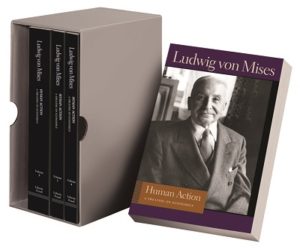

Human Action: A Treatise on Economics

By Ludwig Mises

IT GIVES me great satisfaction to see this book, handsomely printed by a distinguished publishing house, appear in its third revised edition. Two terminological remarks may be in order. First, I employ the term “liberal” in the sense attached to it everywhere in the nineteenth century and still today in the countries of continental Europe. This usage is imperative because there is simply no other term available to signify the great political and intellectual movement that substituted free enterprise and the market economy for the precapitalistic methods of production; constitutional representative government for the absolutism of kings or oligarchies; and freedom of all individuals for slavery, serfdom, and other forms of bondage…. [From the Forward to the Third Edition]

First Pub. Date

1949

Publisher

Irvington-on-Hudson, NY: The Foundation for Economic Education

Pub. Date

1998

Comments

Printed 1998. 4th revised edition. Foreword by Bettina Bien Greaves.

Copyright

The text of this edition is under copyright. Picture of Ludwig von Mises: file photo, Liberty Fund, Inc.

- Foreword to Fourth Edition, by Bettina Bien Greaves

- Foreword to the Third Edition

- Introduction

- Part 1, Chapter I. Acting man

- Part 1, Chapter II. The epistemological problems of the sciences of human action

- Part 1, Chapter III. Economics and the revolt against reason

- Part 1, Chapter IV. A first analysis of the category of action

- Part 1, Chapter V. Time

- Part 1, Chapter VI. Uncertainty

- Part 1, Chapter VII. Action within the world

- Part 2, Chapter VIII. Human society

- Part 2, Chapter IX. The role of ideas

- Part 2, Chapter X. Exchange within society

- Part 3, Chapter XI. Valuation without calculation

- Part 3, Chapter XII. The sphere of economic calculation

- Part 3, Chapter XIII. Monetary calculation as a tool of action

- Part 4, Chapter XIV. The scope and method of catallactics

- Part 4, Chapter XV. The market

- Part 4, Chapter XVI. Prices

- Part 4, Chapter XVII. Indirect exchange

- Part 4, Chapter XVIII. Action in the passing of time

- Part 4, Chapter XIX. Interest

- Part 4, Chapter XX. Interest, credit expansion, and the trade cycle

- Part 4, Chapter XXI. Work and wages

- Part 4, Chapter XXII. The nonhuman original factors of production

- Part 4, Chapter XXIII. The data of the market

- Part 4, Chapter XXIV. Harmony and conflict of interests

- Part 5, Chapter XXV. The imaginary construction of a socialist society

- Part 5, Chapter XXVI. The impossibility of economic calculation under socialism

- Part 6, Chapter XXVII. The government and the market

- Part 6, Chapter XXVIII. Interference by taxation

- Part 6, Chapter XXIX. Restriction of production

- Part 6, Chapter XXX. Interference with the structure of prices

- Part 6, Chapter XXXI. Currency and credit manipulation

- Part 6, Chapter XXXII. Confiscation and redistribution

- Part 6, Chapter XXXIII. Syndicalism and corporativism

- Part 6, Chapter XXXIV. The economics of war

- Part 6, Chapter XXXV. The welfare principle versus the market principle

- Part 6, Chapter XXXVI. The crisis of interventionism

- Part 7, Chapter XXXVII. The nondescript character of economics

- Part 7, Chapter XXXVIII. The place of economics in learning

- Part 7, Chapter XXXIX. Economics and the essential problems of human existence

Part 4, Chapter

INDIRECT EXCHANGE

1. Media of Exchange and Money

INTERPERSONAL exchange is called indirect exchange if, between the commodities and services the reciprocal exchange of which is the ultimate end of exchanging, one or several media of exchange are interposed. The subject matter of the theory of indirect exchange is the study of the ratios of exchange between the media of exchange on the one hand and the goods and services of all orders on the other hand. The statements of the theory of indirect exchange refer to all instances of indirect exchange and to all things which are employed as media of exchange.

A medium of exchange which is commonly used as such is called money. The notion of money is vague, as its definition refers to the vague term “commonly used.” There are borderline cases in which it cannot be decided whether a medium of exchange is or is not “commonly” used and should be called money. But this vagueness in the denotation of money in no way affects the exactitude and precision required by praxeological theory. For all that is to be predicated of money is valid for every medium of exchange. It is therefore immaterial whether one preserves the traditional term

theory of money or substitutes for it another term. The theory of money was and is always the theory of indirect exchange and of the media of exchange.

*71

2. Observations on Some Widespread Errors

The fateful errors of popular monetary doctrines which have led astray the monetary policies of almost all governments would hardly have come into existence if many economists had not themselves committed blunders in dealing with monetary issues and did not stubbornly cling to them.

There is first of all the spurious idea of the supposed neutrality of money.

*72 An outgrowth of this doctrine was the notion of the “level”

Volkswirtschaft; the volume of trade—i.e., the money equivalent of all transfers of commodities and services as effected in the Volkswirtschaft; the average velocity of circulation of the monetary units; the level of prices. These formulas seemingly provided evidence of the correctness of the price level doctrine. In fact, however, this whole mode of reasoning is a typical case of arguing in a circle. For the equation of exchange already involves the level doctrines which it tries to prove. It is essentially nothing but a mathematical expression of the—untenable—doctrine that there is proportionality in the movements of the quantity of money and of prices.

In analyzing the equation of exchange one assumes that one of its elements—total supply of money, volume of trade, velocity of circulation—changes, without asking how such changes occur. It is not recognized that changes in these magnitudes do not emerge in the Volkswirtschaft as such, but in the individual actors’ conditions, and that it is the interplay of the reactions of these actors that results in alterations of the price structure. The mathematical economists refuse to start from the various individuals’ demand for and supply of money. They introduce instead the spurious notion of velocity of circulation fashioned according to the patterns of mechanics.

There is at this point of our reasoning no need to deal with the question of whether or not the mathematical economists are right in assuming that the services rendered by money consist wholly or essentially in its turnover, in its circulation. Even if this were true, it would still be faulty to explain the purchasing power—the price—of the monetary unit on the basis of its services. The services rendered by water, whisky, and coffee do not explain the prices paid for these things. What they explain is only why people, as far as they recognize

It is true that with regard to money the task of catallactics is broader than with regard to vendible goods. It is not the task of catallactics, but of psychology and physiology, to explain why people are intent on securing the services which the various vendible commodities can render. It

is a task of catallactics, however, to deal with this question with regard to money. Catallactics alone can tell us what advantages a man expects from holding money. But it is not these expected advantages which determine the purchasing power of money. The eagerness to secure these advantages is only one of the factors in bringing about the demand for money. It is demand, a subjective element whose intensity is entirely determined by value judgments, and not any objective fact, any power to bring about a certain effect, that plays a role in the formation of the market’s exchange ratios.

