at high corporate profits and worker priductivity you could infer that the consumers of labor are enjoying a surplus, some of which could be captured by the producers.

Steve Roth

Feb 24 2014 at 3:11am

So how does this explain this:

http://www.irle.berkeley.edu/workingpapers/157-07.pdf

And this:

http://www.chicagofed.org/digital_assets/publications/working_papers/2013/wp2013_26.pdf

The best natural controlled experiment research we’ve got finds:

1. Little employment effect

2. Significant earnings effect

3. Increased churn/creative destruction among firms, favoring more labor-efficient firms

Since the explanation in this post doesn’t account for 1 and 2, some economic effects (maybe 3?) must be missing from that explanation.

Steve Roth

Feb 24 2014 at 3:16am

Oh and one more, sampling 64 studies of employment elasticity:

http://www.asymptosis.com/jared-bernstein-gives-us-the-best-graph-on-the-employment-effects-of-minimum-wage-increases.html

If the theory is contradicted by the facts, do you change the theory?

Jim Satterfield

Feb 24 2014 at 3:41am

I’m just amazed that anyone could actually write that Figure 1 represents the real world in any way and expect to be taken seriously. It’s a graph from some kind of intro to econ where they make no attempt to look at all of the complicating factors that exist.

Chris Anderson

Feb 24 2014 at 5:01am

But if Peter Thiel was right i.e. the world looked like figure 4, then surely the number of people actually employed at the minimum wage would be completely miniscule, after all it would be irrational to earn minimum wage when benefits provided more?

As it is there are about 3-4 million people earning at or below the minimum wage, so surely this can’t be the case? Unless you also assume that these 3-4 million people are irrational in maximising their income?

andy

Feb 24 2014 at 5:05am

Steve – yes, the last graph is very interesting. My problem with these studies is that if I did a study, I would not expect to find an effect. Why? Because it is in everbody interest to ignore the law. Example? Suppose that your wage is $8 at 8 hours a day, making it $64 a day; however you have ‘nice’ working conditions, so you are actually working 7.5 hours a day. The ‘real’ wage is $8.5. Minimum wage is raised to $9. Your employer changes working environment, so you now work for $9 an hour; but you are ‘illegaly’ working 9 hours a day. Your daily wage is $72, but your ‘real wage’ is now $8. What would an econometrician find? Exactly what you describe.

A few years ago there was a newspaper article about survey that found out that the ‘work law’ in a huge percentage (~50%?) of the low wage jobs. If you want to make the case that minimum wage causes changes in the supply curve (i.e. if you could choose between less work for $8 and more work for $9, you will choose less work; choosing between work for $9 and no work, you might choose $9), is it a positive or negative effect?

Also, is this a coincidence? France has minimum wage $12 and faces horrible teen unemployment. Singapore does not have a minimum wage (I think instead of discouraging low-wage employment with minimum wage, they encourage it) and they have practically zero unemployment; their unemployment even does not seem to be clustered around low-skill people.

If the theory is contradicted by facts, you change the theory. For example when the physicist measured particles faster than light, they… measured it again and found out that they made an error. Never mind.

If the theory is contradicted by facts, you change the theory. But is the theory contradicted by facts? If people can work around minimum wage (and they can and have strong motivation to do so), what would you expect to find in the studies? How does finding close to zero employment effects challenge the theory? Do you have better theory supported by the facts?

Don Boudreaux

Feb 24 2014 at 8:20am

Commenter Jim Satterfield writes

“I’m just amazed that anyone could actually write that Figure 1 represents the real world in any way and expect to be taken seriously. It’s a graph from some kind of intro to econ where they make no attempt to look at all of the complicating factors that exist.”

Questions for Mr. Satterfield: How would you better describe the relationship between buyers and sellers? Do you believe that demand curves in the real world slope in some direction other than that drawn in Figure 1 by Bryan? Do you believe that supply curves in the real world slope in some direction other than that drawn in Figure 1 by Bryan?

