In 2016, the Indian government demonetized all 500 and 1000 rupee bills. These were worth roughly $7.50 and $15, but are considered large denomination in a low-income country like India. The goal was to reduce corruption, and the experiment was widely seen to have failed.

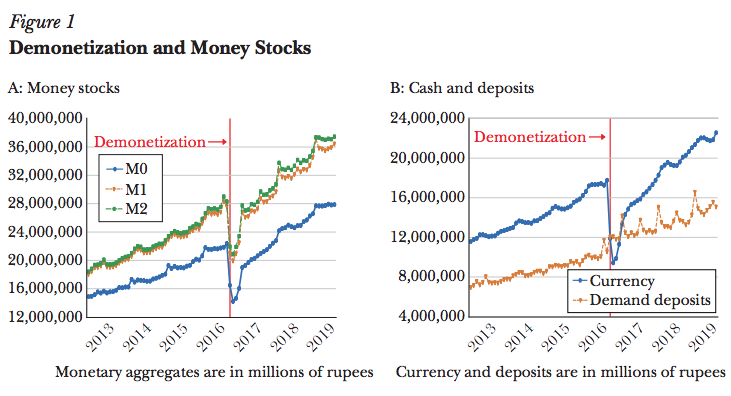

Here I’d like to focus on another aspect of this natural experiment, the impact on the macroeconomy. Interestingly, India ended up testing a very important tenet of modern macroeconomic theory—the idea that temporary currency injections have very little impact on the economy. A new paper by Amartya Lahiri shows that the reduction in the currency stock and money supply was quite severe, but also temporary:

According to Lahiri, the shock did cause some temporary disruption to the Indian economy, but didn’t seem to impact the growth of GDP over a period of 12 months:

According to Lahiri, the shock did cause some temporary disruption to the Indian economy, but didn’t seem to impact the growth of GDP over a period of 12 months:

Existing research on estimating the costs of demonetization using disaggregated data suggests that it could have lowered output by as much as 2 percentage points during the demonetization quarter. Almost all work in this area also suggests that the costs were temporary and lasted at most two quarters. This is not a surprise because the monetary shock was temporary and the remonetization of the economy was complete in less than two quarters. Available labor market statistics suggest that up to 3.5 million jobs may have been lost during the three months following demonetization while 15 million people may have exited the labor force.

It is surprising, however, that the aggregate statistics do not reveal much effect of the demonetization shock. Perhaps the most striking is the official aggregate GDP statistic for fiscal year 2016–2017. On January 31, 2019, India’s Central Statistical Organization released a revised GDP series, which estimates real GDP growth in the fiscal year 2016–2017 to have been 8.2 percent, the highest since 2011–2012. This implies that India’s annual GDP growth increased by 20 basis points in the year of demonetization, relative to the previous year. It is possible that growth in the nondemonetization quarters, particularly the period April–September 2016, saw very rapid economic growth that was partially undone by the negative effects of demonetization during the rest of the year. On the face of it, however, the dissonance between the available cost estimates of demonetization from the disaggregated studies and the estimated increase in aggregate GDP growth from the official statistics for that year represents a puzzle which requires a closer examination.

In my view, this was more like a real shock than a monetary shock. Because there was no impact on the medium to longer-term expectations for money growth or NGDP, it had relatively little cyclical effect on the Indian economy. But while there was no major deflationary impact, it did gum up the transactions technology of the India economy. You might almost view it as a technology shock, something like what would happen if all the cash registers or credit card computers had stopped working in America for a few weeks. China’s having a similar real shock right now, as the coronavirus disrupts business for what’s expected to be a few months. Japan had this sort of shock right after the tsunami of 2011. These shocks may impact RGDP for a quarter, but they generally don’t cause the sort of business cycle that creates a lot of unemployment.

When recessions are caused by tight money policies that are expected to persist, as in 2008-09, the effects are much more persistent than a quarter or two. The Great Recession led to almost a decade of elevated unemployment. Real factors determine long run growth, and explain the relative wealth of nations, but monetary factors dominate at cyclical frequencies. Most importantly, the monetary shocks that matter are those that are expected to persist.