The deficiency of the equation of exchange and its basic elements is that they look at market phenomena from a holistic point of view. They are deluded by their prepossession with the Volkswirtschaft notion. But where there is, in the strict sense of the term, a Volkswirtschaft, there is neither a market nor prices and money. On a market there are only individuals or groups of individuals acting in concert. What motivate these actors are their own concerns, not those of the whole market economy. If there is any sense in such notions as volume of trade and velocity of circulation, then they refer to the resultant of the individuals’ actions. It is not permissible to resort to these notions in order to explain the actions of the individuals. The first question that catallactics must raise with regard to changes in the total quantity of money available in the market system is how such changes affect the various individuals’ conduct. Modern economics does not ask what “iron” or “bread” is worth, but what a definite piece of iron or of bread is worth to an acting individual at a definite date and a definite place. It cannot help proceeding in the same way with regard to money. The equation of exchange is incompatible with the fundamental principles of economic thought. It is a relapse to the thinking of ages in which people failed to comprehend praxeological phenomena because they were committed to holistic notions. It is sterile, as were the speculations of earlier ages concerning the value of “iron” and “bread” in general.

The theory of money is an essential part of the catallactic theory.

3. Demand for Money and Supply of Money

In the marketability of the various commodities and services there prevail considerable differences. There are goods for which it is not difficult to find applicants ready to disburse the highest recompense which, under the given state of affairs, can possibly be obtained, or a recompense only slightly smaller. There are other goods for which it is very hard to find a customer quickly, even if the vendor is ready to be content with a compensation much smaller than he could reap if he could find another aspirant whose demand is more intense. It is these differences in the marketability of the various commodities and services which created indirect exchange. A man who at the instant cannot acquire what he wants to get for the conduct of his own household or business, or who does not yet know what kind of goods he will need in the uncertain future, comes nearer to his ultimate goal if he exchanges a less marketable good he wants to trade against a more marketable one. It may also happen that the physical properties of the merchandise he wants to give away (as, for instance, its perishability or the costs incurred by its storage or similar circumstances) impel him not to wait longer. Sometimes he may be prompted to hurry in giving away the good concerned because he is afraid of a deterioration of its market value. In all such cases he improves his own situation in acquiring a more marketable good, even if this good is not suitable to satisfy directly any of his own needs.

A medium of exchange is a good which people acquire neither for their own consumption nor for employment in their own production activities, but with the intention of exchanging it at a later date against those goods which they want to use either for consumption or for production.

Money is a medium of exchange. It is the most marketable good which people acquire because they want to offer it in later acts of interpersonal exchange. Money is the thing which serves as the generally accepted and commonly used medium of exchange. This is its only function. All the other functions which people ascribe to money are merely particular aspects of its primary and sole function, that of a medium of exchange.

*73

Media of exchange are economic goods. They are scarce; there is

There exists a demand for media of exchange because people want to keep a store of them. Every member of a market society wants to have a definite amount of money in his pocket or box, a cash holding or cash balance of a definite height. Sometimes he wants to keep a larger cash holding, sometimes a smaller; in exceptional cases he may even renounce any cash holding. At any rate, the immense majority of people aim not only to own various vendible goods; they want no less to hold money. Their cash holding is not merely a residuum, an unspent margin of their wealth. It is not an unintentional remainder left over after all intentional acts of buying and selling have been consummated. Its amount is determined by a deliberate demand for cash. And as with all other goods, it is the changes in the relation between demand for and supply of money that bring about changes in the exchange ratio between money and the vendible goods.

Every piece of money is owned by one of the members of the market economy. The transfer of money from the control of one actor into that of another is temporally immediate and continuous. There is no fraction of time in between in which the money is not a part of an individual’s or a firm’s cash holding, but just in “circulation.”

*74 It is unsound to distinguish between circulating and idle money. It is no less faulty to distinguish between circulating money and hoarded money. What is called hoarding is a height of cash holding which—according to the personal opinion of an observer—exceeds what is deemed normal and adequate. However, hoarding is cash holding. Hoarded money is still money and it serves in the hoards the same purposes which it serves in cash holdings called normal. He who hoards money believes that some special conditions make it expedient to accumulate a cash holding which exceeds the amount he himself would keep under different conditions, or other people keep, or an economist censuring his action considers appropriate. That he acts in this way influences the configuration of the

Many economists avoid applying the terms demand and supply in the sense of demand for and supply of money for cash holding because they fear a confusion with the current terminology as used by the bankers. It is, in fact, customary to call demand for money the demand for short-term loans and supply of money the supply of such loans. Accordingly, one calls the market for short-term loans the money market. One says money is scarce if there prevails a tendency toward a rise in the rate of interest for short-term loans, and one says money is plentiful if the rate of interest for such loans is decreasing. These modes of speech are so firmly entrenched that it is out of the question to venture to discard them. But they have favored the spread of fateful errors. They made people confound the notions of money and of capital and believe that increasing the quantity of money could lower the rate of interest lastingly. But it is precisely the crassness of these errors which makes it unlikely that the terminology suggested could create any misunderstanding. It is hard to assume that economists could err with regard to such fundamental issues.

Others maintained that one should not speak of the demand for and supply of money because the aims of those demanding money differ from the aims of those demanding vendible commodities. Commodities, they say, are demanded ultimately for consumption, while money is demanded in order to be given away in further acts of exchange. This objection is no less invalid. The use which people make of a medium of exchange consists eventually in its being given away. But first of all they are eager to accumulate a certain amount of it in order to be ready for the moment in which a purchase may be accomplished. Precisely because people do not want to provide for their own needs right at the instant at which they give away the goods and services they themselves bring to the market, precisely because they want to wait or are forced to wait until propitious conditions for buying appear, they barter not directly but indirectly through the interposition of a medium of exchange. The fact that money is not worn out by the use one makes of it and that it can render its services practically for an unlimited length of time is an important factor in the configuration of its supply. But it does not alter the fact that the appraisement of money is to be explained in the same way as the appraisement of all other goods: by the demand on the part of those who are eager to acquire a definite quantity of it.

Economists have tried to enumerate the factors which within the

Another objection raised against the notion of the demand for money was this: The marginal utility of the money unit decreases much more slowly than that of the other commodities; in fact its decrease is so slow that it can be practically ignored. With regard to money nobody ever says that his demand is satisfied, and nobody ever forsakes an opportunity to acquire more money provided the sacrifice required is not too great. It is therefore impermissible to consider the demand for money as limited. The very notion of an unlimited demand is, however, contradictory. This popular reasoning is entirely fallacious. It confounds the demand for money for cash holding with the desire for more wealth as expressed in terms of money. He who says that his thirst for more money can never be quenched, does not mean to say that his cash holding can never be too large. What he really means is that he can never be rich enough. If additional money flows into his hands, he will not use it for an increase of his cash balance or he will use only a part of it for this purpose. He will expend the surplus either for instantaneous consumption or for investment. Nobody ever keeps more money than he wants to have as cash holding.