If your answer to each of these previous two questions is “no,” then what complicating factors do you have in mind that make this graph unhelpful for understanding a wide-range of exchange relationships between countless low-skilled individuals seeking paid employment and countless employers seeking to profitably produce output, likely by using some quantities of low-skilled workers?

Jeff H

Feb 24 2014 at 8:29am

I find it odd that the demand curve for labor is unchanging. I think a lot of people would argue that welfare increases consumption of the poor, which would, in turn, shift out the demand curve. After all, those welfare recipients now have money to spend that they didn’t previously have. (Of course, they had to get it from somewhere…)

nl7

Feb 24 2014 at 9:51am

He would be right if it operated as a tradeoff from the buyer’s side (employer’s perspective) as well as the seller’s side (employee’s perspective). Workers have a choice between welfare and work, and let’s just pretend momentarily that the minimum wage is at or near the wage they would get if they were not on welfare. It makes sense to think a higher wage would incentivize people to tradeoff welfare and take work.

But employers don’t necessarily get any tax reductions for hiring people at minimum wage. There have previously been some temporary tax credits for hiring people with poor work histories or whatever, but those are sporadic and difficult to plan for (often employers don’t know who will qualify until that person is hired).

So the worker can take wage or welfare (in theory, though in practice lots of working poor qualify for some welfare) but the employer can’t decide to pay taxes or wages. Taxes are generally immutable.

So once again, the better incentive is EITC. Rather than making employers pay higher wages, it makes the government collect fewer taxes (which usually results in a refund that looks like welfare but in some ways could be seen as the government funding a boost in the minimum wage).

Yancey Ward

Feb 24 2014 at 10:57am

Jeff H wrote:

I think your quote is better written at the end….

“Of course, they had to get it from someone“. Sure, the poor have more with which to consume, but someone else has less with which to consume. I know that a lot of people will then claim that the change is asymmetrical and again claim the welfare recipients have a higher propensity to consume, but then I could say that the welfare payers now have a lower demand to hire labor. And we could go on all day, couldn’t we?

I am not picking on you, you clearly recognized the effect to a second order, but it doesn’t end there.

Anonymous

Feb 24 2014 at 11:34am

“”If we look at high corporate profits and worker productivity you could infer that the consumers of labor are enjoying a surplus, some of which could be captured by the producers.””

Except that the corporate profits we’re concerned with aren’t high, foreign profits are high. Domestic profits are right in line with their historic averages…

http://www.cbo.gov/sites/default/files/cbofiles/images/pubs-images/44xxx/44433-land-figure2.png

And even then, most of that is coming from the financial and technology sectors, not service and retail where people actually work at or near the minimum wage, and producers operate on razor thin margins.

Zvi Mowshowitz

Feb 24 2014 at 11:58am

I think this model fails to capture what Thiel is getting at. He would agree that regardless of generosity of welfare state, increasing the minimum wage decreases the number of jobs, and of the rest some of them pay more, since they are not all standardized.

However, consider a situation in which there is a generous welfare state. There are two kinds of jobs: Jobs that are Good, which pay enough to be worth getting, and jobs that are Bad, which are indifferent with welfare, or worse, or only take people who can’t get welfare, or what not. When you are hired for a Bad job, you don’t care much if you’re fired, they don’t invest in you, and so on. You don’t develop skills or a track record and you often quit. You can capture epsilon utility by holding that job (in your own predictions) maybe, but no more.

However, if you have a Good job, then that’s worth something; it’s much better than welfare. Thus, you will be willing to engage in costly skill development (or signaling or shopping around, or what not) in order to have a shot at such a job, or keep it. As you do these things, you develop social capital and working gets better for you than not-working: You escape the welfare trap.

Let there be good and bad workers, then, too. Thus, a “Bad Job” in this model only hires Bad Workers, and doesn’t motivate them (much) to become Good Workers, so they have jobs but remain in the welfare trap. However, Bad Workers can choose to devote resources to become Good Workers in order to get or hold down a Good Job.