PS. At least as far back as Neil Wallace in the 1970s, economists have been looking at the distinction between temporary and permanent monetary injections. In a 1993 paper on Colonial currency, I argued that a temporary currency injection would not be highly inflationary. In 1998, Paul Krugman wrote the definitive paper on liquidity traps, which also hinged on the distinction between temporary and permanent currency injections. Since then, people like Michael Woodford and Gauti Eggertsson have developed formal models where changes in the expected future path of monetary policy are much more important than changes in the current stance of policy.

READER COMMENTS

Thaomas

Feb 11 2020 at 6:33pm

Does this imply that the whole “QE is ineffective” argument was really about arbitrary (amounts and timing) QE injections/withdrawals, not as instruments of a outcomes-defined policy?

Scott Sumner

Feb 11 2020 at 8:02pm

If I understand you correctly, then yes.

Thaomas

Feb 12 2020 at 10:44am

How do you explain the Fed’s not having explained it’s use of the instrument better?

Scott Sumner

Feb 12 2020 at 12:49pm

The Fed is not good at explaining monetary policy. Neither is the broader profession.

Dylan

Feb 11 2020 at 9:01pm

Scott,

This is off topic, but I thought you might be interested in this story, given your question about the Huawei risk from a couple weeks ago. Posting a link always seems to get my posts quarantined for a couple of days, but if you search for this title you’ll find the story, which is being covered lots of places.

“For decades, US and Germany owned Swiss crypto company used by 120 countries”

This coming out on the same day as news that the U.S. has shared “proof” of Huawei having a backdoor into mobile-phone networks with Germany and the UK.

Scott Sumner

Feb 12 2020 at 12:55pm

Interesting. So what’s the takeaway here? Despite all this intelligence, the CIA has done a poor job over the years. Recall the Iraq WMD fiasco. Is the usefulness of intelligence overrated?

What sort of non-military intelligence could the Chinese get from the US government that would be useful to them?

(I’m not advocating Huawei for US military applications.)

Dylan

Feb 12 2020 at 7:57pm

I’m guessing the CIA would disagree with the takeaway that they’ve done a poor job. I’m pretty neutral on this, but will note that we’re probably more likely to have learned of the failures than the successes. But I’d think that the U.S. has a pretty good idea of what kind of info can be gleaned from backdoor access to a cell network, and they are pretty invested in making sure they’ve got a monopoly on that access.

I really don’t have a strong opinion either way on this. I think the security agencies of the U.S. are a bit hypocritical, in demanding backdoor access is built into services in the first place, and then thinking they can somehow keep that info out of the hands of other foreign powers. But, at the same time, not exactly enthusiastic about a state like China having easy access to the communications of 300m Americans.

David S

Feb 13 2020 at 2:07pm

Typically, the information is used for blackmail. You find out which underaged girl the important undersecretary is calling, get some pictures, and then you have an operative approach them to discuss advancing your interests. This happens often, from my understanding of the matter. They only need to find one person in power that is having an affair/is closet gay/likes Trump.

This is the reason why in security clearance interviews, when you say that you are closet gay or whatever they tell you to call your mom and tell her – after that, it can’t be used as blackmail.

TMC

Feb 14 2020 at 8:58am

Dylan, add to that the story that Chinese military has been charged in court to the Equifax hack 3 yrs ago. 145 million records stolen.

Nick

Feb 12 2020 at 7:27am

Scott, you said “In my view, this was more like a real shock than a monetary shock. Because there was no impact on the medium to longer-term expectations for money growth or NGDP, it had relatively little cyclical effect on the Indian economy.”

The charts seem to indicate not only that there was no long term growth change, but that they also caught up with the level. I suspect expectations about the level returning to “normal” were also important and that resuming growth from a new lower level would have led to a noticeable impact?

Scott Sumner

Feb 12 2020 at 12:50pm

Nick, Yes, you get something close to level targeting when you have these very temporary shocks.

Prakash

Feb 13 2020 at 2:36am

I agree to most of it except you there was no impact, before demonetization there were reports of fake currency that too in 500 and 1000 denominations,which was 5-10 times the actual currency.

With demonetization, most of actual currency got back into banks and fake currency got filtered out from the system impacting terror funding/ fake propaganda funding, by which law and order and safety was improved. Indeed this move discomforted the common man but they were ok with it, only people who went on protests spreading lies are the propaganda activists whose funding was badly impacted

Comments are closed.