The insight that the exchange ratio between money on the one

quantity theory of money. This theory is essentially an application of the general theory of supply and demand to the special instance of money. Its merit was the endeavor to explain the determination of money’s purchasing power by resorting to the same reasoning which is employed for the explanation of all other exchange ratios. Its short-coming was that it resorted to a holistic interpretation. It looked at the total supply of money in the Volkswirtschaft and not at the actions of the individual men and firms. An outgrowth of this erroneous point of view was the idea that there prevails a proportionality in the changes of the—total—quantity of money and of money prices. But the older critics failed in their attempts to explode the errors inherent in the quantity theory and to substitute a more satisfactory theory for it. They did not fight what was wrong in the quantity theory; they attacked, on the contrary, its nucleus of truth. They were intent upon denying that there is a causal relation between the movements of prices and those of the quantity of money. This denial led them into a labyrinth of errors, contradictions, and nonsense. Modern monetary theory takes up the thread of the traditional quantity theory as far as it starts from the cognition that changes in the purchasing power of money must be dealt with according to the principles applied to all other market phenomena and that there exists a connection between the changes in the demand for and supply of money on the one hand and those of purchasing power on the other. In this sense one may call the modern theory of money an improved variety of the quantity theory.

The Epistemological Import of Carl Menger’s Theory of the Origin of Money

Carl Menger has not only provided an irrefutable praxeological theory of the origin of money. He has also recognized the import of his theory for the elucidation of fundamental principles of praxeology and its methods of research.

*75

There were authors who tried to explain the origin of money by decree or covenant. The authority, the state, or a compact between citizens has purposively and consciously established indirect exchange and money. The main deficiency of this doctrine is not to be seen in the assumption that people of an age unfamiliar with indirect

If it is assumed that the conditions of the parties concerned are improved by every step that leads from direct exchange to indirect exchange and subsequently to giving preference for use as a medium of exchange to certain goods distinguished by their especially high marketability, it is difficult to conceive why one should, in dealing with the origin of indirect exchange, resort in addition to authoritarian decree or an explicit compact between citizens. A man who finds it hard to obtain in direct barter what he wants to acquire renders better his chances of acquiring it in later acts of exchange by the procurement of a more marketable good. Under these circumstances there was no need of government interference or of a compact between the citizens. The happy idea of proceeding in this way could strike the shrewdest individuals, and the less resourceful could imitate the former’s method. It is certainly more plausible to take for granted that the immediate advantages conferred by indirect exchange were recognized by the acting parties than to assume that the whole image of a society trading by means of money was conceived by a genius and, if we adopt the covenant doctrine, made obvious to the rest of the people by persuasion.

If, however, we do not assume that individuals discovered the fact that they fare better through indirect exchange than through waiting for an opportunity for direct exchange, and, for the sake of argument, admit that the authorities or a compact introduced money, further questions are raised. We must ask what kind of measures were applied in order to induce people to adopt a procedure the utility of which they did not comprehend and which was technically more complicated than direct exchange. We may assume that compulsion was practiced. But then we must ask, further, at what time and by what occurrences indirect exchange and the use of money later ceased to be procedures troublesome or at least indifferent to the individuals concerned and became advantageous to them.

The praxeological method traces all phenomena back to the actions of individuals. If conditions of interpersonal exchange are such that indirect exchange facilitates the transactions, and if and as far as people realize these advantages, indirect exchange and money come into being. Historical experience shows that these conditions were and are present. How, in the absence of these conditions, people could have adopted indirect exchange and money and clung to these modes of exchanging is inconceivable.

The historical question concerning the origin of indirect exchange

History may tell us where and when for the first time media of exchange came into use and how, subsequently, the range of goods employed for this purpose was more and more restricted. As the differentiation between the broader notion of a medium of exchange and the narrower notion of money is not sharp, but gradual, no agreement can be reached about the historical transition from simple media of exchange to money. Answering such a question is a matter of historical understanding. But, as has been mentioned, the distinction between direct exchange and indirect exchange is sharp and everything that catallactics establishes with regard to media of exchange refers categorially to all goods which are demanded and acquired as such media.

As far as the statement that indirect exchange and money were established by decree or by covenant is meant to be an account of historical events, it is the task of historians to expose its falsity. As far as it is advanced merely as a historical statement, it can in no way affect the catallactic theory of money and its explanation of the evolution of indirect exchange. But if it is designed as a statement about human action and social events, it is useless because it states nothing about action. It is not a statement about human action to declare that one day rulers or citizens assembled in convention were suddenly struck by the inspiration that it would be a good idea to exchange indirectly and through the intermediary of a commonly used medium of exchange. It is merely pushing back the problem involved.

It is necessary to comprehend that one does not contribute anything to the scientific conception of human actions and social phenomena if one declares that the state or a charismatic leader or an inspiration

*76

4. The Determination of the Purchasing Power of Money

As soon as an economic good is demanded not only by those who want to use it for consumption or production, but also by people who want to keep it as a medium of exchange and to give it away at need in a later act of exchange, the demand for it increases. A new employment for this good has emerged and creates an additional demand for it. As with every other economic good, such an additional demand brings about a rise in its value in exchange, i.e., in the quantity of other goods which are offered for its acquisition. The amount of other goods which can be obtained in giving away a medium of exchange, its “price” as expressed in terms of various goods and services, is in part determined by the demand of those who want to acquire it as a medium of exchange. If people stop using the good in question as a medium of exchange, this additional specific demand disappears and the “price” drops concomitantly.

Thus the demand for a medium of exchange is the composite of two partial demands: the demand displayed by the intention to use it in consumption and production and that displayed by the intention to use it as a medium of exchange.

*77 With regard to modern metallic money one speaks of the industrial demand and of the monetary demand. The value in exchange (purchasing power) of a medium of exchange is the resultant of the cumulative effect of both partial demands.

Now the extent of that part of the demand for a medium of exchange which is displayed on account of its service as a medium of exchange depends on its value in exchange. This fact raises difficulties which many economists considered insoluble so that they abstained from following farther along this line of reasoning. It is illogical, they said, to explain the purchasing power of money by reference to the demand for money, and the demand for money by reference to its purchasing power.

The difficulty is, however, merely apparent. The purchasing power

*78

But, say the critics, this is tantamount to merely pushing back the problem. For now one must still explain the determination of yesterday’s purchasing power. If one explains this in the same way by referring to the purchasing power of the day before yesterday and so on, one slips into a

regressus in infinitum. This reasoning, they assert, is certainly not a complete and logically satisfactory solution of the problem involved. What these critics fail to see is that the regression does not go back endlessly. It reaches a point at which the explanation is completed and no further question remains unanswered. If we trace the purchasing power of money back step by step, we finally arrive at the point at which the service of the good concerned as a medium of exchange begins. At this point yesterday’s exchange value is exclusively determined by the nonmonetary—industrial—demand which is displayed only by those who want to use this good for other employments than that of a medium of exchange.