By increasing minimum wage, you might destroy 1 Bad Job, and transform 1 Bad Job into 1 Good Job. Now, 1 worker trains to move from Bad Worker to Good Worker, increasing wealth and productivity, and this compensates (hopefully) for the loss of the labor of the bad worker as he goes on welfare. In the long run, this grows the economy and the pie, leaving everyone better off.

yarbel

Feb 24 2014 at 12:40pm

Could someone clarify the following for me? If a wage of, say, 4$/hr is below subsistence levels, doesn’t that imply that the supply of labor would be fixed for wages under 4$?

If so, and if current minimum wages are below or around basic subsistence levels, doesn’t that imply a benefit for minimum wages?

Steve Roth

Feb 24 2014 at 1:35pm

andy:

You’re definitely right that various economic/incentive/behavioral effects might be (are certainly) at play. That’s very much my point in suggesting that the simple S/D analysis in this post can’t tell us much.

I find it too convenient to simply dismiss that graph because you can’t zoom in — especially if you factor in the (demonstrated but undisplayed) publication bias by those finding negative effects.

You can find more about it in this ungated early working paper from which the graph was derived:

https://www.deakin.edu.au/buslaw/aef/workingpapers/papers/2008_14eco.pdf

Which concludes:

“Do you have better theory supported by the facts?”

Per the above, it might go something like this:

“Given an environment of oligopolistic or monopsonistic competition, coupled with collectively agreed-upon welfare support systems [a.k.a. Thiel’s “market distortion”], an increased minimum wage pushes the economic system to a new, higher equilibrium in which worker’s market earnings are higher (while subsidies are reduced), and (Chicago Fed paper) firms which cannot profit and survive without welfare subsidies are replaced with better-run businesses that can.”

See:

The Conservative Case for a Minimum Wage Hike

http://www.asymptosis.com/the-conservative-case-for-a-minimum-wage-hike.html

“France has minimum wage $12 and faces horrible teen unemployment. Singapore does not have a minimum wage (I think instead of discouraging low-wage employment with minimum wage, they encourage it) and they have practically zero unemployment ”

Given the various and interacting economic effects at play, I find this correlational analysis of two sample points to be almost completely uninformative.

Nathan Smith

Feb 24 2014 at 1:47pm

Jim Satterfield writes:

“I’m just amazed that anyone could actually write that Figure 1 represents the real world in any way and expect to be taken seriously. It’s a graph from some kind of intro to econ where they make no attempt to look at all of the complicating factors that exist.”

No, no, no! This is a very dangerous, mind-killing statement! We have to simplify in order to think clearly. And often the simplifications don’t even end up having all that high a cost in realism, because the clutter of complexity that characterizes the real world doesn’t have much effect on the result. So here, I think; but even if the theory did oversimplify in a damaging way, what’s needed is a better theory, not a knee-jerk rejection of theory as such.

Nathan Smith

Feb 24 2014 at 1:49pm

Question for Caplan.

This is all very lucid and correct as far as it goes. Bravo!

Except… what about the EITC? Sometimes a low-wage job actually enables a person to qualify for welfare. Is there a case for the minimum wage then, to prevent employers from milking taxpayers through subsidized cheap labor?

Steve Roth

Feb 24 2014 at 3:14pm

>Is there a case for the minimum wage then, to prevent employers from milking taxpayers through subsidized cheap labor?

Exactly right.

Absent a minimum wage, it’s not crazy economics to suggest that the incidence of welfare payments devolves to employers.

Assume: a healthy economy has to somehow cover the costs of keeping workers alive, housed, educated, healthy, mobile, secure, and generally employable.

It’s also not crazy to suggest that this necessary level is best delivered by earned wages rather than welfare subsidies.

One could argue that absent welfare (“market distortion”) the market would arrange for that with no need for a minimum wage. But 10,000 years of history rather serves to suggest otherwise.