But, the critics continue, this means explaining that part of money’s purchasing power which is due to its service as a medium of exchange by its employment for industrial purposes. The very problem, the explanation of the specific monetary component of its exchange value, remains unsolved. Here too the critics are mistaken. That component of money’s value which is an outcome of the services it renders as a medium of exchange is entirely explained by reference to these specific monetary services and the demand they create. Two facts are not to be denied and are not denied by anybody. First, that the demand for a medium of exchange is determined by considerations

Finally it was objected to the regression theorem that its approach is historical, not theoretical. This objection is no less mistaken. To explain an event historically means to show how it was produced by forces and factors operating at a definite date and a definite place. These individual forces and factors are the ultimate elements of the interpretation. They are ultimate data and as such not open to any further analysis and reduction. To explain a phenomenon theoretically means to trace back its appearance to the operation of general rules which are already comprised in the theoretical system. The regression theorem complies with this requirement. It traces the specific exchange value of a medium of exchange back to its function as such a medium and to the theorems concerning the process of valuing and pricing as developed by the general catallactic theory. It deduces a more special case from the rules of a more universal theory. It shows how the special phenomenon necessarily emerges out of the operation of the rules generally valid for all phenomena. It does not say: This happened at that time and at that place. It says: This always happens when the conditions appear; whenever a good which has not been demanded previously for the employment as a medium of exchange begins to be demanded for this employment, the same effects must appear again; no good can be employed for the function of a medium of exchange which at the very beginning of its use for this purpose did not have exchange value on account of other employments. And all these statements implied in the regression theorem are enounced apodictically as implied in the apriorism of praxeology. It

must happen this way. Nobody can ever succeed in constructing a hypothetical case in which things were to occur in a different way.

The purchasing power of money is determined by demand and supply, as is the case with the prices of all vendible goods and services. As action always aims at a more satisfactory arrangement of future

The relation between the demand for money and the supply of money, which may be called the money relation, determines the height of purchasing power. Today’s money relation, as it is shaped on the ground of yesterday’s purchasing power, determines today’s purchasing power. He who wants to increase his cash holding restricts

Changes in the supply of money must necessarily alter the disposition of vendible goods as owned by various individuals and firms. The quantity of money available in the whole market system cannot increase or decrease otherwise than by first increasing or decreasing the cash holdings of certain individual members. We may, if we like, assume that every member gets a share of the additional money right at the moment of its inflow into the system, or shares in the reduction of the quantity of money. But whether we assume this or not, the final result of our demonstration will remain the same. This result will be that changes in the structure of prices brought about by changes in the supply of money available in the economic system never affect the prices of the various commodities and services to the same extent and at the same date.

Let us assume that the government issues an additional quantity of paper money. The government plans either to buy commodities and services or to repay debts incurred or to pay interest on such debts. However this may be, the treasury enters the market with an additional demand for goods and services; it is now in a position to buy more goods than it could buy before. The prices of the commodities it buys rise. If the government had expended in its purchases money collected by taxation, the taxpayers would have restricted their purchases and, while the prices of goods bought by the government would have risen, those of other goods would have dropped. But this fall in the prices of the goods the taxpayers used to buy does not occur if the government increases the quantity of money at its disposal without reducing the quantity of money in the hands of the public. The prices of some commodities—viz., of those the government buys—rise immediately, while those of the other commodities remain unaltered for the time being. But the process goes on. Those selling the commodities asked for by the government are now themselves in a position to buy more than they used previously. The prices of the things these people are buying in larger quantities therefore rise too. Thus the boom spreads from one group of commodities and services to other groups until all prices and wage rates have risen. The rise in prices is thus not synchronous for the various commodities and services.

When eventually, in the further course of the increase in the quantity

The main fault of the old quantity theory as well as the mathematical economists’ equation of exchange is that they have ignored this fundamental issue. Changes in the supply of money must bring about changes in other data too. The market system before and after the inflow or outflow of a quantity of money is not merely changed in that the cash holdings of the individuals and prices have increased or decreased. There have been effected also changes in the reciprocal exchange ratios between the various commodities and services which, if one wants to resort to metaphors, are more adequately described by the image of price revolution than by the misleading figure of an elevation or a sinking of the “price level.”

We may at this point disregard the effects brought about by the influence on the content of all deferred payments as stipulated by contracts. We will deal later with them and with the operation of monetary events on consumption and production, investment in capital goods, and accumulation and consumption of capital. But even in setting aside all these things, we must never forget that changes in the quantity of money affect prices in an uneven way. It depends on the data of each particular case at what moment and to what

Changes in the money relation are not only caused by governments issuing additional paper money. An increase in the production of the precious metals employed as money has the same effects although, of course, other classes of the population may be favored or hurt by it. Prices also rise in the same way if, without a corresponding reduction in the quantity of money available, the demand for money falls because of a general tendency toward a diminution of cash holdings. The money expended additionally by such a “dishoarding” brings about a tendency toward higher prices in the same way as that flowing from the gold mines or from the printing press. Conversely, prices drop when the supply of money falls (e.g., through a withdrawal of paper money) or the demand for money increases (e.g., through a tendency toward “hoarding,” the keeping of greater cash balances). The process is always uneven and by steps, disproportionate and asymmetrical.

It could be and has been objected that the normal production of the gold mines brought to the market may well entail an increase in the quantity of money, but does not increase the income, still less the wealth, of the owners of the mines. These people earn only their “normal” income and thus their spending of it cannot disarrange market conditions and the prevailing tendencies toward the establishment of final prices and the equilibrium of the evenly rotating economy. For them, the annual output of the mines does not mean an increase in riches and does not impel them to offer higher prices. They will continue to live at the standard at which they used to live before. Their spending within these limits will not revolutionize the market. Thus the normal amount of gold production, although certainly increasing the quantity of money available, cannot put into motion the process of depreciation. It is neutral with regard to prices.

As against this reasoning one must first of all observe that within a progressing economy in which population figures are increasing and the division of labor and its corollary, industrial specialization, are perfected, there prevails a tendency toward an increase in the demand for money. Additional people appear on the scene and want to establish cash holdings. The extent of economic self-sufficiency, i.e., of production for the household’s own needs, shrinks and people become more dependent upon the market; this will, by and large,

The fact that the owners of gold mines rely upon steady yearly proceeds from their gold production does not cancel the newly mined gold’s impression upon prices. The owners of the mines take from the market, in exchange for the gold produced, the goods and services required for their mining and the goods needed for their consumption and their investments in other lines of production. If they had not produced this amount of gold, prices would not have been affected by it. It is beside the point that they have anticipated the future yield of the mines and capitalized it and that they have adjusted their standard of living to the expectation of steady proceeds from the mining operations. The effects which the newly mined gold exercises on their expenditure and on that of those people whose cash holdings it enters later step by step begin only at the instant this gold is available in the hands of the mine owners. If, in the expectation of future yields, they had expended money at an earlier date and the expected yield failed to appear, conditions would not differ from other cases in which consumption was financed by credit based on expectations not realized by later events.