TANSTFL

Feb 24 2014 at 3:22pm

http://www.socsci.uci.edu/~dneumark/min_wage_review.pdf

🙂

Adam Nowakowski

Feb 24 2014 at 3:34pm

The best argument would be that the demand curve is much closer to being (or even is) vertical?

MikeP

Feb 24 2014 at 3:44pm

One could argue that absent welfare (“market distortion”) the market would arrange for that with no need for a minimum wage. But 10,000 years of history rather serves to suggest otherwise.

Which 10,000 years is that? 99% of the last 10,000 years were without welfare or minimum wage, and people in functional economies didn’t simply starve in the streets.

MikeP

Feb 24 2014 at 4:03pm

Chris Anderson,

As it is there are about 3-4 million people earning at or below the minimum wage, so surely this can’t be the case? Unless you also assume that these 3-4 million people are irrational in maximising their income?

Or you realize that the vast majority of minimum wage earners are not from poor households.

Steve Roth

Feb 24 2014 at 4:23pm

@MikeP: “people in functional economies didn’t simply starve in the streets”

1. Yes they did.

2. Is that your benchmark? Most people would set the benchmark for a thriving and widely prosperous society somewhat higher.

Steve Roth

Feb 24 2014 at 5:11pm

Adam Nowakowski writes: “The best argument would be that the demand curve is much closer to being (or even is) vertical?”

Great question. See SD diagram here:

Is the Elasticity of Labor Demand at Zero?http://www.asymptosis.com/is-the-elasticity-of-labor-demand-at-zero.html

Note that Nick Rowe responds quite approvingly in the comments, citing some good (but largely forgotten) theory from the 70s.

MikeP

Feb 24 2014 at 5:16pm

Steve Roth,

You’re the one who set the bar so high:

Assume: a healthy economy has to somehow cover the costs of keeping workers alive, housed, educated, healthy, mobile, secure, and generally employable.

This assumes too much. An economy really just needs workers to be able to work — i.e., not starve in the streets.

But, frankly, I believe that the best way to arrive at what you assume is to have a completely laissez-faire economy and a bare-bones safety net. I’m even willing to bump up from bare-bones because I think an otherwise unfettered economy would have quite a bit higher growth than the one we have today.

In other words, I think that welfare is better than a minimum wage. Set the welfare at the prevailing minimum — i.e., above where people are starving in the streets but below where people are climbing the wage ladder — and you do little to distort the economy.

Mike Gibson

Feb 24 2014 at 5:27pm

Great post. I, too, am against the minimum wage for the reasons you give, but under some conditions in some professions it seems to have a positive effect, namely in the NBA and MLB.

Why does the minimum wage seem to work well for these organizations?

Hazel Meade

Feb 24 2014 at 5:45pm

Many people have argued that welfare allows employers to pay less because the welfare effectively subsidizes the employees income, so they don’t need as much to live on.

I find this argument nonsensical, but I havn’t really seen it rebutted by libertarians.

I’ve never known anyone at a low wgae level who would be willing to work for *less* because they were getting welfare. And employers don’t pay people based on how much they need, but on what their marginal utility is to the business.

These charts point in the opposite direction. Welfare reduces the incentive to work, and the supply of labor, so employers should have to pay MORE to attract workers, not less.

Arthur_500

Feb 24 2014 at 5:47pm

About twenty years ago the head of the Welfare system in Alaska wrote a paper claiming that an individual would have to be paid in the $15 per hour range to equal the benefits of welfare. She went on to state that most of the people on Welfare were not $15 per hour employees.

However, the minimum wage is mostly for younger people entering the workforce (about 80%) and they aren’t necessarily on Welfare. Therefore, having this discussion is getting away from the basic question.

It is somewhat like saying we need Pot for those who need it medically. It changes the argument from “I want to get high” to “we need to take care of the unhealthy.” Suddenly you aren’t arguing anything substantially relevant. You have simply changed the argument to something more socially acceptable.

The idea that we need to be concerned about the people with families struggling for a minimum wage is a non-issue. However, we continue to discuss these people as though they are the majority.

The real question is how do we get people who need a living wage (students and other family dependents don’t count here) the skills, work ethic, and desire to become useful employed citizens.

MikeP

Feb 24 2014 at 6:11pm

…the NBA and MLB… Why does the minimum wage seem to work well for these organizations?

My guess is that they want to offer a high minimum — currently $500k for each of MLB and NBA — to provide team stability that the franchise players can leverage. That wage is higher than what the players would make in any other job and comparable to what they might make playing overseas. Thus they stick around and help out the team.

Mark

Feb 24 2014 at 6:12pm

As many min wage earners are students, second earners or elderly, they do nit have a work/ welfare tradeoff. This would seem to complicate scenarios 3&4. In other words, those subsets of the labor force are in figure2, yet to some extent competing with persons in figures 3&4.

Peter Schaeffer

Feb 24 2014 at 7:29pm

An entire article and many comments without a single use of the “I” word (immigration). What makes this remarkable is that immigration is almost certainly the largest influence (by far) on the low skill labor market.

Yet, it goes completely unmentioned. Sadly, predictable.

Here are the real economics. Raise the minimum wage and the domestic supply of labor goes up. The need for unskilled immigrants goes down. More Americans work and fewer foreigners.

Of course, Caplan knows all of this.

Steve Adams

Feb 24 2014 at 9:34pm

Two issues:

1) andy above touched on a good point – raise the minimum wage high enough and employers like myself will no longer offer paid lunches and breaks.

2) interesting technical analysis – one weakness is that it’s only in two dimensions. Add time and see what happens as well. How many welfare recipients get promoted to line leader? How many will then get promoted to supervisor? How many will develop the skills to get to work each day? How many will learn to work with people that annoy them a little?

This whole minimum wage push is had by people that never really work with people in this salary scale. Yes, many people need help – minimum wage and quite a pile of other programs are NOT helping them.

ww

Feb 24 2014 at 9:46pm

Get rid of minimum wage, but institute substantive negative income tax (available, no strings attached, no form to fill, for everybody).

Done deal. Move on to other issues.

Mark V Anderson

Feb 24 2014 at 10:04pm

This is where many different people are affected differently:

1) Many minimum wage earners are teenagers living at home. What is subsistence level then makes no difference.

2) Often there are many earners in one household, especially immigrant households. Many earners in one household makes it easier to survive on less income.

3) What is subsistence is pretty arbitrary. When I was poor, I was saving money on wages others considered below subsistence.

4) What is subsistence earnings in NYC is luxury living in Mississippi.

Tim

Feb 24 2014 at 11:49pm

Arthur_500 writes:

The real question is how do we get people who need a living wage (students and other family dependents don’t count here) the skills, work ethic, and desire to become useful employed citizens.

I think the solution is simple. Allow people to work at whatever rate they can and develop those skills. That’s how most people improved their wage, via gaining experience.

I didn’t graduate college and instead began working in restaurants. I started out at a casual restaurant making little money but learning a lot about the industry and gaining a valuable reference for future employers. Over the years I have gradually sought and gained employment at higher priced establishments that had much higher standards and required more extensive food, beverage and service knowledge.

Someone without any skills couldn’t walk off the street and do my job as well as I do it today, but they could certainly get to this level of they were given the time to develop their talent.

Jabor

Feb 25 2014 at 12:39am

Anonymous writes:

Except that the corporate profits we’re concerned with aren’t high, foreign profits are high. Domestic profits are right in line with their historic averages…

……

And even then, most of that is coming from the financial and technology sectors, not service and retail where people actually work at or near the minimum wage, and producers operate on razor thin margins.