Changes in the extent of the desired cash holding of various people neutralize one another only to the extent that they are regularly recurring and mutually connected by a causal reciprocity. Salaried people and wage earners are not paid daily, but at certain pay days

It was this phenomenon that led economists to the image of a regular circulation of money and to the neglect of the changes in the individuals’ cash holdings. However, we are faced with a concatenation which is limited to a narrow, neatly circumscribed field. Only as far as the increase in the cash holding of one group of people is temporally and quantitatively related to the decrease in the cash holding of another group and as far as these changes are self-liquidating within the course of a period which the members of both groups consider as a whole in planning their cash holding, can the neutralization take place. Beyond this field there is no question of such a neutralization.

5. The Problem of Hume and Mill and the Driving Force of Money

Is it possible to think of a state of affairs in which changes in the purchasing power of money occur at the same time and to the same extent with regard to all commodities and services and in proportion to the changes effected in either the demand for or the supply of money? In other words, is it possible to think of neutral money within the frame of an economic system which does not correspond to the imaginary construction of an evenly rotating economy? We may call this pertinent question the problem of Hume and Mill.

It is uncontested that neither Hume nor Mill succeeded in finding a positive answer to this question.

*79 Is it possible to answer it categorically in the negative?

We imagine two systems of an evenly rotating economy

A and

B. The two systems are independent and in no way connected with one another. The two systems differ from one another only in the fact

m in

A there corresponds an amount

nm in

B,n being greater or smaller than 1; we assume that there are no deferred payments and that the money used in both systems serves only monetary purposes and does not allow of any nonmonetary use. Consequently the prices in the two systems are in the ratio 1 :

n. Is it thinkable that conditions in

A can be altered at one stroke in such a way as to make them entirely equivalent to conditions in

B?

The answer to this question must obviously be in the negative. He who wants to answer it in the positive must assume that a

deus ex machina approaches every individual at the same instant, increases or decreases his cash holding by multiplying it by

n, and tells him that henceforth he must multiply by

n all price data which he employs in his appraisements and calculations. This cannot happen without a miracle.

It has been pointed out already that in the imaginary construction of an evenly rotating economy the very notion of money vanishes into an unsubstantial calculation process, self-contradictory and devoid of any meaning.

*80 It is impossible to assign any function to indirect exchange, media of exchange, and money within an imaginary construction the characteristic mark of which is unchangeability and rigidity of conditions.

Where there is no uncertainty concerning the future, there is no need for any cash holding. As money must necessarily be kept by people in their cash holdings, there cannot be any money. The use of media of exchange and the keeping of cash holdings are conditioned by the changeability of economic data. Money in itself is an element of change; its existence is incompatible with the idea of a regular flow of events in an evenly rotating economy.

Every change in the money relation alters—apart from its effects upon deferred payments—the conditions of the individual members of society. Some become richer, some poorer. It may happen that the effects of a change in the demand for and supply of money encounter the effects of opposite changes occurring by and large at the same time and to the same extent; it may happen that the resultant of the two opposite movements is such that no conspicuous changes in the price structure emerge. But even then the effects on the conditions of the various individuals are not absent. Each change in the money relation takes its own course and produces its own particular effects. If an inflationary movement and a deflationary one occur at the same time or if an inflation is temporally followed by a deflation in such a

Money is neither an abstract

numéraire nor a standard of value or prices. It is necessarily an economic good and as such it is valued and appraised on its own merits, i.e., the services which a man expects from holding cash. On the market there is always change and movement. Only because there are fluctuations is there money. Money is an element of change not because it “circulates,” but because it is kept in cash holdings. Only because people expect changes about the kind and extent of which they have no certain knowledge whatsoever, do they keep money.

While money can be thought of only in a changing economy, it is in itself an element of further changes. Every change in the economic data sets it in motion and makes it the driving force of new changes. Every shift in the mutual relation of the exchange ratios between the various nonmonetary goods not only brings about changes in production and in what is popularly called distribution, but also provokes changes in the money relation and thus further changes. Nothing can happen in the orbit of vendible goods without affecting the orbit of money, and all that happens in the orbit of money affects the orbit of commodities.

The notion of a neutral money is no less contradictory than that of a money of stable purchasing power. Money without a driving force of its own would not, as people assume, be a perfect money; it would not be money at all.

It is a popular fallacy to believe that perfect money should be neutral and endowed with unchanging purchasing power, and that the goal of monetary policy should be to realize this perfect money. It is easy to understand this idea as a reaction against the still more popular postulates of the inflationists. But it is an excessive reaction, it is in itself confused and contradictory, and it has worked havoc because it was strengthened by an inveterate error inherent in the thought of many philosophers and economists.

These thinkers are misled by the widespread belief that a state of rest is more perfect than one of movement. Their idea of perfection implies that no more perfect state can be thought of and consequently that every change would impair it. The best that can be said of a motion is that it is directed toward the attainment of a state of perfection in which there is rest because every further movement would

With the real universe of action and unceasing change, with the economic system which cannot be rigid, neither neutrality of money nor stability of its purchasing power are compatible. A world of the kind which the necessary requirements of neutral and stable money presuppose would be a world without action.

It is therefore neither strange nor vicious that in the frame of such a changing world money is neither neutral nor stable in purchasing power. All plans to render money neutral and stable are contradictory. Money is an element of action and consequently of change. Changes in the money relation, i.e., in the relation of the demand for and the supply of money, affect the exchange ratio between money on the one hand and the vendible commodities on the other hand. These changes do not affect at the same time and to the same extent the prices of the various commodities and services. They consequently affect the wealth of the various members of society in a different way.

6. Cash-Induced and Goods-Induced Changes in Purchasing Power

Changes in the purchasing power of money, i.e., in the exchange ratio between money and the vendible goods and commodities, can originate either from the side of money or from the side of the vendible goods and commodities. The change in the data which provokes them can either occur in the demand for and supply of money or in the demand for and supply of the other goods and services. We may accordingly distinguish between cash-induced and goods-induced changes in purchasing power.

Goods-induced changes in purchasing power can be brought about by changes in the supply of commodities and services or in the demand for individual commodities and services. A general rise or fall

Let us now scrutinize the social and economic consequences of changes in the purchasing power of money under the following three assumptions: first, that the money in question can only be used as money—i.e., as a medium of exchange—and can serve no other purpose; second, that there is only exchange of present goods and no exchange of present goods against future goods; third, that we disregard the effects of changes in purchasing power on monetary calculation.

Under these assumptions all that cash-induced changes in purchasing power bring about are shifts in the disposition of wealth among different individuals. Some get richer, others poorer; some are better supplied, others less; what some people gain is paid for by the loss of others. It would, however, be impermissible to interpret this fact by saying that total satisfaction remained unchanged or that, while no changes have occurred in total supply, the state of total satisfaction or of the sum of happiness has been increased or decreased by changes in the distribution of wealth. The notions of total satisfaction or total happiness are empty. It is impossible to discover a standard for comparing the different degrees of satisfaction or happiness attained by various individuals.

Cash-induced changes in purchasing power indirectly generate further changes by favoring either the accumulation of additional capital or the consumption of capital available. Whether and in what direction such secondary effects are brought about depends on the specific data of each case. We shall deal with these important problems at a later point.