Then Steve Roth writes:

“Given an environment of oligopolistic or monopsonistic competition, coupled with collectively agreed-upon welfare support systems [a.k.a. Thiel’s “market distortion”], an increased minimum wage pushes the economic system to a new, higher equilibrium in which worker’s market earnings are higher (while subsidies are reduced), and (Chicago Fed paper) firms which cannot profit and survive without welfare subsidies are replaced with better-run businesses that can.”

………

Theories are wonderful, but what I have seen over my years in business as an owner, consultant, and employee is as follows:

Government-forced, rather than market-forced, wage increases kills smaller businesses (like one of mine at one time) that rely on lower wage workers to survive. This is especially true in a service sector where the ability to increase productivity is minimal. This has nothing to do with efficiency; but rather with the ability of larger business’ to survive “losses,” often from the profitability of their other product offerings, while the smaller business’ exit the market place. This happens even if the smaller business has a better product. The result is less product choice & competition, and followed by the ability to raise the price of their previously zero/low margin products (at the expense of demand) to a point where they can be profitable. Not to mention the former employees (and owners) who need to find jobs in a smaller market.

andy

Feb 25 2014 at 1:12am

@Steve

1) It also implies that other labour market theories, such as those involving oligopolistic or monopsonistic competition, or efficiency wages, or heterodox models, are more appropriate.

2) Secondly, minimum-wage effects might exist but they may be too difficult to detect

3)and/or are very small. Perhaps researchers are “looking for a needle in a haystack” (Kennan, 1995, p. 1955).

In other words – they think, that either:

1) The market with thousands and thousands members on either side with relatively free entry is monopsonic, ologopolistic, or just “something different”.

2) People try to work around minimum wage laws, have a strong motivation to do so, so obviously you won’t find an effect when the minimum wage laws are worked around (you would have to look at different data, much harder to find)

3) Employers ignore their costs.

Which of these 3 options seems most probable? I vote for 2). Which one do you vote for and why?

andy

Feb 25 2014 at 1:40am

@Steve

http://www.asymptosis.com/the-conservative-case-for-a-minimum-wage-hike.html

I have already heard it and there is one question: everything is possible on the economy. The ‘better use of labour’ is obviously one possible way – but could you expand on the theory? It seems to me strange that this could conceivably work:

There is some amount of work X that is demanded by employers. Considering that minimum wage raises costs, we will very conservatively assume that this amount does not change. Employers invest in capital thus being able to do work X with less workers (let’s assume they will use subset of minimum wage workers and not new workers that didn’t supply work before the change). So you end up with the same work X done with more machines, less labour and slightly higher costs. These firms produce the same output as before the change.

And now what? How would you employ the people who lost the job? Why would anyone invest in more capital for these people – there is no reason to think that the demand side of the firms changed because of minimum wage laws.

Steve Roth

Feb 25 2014 at 9:46am

@andy: “there is no reason to think that the demand side of the firms changed because of minimum wage laws”

If it increases the V in MV (declining marginal propensity to spend out of income/wealth), Y increases.

cf. the new CBO report predicts, for $10.10/indexed: $19b more income for poorer, $17b less for richer, net GDI increase of $2b. Table 1 page 2. (Yeah I know: small change, but not so much cause the extra $2b goes to people who really value it.) I think that GDI increase is explained by the last phrase in Footnote F to that table.

Market monetarists will say, of course, that the Fed will just stomp on any resulting extra GDP growth generated by downward redistribution. Or, that we could achieve the same thing by just “printing more money.” That’s how Nick Rowe responded to one of my posts on this.

But there are serious problems with that position that I won’t wander into here. And it’s the only substantive counterargument I’ve found. I’ve really looked and blegged to find the best I could find.

andy

Feb 25 2014 at 4:28pm

@steve

If it increases the V in MV (declining marginal propensity to spend out of income/wealth), Y increases.