*81

Goods-induced changes in purchasing power are sometimes nothing else but consequences of a shift of demand from some goods to others. If they are brought about by an increase or a decrease in the supply of goods they are not merely transfers from some people to other people. They do not mean that Peter gains what Paul has lost. Some people may become richer although nobody is impoverished, and vice versa.

We may describe this fact in the following way: Let

A and

B be two independent systems which are in no way connected with each other. In both systems the same kind of money is used, a money which cannot be used for any nonmonetary purpose. Now we assume, as case 1, that

A and

B differ from each other only in so far as in

B the

n m, m being the total supply of money in

A, and that to every cash holding of

c and to every claim in terms of money

d in

A there corresponds a cash holding of

nc and a claim of

nd in

B. In every other respect

A equals

B. Then we assume, as case 2, that

A and

B differ from each other only in so far as in

B the total supply of a certain commodity

r is

np,p being the total supply of this commodity in

A, and that to every stock

v of this commodity

r in

A there corresponds a stock of

nv in

B. In both cases

n is greater than 1. If we ask every individual of

A whether he is ready to make the slightest sacrifice in order to exchange his position for the corresponding place in

B, the answer will be unanimously in the negative in case 1. But in case 2 all owners of

r and all those who do not own any

r, but are eager to acquire a quantity of it—i.e., at least one individual—will answer in the affirmative.

The services money renders are conditioned by the height of its purchasing power. Nobody wants to have in his cash holding a definite number of pieces of money or a definite weight of money; he wants to keep a cash holding of a definite amount of purchasing power. As the operation of the market tends to determine the final state of money’s purchasing power at a height at which the supply of and the demand for money coincide, there can never be an excess or a deficiency of money. Each individual and all individuals together always enjoy fully the advantages which they can derive from indirect exchange and the use of money, no matter whether the total quantity of money is great or small. Changes in money’s purchasing power generate changes in the disposition of wealth among the various members of society. From the point of view of people eager to be enriched by such changes, the supply of money may be called insufficient or excessive, and the appetite for such gains may result in policies designed to bring about cash-induced alterations in purchasing power. However, the services which money renders can be neither improved nor repaired by changing the supply of money. There may appear an excess or a deficiency of money in an individual’s cash holding. But such a condition can be remedied by increasing or decreasing consumption or investment. (Of course, one must not fall prey to the popular confusion between the demand for money for cash holding and the appetite for more wealth.) The quantity of money available in the whole economy is always sufficient to secure for everybody all that money does and can do.

From the point of view of this insight one may call wasteful all expenditures incurred for increasing the quantity of money. The fact that things which could render some other useful services are

The choice of the good to be employed as a medium of exchange and as money is never indifferent. It determines the course of the cash-induced changes in purchasing power. The question is only who should make the choice: the people buying and selling on the market, or the government? It was the market which in a selective process, going on for ages, finally assigned to the precious metals gold and silver the character of money. For two hundred years the governments have interfered with the market’s choice of the money medium. Even the most bigoted étatists do not venture to assert that this interference has proved beneficial.

Inflation and Deflation; Inflationism and Deflationism

The notions of inflation and deflation are not praxeological concepts. They were not created by economists, but by the mundane speech of the public and of politicians. They implied the popular fallacy that there is such a thing as neutral money or money of stable purchasing power and that sound money should be neutral and stable in purchasing power. From this point of view the term inflation was applied to signify cash-induced changes resulting in a drop in purchasing power, and the term deflation to signify cash-induced changes resulting in a rise in purchasing power.

big cash-induced changes in purchasing power—is valid also with regard to small changes, although, of course, the consequences of smaller changes are less conspicuous than those of big changes.

The terms inflationism and deflationism, inflationist and deflationist, signify the political programs aiming at inflation and deflation in the sense of big cash-induced changes in purchasing power.

The semantic revolution which is one of the characteristic features of our day has also changed the traditional connotation of the terms inflation and deflation. What many people today call inflation or deflation is no longer the great increase or decrease in the supply of money, but its inexorable consequences, the general tendency toward a rise or a fall in commodity prices and wage rates. This innovation is by no means harmless. It plays an important role in fomenting the popular tendencies toward inflationism.

First of all there is no longer any term available to signify what inflation used to signify. It is impossible to fight a policy which you cannot name. Statesmen and writers no longer have the opportunity of resorting to a terminology accepted and understood by the public when they want to question the expediency of issuing huge amounts of additional money. They must enter into a detailed analysis and description of this policy with full particulars and minute accounts whenever they want to refer to it, and they must repeat this bothersome procedure in every sentence in which they deal with the subject. As this policy has no name, it becomes self-understood and a matter of fact. It goes on luxuriantly.

The second mischief is that those engaged in futile and hopeless attempts to fight the inevitable consequences of inflation—the rise in prices—are disguising their endeavors as a fight against inflation.

It is obvious that this new-fangled connotation of the terms inflation and deflation is utterly confusing and misleading and must be unconditionally rejected.

7. Monetary Calculation and Changes in Purchasing Power

Monetary calculation reckons with the prices of commodities and services as they were determined or would have been determined or presumably will be determined on the market. It is eager to detect price discrepancies and to draw conclusions from such a detection.

Cash-induced changes in purchasing power cannot be taken into account in such calculations. It is possible to put in the place of calculation based on a definite kind of money

a a mode of calculating based on another kind of money

b. Then the result of the calculation is made safe against adulteration on the part of changes effected in the purchasing power of

a; but it can still be adulterated by changes effected in the purchasing power of

b. There is no means of freeing any mode of economic calculation from the influence of changes in the purchasing power of the definite kind of money on which it is based.

All results of economic calculation and all conclusions derived from them are conditioned by the vicissitudes of cash-induced changes in purchasing power. In accordance with the rise or fall in purchasing power there emerge between items reflecting earlier prices and those reflecting later prices specific differences; the calculation shows profits or losses which are merely produced by cash-induced changes effected in the purchasing power of money. If we compare such profits or

It is therefore possible to maintain that economic calculation is not perfect. However, nobody can suggest a method which could free economic calculation from these defects or design a monetary system which could remove this source of error entirely.

It is an undeniable fact that the free market has succeeded in developing a currency system which well served all the requirements both of indirect exchange and of economic calculation. The aims of monetary calculation are such that they cannot be frustrated by the inaccuracies which stem from slow and comparatively slight movements in purchasing power. Cash-induced changes in purchasing power of the extent to which they occurred in the last two centuries with metallic money, especially with gold money, cannot influence the result of the businessmen’s economic calculations so considerably as to render such calculations useless. Historical experience shows that one could, for all practical purposes of the conduct of business, manage very well with these methods of calculation. Theoretical consideration shows that it is impossible to design, still less to realize, a better method. In view of these facts it is vain to call monetary calculation imperfect. Man has not the power to change the categories of human action. He must adjust his conduct to them.

Businessmen never deemed it necessary to free economic calculation in terms of gold from its dependence on the fluctuations in purchasing power. The proposals to improve the currency system by adopting a tabular standard based on index numbers or by adopting various methods of commodity standards were not advanced with regard to business transactions and to monetary calculation. Their aim was to provide a less fluctuating standard for long-run loan contracts. Businessmen did not even consider it expedient to modify their accounting methods in those regards in which it would have been easy to narrow down certain errors induced by fluctuations in purchasing power. It would, for instance, have been possible to discard the practice of writing off durable equipment by means of yearly

All this is valid only with regard to money which is not subject to rapid, big cash-induced changes in purchasing power. But money with which such rapid and big changes occur loses its suitability to serve as a medium of exchange altogether.

8. The Anticipation of Expected Changes in Purchasing Power

The deliberations of the individuals which determine their conduct with regard to money are based on their knowledge concerning the prices of the immediate past. If they lacked this knowledge, they would not be in a position to decide what the appropriate height of their cash holdings should be and how much they should spend for the acquisition of various goods. A medium of exchange without a past is unthinkable. Nothing can enter into the function of a medium of exchange which was not already previously an economic good and to which people assigned exchange value already before it was demanded as such a medium.

But the purchasing power handed down from the immediate past is modified by today’s demand for and supply of money. Human action is always providing for the future, be it sometimes only the future of the impending hour. He who buys, buys for future consumption and production. As far as he believes that the future will differ from the present and the past, he modifies his valuation and appraisement. This is no less true with regard to money than it is with regard to all vendible goods. In this sense we may say that today’s exchange value of money is an anticipation of tomorrow’s exchange value. The basis of all judgments concerning money is its purchasing power as it was in the immediate past. But as far as cash-induced changes in purchasing power are expected, a second factor enters the scene, the anticipation of these changes.

He who believes that the prices of the goods in which he takes an interest will rise, buys more of them than he would have bought in the absence of this belief; accordingly he restricts his cash holding. He who believes that prices will drop, restricts his purchases and thus enlarges his cash holding. As long as such speculative anticipations are limited to some commodities, they do not bring about a general tendency toward changes in cash holding. But it is different if people

But if once public opinion is convinced that the increase in the quantity of money will continue and never come to an end, and that consequently the prices of all commodities and services will not cease to rise, everybody becomes eager to buy as much as possible and to restrict his cash holding to a minimum size. For under these circumstances the regular costs incurred by holding cash are increased by the losses caused by the progressive fall in purchasing power. The advantages of holding cash must be paid for by sacrifices which are deemed unreasonably burdensome. This phenomenon was, in the great European inflations of the ‘twenties, called

flight into real goods (Flucht in die Sachwerte) or

crack-up boom (Katastrophenhausse). The mathematical economists are at a loss to comprehend the causal relation between the increase in the quantity of money and what they call “velocity of circulation.”

The characteristic mark of this phenomenon is that the increase in the quantity of money causes a fall in the demand for money. The tendency toward a fall in purchasing power as generated by the increased supply of money is intensified by the general propensity to restrict cash holdings which it brings about. Eventually a point is reached where the prices at which people would be prepared to part with “real” goods discount to such an extent the expected progress in the fall of purchasing power that nobody has a sufficient amount of cash at hand to pay them. The monetary system breaks down; all transactions in the money concerned cease; a panic makes its purchasing power vanish altogether. People return either to barter or to the use of another kind of money.

The course of a progressing inflation is this: At the beginning the inflow of additional money makes the prices of some commodities and services rise; other prices rise later. The price rise affects the various commodities and services, as has been shown, at different dates and to a different extent.

This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the

But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against “real” goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

It was this that happened with the

Continental currency in America in 1781, with the French

mandats territoriaux in 1796, and with the German

Mark in 1923. It will happen again whenever the same conditions appear. If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds. Inflation is a policy that cannot last.

9. The Specific Value of Money

As far as a good used as money is valued and appraised on account of the services it renders for nonmonetary purposes, no problems are raised which would require special treatment. The task of the theory of money consists merely in dealing with that component in the valuation of money which is conditioned by its function as a medium of exchange.

In the course of history various commodities have been employed as media of exchange. A long evolution eliminated the greater part of these commodities from the monetary function. Only two, the precious metals gold and silver, remained. In the second part of the nineteenth century more and more governments deliberately turned toward the demonetization of silver.

In all these cases what is employed as money is a commodity which is used also for nonmonetary purposes. Under the gold standard gold is money and money is gold. It is immaterial whether or not the laws assign legal tender quality only to gold coins minted by the government. What counts is that these coins really contain a fixed weight

commodity money.

A second sort of money is

credit money. Credit money evolved out of the use of money-substitutes. It was customary to use claims, payable on demand and absolutely secure, as substitutes for the sum of money to which they gave a claim. (We shall deal with the features and problems of money-substitutes in the next sections.) The market did not stop using such claims when one day their prompt redemption was suspended and thereby doubts about their safety and the solvency of the obligee were raised. As long as these claims had been daily maturing claims against a debtor of undisputed solvency and could be collected without notice and free of expense, their exchange value was equal to their face value; it was this perfect equivalence which assigned to them the character of money-substitutes. Now, as redemption was suspended, the maturity date postponed to an undetermined day, and consequently doubts about the solvency of the debtor or at least about his willingness to pay emerged, they lost a part of the value previously ascribed to them. They were now merely claims, which did not bear interest, against a questionable debtor and falling due on an undefined day. But as they were used as media of exchange, their exchange value did not drop to the level to which it would have dropped if they were merely claims.

One can fairly assume that such credit money could remain in use as a medium of exchange even if it were to lose its character as a claim against a bank or a treasury, and thus would become

fiat money. Fiat money is a money consisting of mere tokens which can neither be employed for any industrial purposes nor convey a claim against anybody.

It is not a task of catallactics but of economic history to investigate whether there appeared in the past specimens of fiat money or whether all the sorts of money which were not commodity money were credit money. The only thing that catallactics has to establish is that the possibility of the existence of fiat money must be admitted.

The important thing to be remembered is that with every sort of money, demonetization—i.e., the abandonment of its use as a medium of exchange—must result in a serious fall of its exchange value. What this practically means has become manifest when in the last ninety years the use of silver as commodity money has been progressively restricted.

The keeping of cash holding requires sacrifices. To the extent that a man keeps money in his pockets or in his balance with a bank, he forsakes the instantaneous acquisition of goods he could consume or employ for production. In the market economy these sacrifices can be precisely determined by calculation. They are equal to the amount of originary interest he would have earned by investing the sum. The fact that a man takes this falling off into account is proof that he prefers the advantages of cash holding to the loss in interest yield.

It is possible to specify the advantages which people expect from keeping a definite amount of cash. But it is a delusion to assume that an analysis of these motives could provide us with a theory of the determination of purchasing power which could do without the notions of cash holding and demand for and supply of money.

*82 The advantages and disadvantages derived from cash holding are not objective factors which could directly influence the size of cash holdings. They are put on the scales by each individual and weighed against one another. The result is a subjective judgment of value, colored by the individual’s personality. Different people and the same people at different times value the same objective facts in a different way. Just as knowledge of a man’s wealth and his physical condition does not tell us how much he would be prepared to spend for food of a certain nutritive power, so knowledge about data concerning a man’s material situation does not enable us to make definite assertions with regard to the size of his cash holding.