When standard economy fails to support your position, try macro model…

You raise minimum wage. This supposedly transfers wealth from rich to poor. This increases C (higher propensity to spend), decreases I. Firms economize on work, so they increase I (didn’t we just decrease I?). This whole miracle is directed into higher demand particularly for unskilled labour.

cf. the new CBO report predicts, for $10.10/indexed: $19b more income for poorer, $17b less for richer, net GDI increase of $2b. Table 1 page 2. (Yeah I know: small change, but not so much cause the extra $2b goes to people who really value it.)

This seems very strange; CBO is estimating that 500.000 people lose job and as a result of this you get higher GDI? This seems so strange I would expect at least a word anywhere else in the text. There is none.

Anyway, this is the question I asked:

Why would anyone invest in more capital for these people

I don’t think this answers the question even if it was correct.

Tony Soprano

Feb 25 2014 at 4:49pm

“1) The market with thousands and thousands members on either side with relatively free entry is monopsonic, ologopolistic, or just “something different”.”

Additionally, I’d love to know how a fallacy known as “affirming the consequent” has become a means of validating what theory of labour market competition is most accurate.

Beyond this, I would love to know how oligopsonistic or monopsonistic competition preclude efficient pricing of labour, why the industries where MW is most prevalent could be described as such, why, if such a description is fitting, they are this way and why something like a negative income tax or voluntary unionisation could not solve the problem better than these very tenuous arguments for the MW, assuming there is a “problem” to begin with.

NYC economist

Feb 26 2014 at 12:56am

WRONG DIAGRAM. Theil’s worry about the disincentive effects (“100 percent” marginal tax rate) suggests the RIGHT DIAGRAM is one that shows a labor-consumption tradeoff and the work disincentive depicted vividly by an indifference curve on a kink (at the threshold of benefit eligibility). In that context it is trivial to show the possibility than an increase in the real minimum wage could rotate the budget line by enough to get people to be willing to move off the kink and onto an interior tangency with larger labor supply.

andy

Feb 26 2014 at 6:41am

@NYC economist

Assuming 100% marginal tax rate would mean that on some interval (where it intersects the Demand) the Supply curve would be almost vertical. Higher minimum wage would mean that for higher prices the supply curve would change to something with ‘normal’ slope.

Is it correct? How does it change Bryan’s conclusions?

Steve Roth

Feb 26 2014 at 10:34am

@andy: “This increases C (higher propensity to spend), decreases I.”

You’ve assumed Y is fixed.

If you’re doing backward-looking accounting, this seems inevitable. There’s a given Y so if C is bigger I *must* be smaller.

But that’s not how economies work. More C doesn’t cause less I. QTC, in fact.

andy

Feb 27 2014 at 5:16am

@Steve

The Keynessian multiplier is supposed to work in recessions – when you have extensive unemployment and there is ‘lack of demand’. In normal times the multiplier seems to be less than 1. Anyway, the idea is:

Lack of demand -> government spends more -> demand increases -> firms produce more -> higher Y

What you suggest is:

Government increases cost of some workers -> firms start economizing on workforce -> that’s why CBO projects higher unemployment -> money is redirected from people investing in productivity-incrasing machines (I) to people buying TV sets (C) -> magic -> higher Y

Alice of Wonderland economy?

Anyway, even if there was some magic, it still does not show why the increased I should be directed primarily into capital increasing productivity of unskilled people. What is so great on expensive unskilled labour that makes it such an attractive investment opportunity?

Ged Hession

Feb 27 2014 at 8:52am

This article doesn’t mention the poverty trap. If my welfare benefits are $100 p.w. and my market wage is $90 p.w. then logically I will stay on welfare. This article says nothing about how firms behave and recruit. Even if welfare was cut it would be risky to assume that firms will recruit more welfare recipients, faced with issues like “skill atropy” , i.e. firms will refuse to recruit welfare recipients on the basis they they will be unemployable. It is well documented , from studies on welfare reform, that firms show some degree of reluctance to recruit welfare recipients.

Comments are closed.