10. The Import of the Money Relation

The money relation, i.e., the relation between demand for and supply of money, uniquely determines the price structure as far as the reciprocal exchange ratio between money and the vendible commodities and services is involved.

If the money relation remains unchanged, neither an inflationary (expansionist) nor a deflationary (contractionist) pressure on trade, business, production, consumption, and employment can emerge. The assertions to the contrary reflect the grievances of people reluctant to

An increase in the quantity of goods produced, other things being unchanged, must bring about an improvement in people’s conditions. Its consequence is a fall in the money prices of the goods the production of which has been increased. But such a fall in money prices does not in the least impair the benefits derived from the additional wealth produced. One may consider as unfair the increase in the share of the additional wealth which goes to the creditors, although such criticisms are questionable as far as the rise in purchasing power has been correctly anticipated and adequately taken into account by a negative price premium.

*83 But one must not say that a fall in prices caused by an increase in the production of the goods concerned is the proof of some disequilibrium which cannot be eliminated otherwise than by increasing the quantity of money. Of course, as a rule every increase in production of some or of all commodities requires a new allocation of factors of production to the various branches of business. If the quantity of money remains unchanged, the necessity of such a reallocation becomes visible in the price structure. Some lines of production become more profitable, while in other profits drop or losses appear. Thus the operation of the market tends to eliminate these much discussed disequilibria. It is possible by means of an increase in the quantity of money to delay or to interrupt this process of adjustment. It is impossible either to make it superfluous or less painful for those concerned.

If the government-made cash-induced changes in the purchasing power of money resulted only in shifts of wealth from some people to other people, it would not be permissible to condemn them from the point of view of catallactics’ scientific neutrality. It is obviously fraudulent to justify them under the pretext of the commonweal or public welfare. But one could still consider them as political measures suitable to promote the interests of some groups of people at the expense of others without further detriment. However, there are still other things involved.

It is not necessary to point out the consequences to which a continued deflationary policy must lead. Nobody advocates such a

*84 Second: The inflationary process does not remove the necessity of adjusting production and real-locating resources. It merely postpones it and thereby makes it more troublesome. Third: Inflation cannot be employed as a permanent policy because it must, when continued, finally result in a breakdown of the monetary system.

A retailer or innkeeper can easily fall prey to the illusion that all that is needed to make him and his colleagues more prosperous is more spending on the part of the public. In his eyes the main thing is to impel people to spend more. But it is amazing that this belief could be presented to the world as a new social philosophy. Lord Keynes and his disciples make the lack of the propensity to consume responsible for what they deem unsatisfactory in economic conditions. What is needed, in their eyes, to make men more prosperous is not an increase in production, but an increase in spending. In order to make it possible for people to spend more, an “expansionist” policy is recommended.

This doctrine is as old as it is bad. Its analysis and refutation will be undertaken in the chapter dealing with the trade cycle.

*85

11. The Money-Substitutes

Claims to a definite amount of money, payable and redeemable on demand, against a debtor about whose solvency and willingness to pay there does not prevail the slightest doubt, render to the individual all the services money can render, provided that all parties with whom he could possibly transact business are perfectly familiar with these essential qualities of the claims concerned: daily maturity as well as undoubted solvency and willingness to pay on the part of the debtor. We may call such claims

money-substitutes, as they can fully replace money in an individual’s or a firm’s cash holding. The technical and legal features of the money-substitutes do not concern catallactics. A money-substitute can be embodied either in a banknote or in a demand deposit with a bank subject to check (“checkbook money” or deposit currency), provided the bank is prepared to

If the debtor—the government or a bank—keeps against the whole amount of money-substitutes a 100% reserve of money proper, we call the money-substitute a

money-certificate. The individual money-certificate is—not necessarily in a legal sense, but always in the catallactic sense—a representative of a corresponding amount of money kept in the reserve. The issuing of money-certificates does not increase the quantity of things suitable to satisfy the demand for money for cash holding. Changes in the quantity of money-certificates therefore do not alter the supply of money and the money relation. They do not play any role in the determination of the purchasing power of money.

If the money reserve kept by the debtor against the money-substitutes issued is less than the total amount of such substitutes, we call that amount of substitutes which exceeds the reserve

fiduciary media. As a rule it is not possible to ascertain whether a concrete specimen of money-substitutes is a money-certificate or a fiduciary medium. A part of the total amount of money-substitutes issued is usually covered by a money reserve held. Thus a part of the total amount of money-substitutes issued is money-certificates, the rest fiduciary media. But this fact can only be recognized by those familiar with the bank’s balance sheets. The individual banknote, deposit, or token coin does not indicate its catallactic character.

The issue of money-certificates does not increase the funds which the bank can employ in the conduct of its lending business. A bank which does not issue fiduciary media can only grant

commodity credit, i.e., it can only lend its own funds and the amount of money which its customers have entrusted to it. The issue of fiduciary media enlarges the bank’s funds available for lending beyond these limits.

circulation credit, i.e., credit granted out of the issue of fiduciary media.

While the quantity of money-certificates is indifferent, the quantity of fiduciary media is not. The fiduciary media affect the market phenomena in the same way as money does. Changes in their quantity influence the determination of money’s purchasing power and of prices and—temporarily—also of the rate of interest.

Earlier economists applied a different terminology. Many were prepared to call the money-substitutes simply money, as they are fit to render the services money renders. However, this terminology is not expedient. The first purpose of a scientific terminology is to facilitate the analysis of the problems involved. The task of the catallactic theory of money—as differentiated from the legal theory and from the technical disciplines of bank management and accountancy—is the study of the problems of the determination of prices and interest rates. This task requires a sharp distinction between money-certificates and fiduciary media.

The term

credit expansion has often been misinterpreted. It is important to realize that commodity credit cannot be expanded. The only vehicle of credit expansion is circulation credit. But the granting of circulation credit does not always mean credit expansion. If the amount of fiduciary media previously issued has consummated all its effects upon the market, if prices, wage rates, and interest rates have been adjusted to the total supply of money proper plus fiduciary media (supply of money in the broader sense), granting of circulation credit without a further increase in the quantity of fiduciary media is no longer credit expansion. Credit expansion is present only if credit is granted by the issue of an additional amount of fiduciary media, not if banks lend anew fiduciary media paid back to them by the old debtors.

12. The Limitation on the Issuance of Fiduciary Media

People deal with money-substitutes as if they were money because they are fully confident that it will be possible to exchange them at any time without delay and without cost against money. We may call those who share in this confidence and are therefore ready to deal with money-substitutes as if they were money, the

clients of the issuing banker, bank, or authority. It does not matter whether or not this issuing establishment is operated according to the patterns of conduct customary in the banking business. Token coins issued by a country’s treasury are money-substitutes too, although the treasury as a rule does not enter the amount issued into its accounts as a

*86