When it comes to public debt and deficits, I sometimes feel like people go to one extreme or the other. Japan has a public debt equal to about 250% of GDP, but many people wave it away as a minor inconvenience, even calling for more fiscal stimulus, despite the failure of previous efforts. In contrast, the Greek debt is often assumed to be obviously unpayable, despite being a far lower percentage of GDP. And maybe it is, but I’m not entirely convinced.

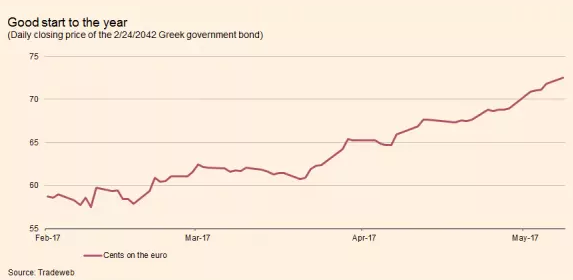

Of course my opinion does not matter—what does matter is the view of bond market participants. And they are becoming increasingly optimistic about Greek debt. Notice that the price has recently risen from below 60 to above 70 (cents on the euro):

The implied probability of default has fallen to well below 50%.

The FT notes that in some respects the Portuguese debt situation is even worse:

Portugal devotes a larger share of its economic output to debt service than Greece does now — about 4.0 per cent of gross domestic product versus 3.3 per cent according to data from the International Monetary Fund. (One wrinkle is that some Portuguese debt is funded by domestic creditors, while almost none of Greece’s is.) Depending on the magnitude of any official debt restructuring, Greek obligations could therefore end up considerably less risky than those issued by many other European countries. That in turn could imply a large decline in spreads and a continuation of the current bull market.

I’m no expert on Greek debt, but 3.3% of GDP is certainly not an unsustainable figure. So what exactly is the problem? Is it that the Greeks “can’t” pay the debt? Or that they “won’t” pay the debt? Any informed comments would be appreciated.

And for those who argue that the Greek debt problem is 100% due to their decision to join the euro, please explain to me what is causing Brazil’s debt problems. Last time I looked, Brazil had its own currency.

PS. Off topic, here’s what I said in February:

As nationalism is on the rise throughout the world, neoliberalism seems to be on the decline. My prediction is that this decline will eventually be seen as a myth. Neoliberalism is not going anywhere.

And here is what Ross Douthat wrote today, in response to the poor showing of Le Pen in the recent French election:

But in neither Europe nor America do post-liberal ideas look anywhere near fully ripe, and in both Europe and America there is a “first as tragedy, then as farce, then as online flamewar” quality to the way they’ve entered into political debates.

Nor do the pressures on the system from social fragmentation and economic stagnation yet look strong enough to overcome the stabilizing effects of the developed world’s great wealth, the risk aversion bred by age and habit, the fearful memories of what the last age of illiberalism wrought.

That’s the case, in brief, for betting on continued stasis, and for interpreting our moment’s perturbations — Trump, Comey and all — as pointing toward a real crisis for the West that still lurks a generation or more ahead.

Those final two paragraphs could have come right out of Tyler Cowen’s recent book.

READER COMMENTS

Vegas

May 11 2017 at 12:07am

4% of GDP translates into approx. 10% tax – historically sustainable and prevalent taxation level. It means pretty much sustainable government revenue consumed by serving debt and nothing left for anything. It will not end well for bond holders.?

jay

May 11 2017 at 1:51am

Please take into consideration – there are only 11 million people in Greece and a large % of that are over 60

S D

May 11 2017 at 4:27am

The issue with Greece is not about economic capacity but political capacity.

Greece has had in effect three debt restructurings and its debt is sustainable by any standard metric.

For example take an alternative measure of the debt burden: Debt interest as a share of total government revenues. In Greece it is 6.6%, a bit above the EU average of 4.5% but well below peers Italy (8.2%) and Ireland (8.0%).Only one euro in fifteen of all Greek taxes is being used to service debt.

The problem is that a large part of the Greek political class blames outsiders for home-grown problems and a large part of the electorate believes it. This tendency exists in Italy and Ireland too, but is less pronounced, and both countries broadly share a political consensus in favour of paying external creditors. Italy has reformed its pension system in recent years and Ireland gave its public servants large pay cuts.

The events in Greece since 2009 would have precipitated a swift reversal in the current account and the need for a primary (government) surplus no matter what the currency regime in place had been. Looking forward, the key risk is that the Greek political system will be unable to deliver policies which are completely normal in the rest of Europe (sustainable pensions, tax collection) and will blame external actors yet again.

Debt interest as a share of total government revenue, EU and neighbouring countries, 2017

Portugal 9.7

Norway 9.1

Italy 8.2

Ireland 8.0

Serbia 7.8

Slovenia 6.9

Spain 6.8

Iceland 6.7

Greece 6.6

United Kingdom 6.4

Cyprus 6.4

Hungary 6.3

Croatia 6.2

Montenegro 5.9

Malta 5.3

Belgium 5.2

Romania 5.1

European Union 4.5

Euro area 4.5

Poland 4.2

Austria 4.1

Lithuania 3.7

Slovakia 3.5

France 3.4

Latvia 2.9

Germany 2.6

Bulgaria 2.3

Netherlands 2.2

Czech Republic 2.1

Denmark 2.0

Finland 1.9

Sweden 0.9

Luxembourg 0.8

Source: European Commission AMECO Database

Scott Sumner

May 11 2017 at 10:04am

SD, Thanks, that’s very informative.

bill

May 11 2017 at 2:47pm

I wonder if with negative interest rates, a country like Germany would ever be in position where its debt would be a Source of revenue, not a Use.

John Hall

May 11 2017 at 4:05pm

“Greek debt problem is 100% due to their decision to join the euro” seems like a straw man. I thought the argument was that if Greece hadn’t joined the euro, then they would have been able to depreciate their currency.

Look at the chart on the Brazil real. It went from like 1.5 USDBRL in 2011 to 4 in early 2016 before they began to turn things around. That was a 60% depreciation of the currency! Of course, that’s not the only factor behind their recovery, but it was a factor.

One additional complication is that Brazil issues a decent amount of US dollar-denominated debt. Depreciating the currency doesn’t makes it harder to pay back that debt.

That’s the difference between Brazil and Japan. All Japanese government debt is denominated in yen.

Todd Kreider

May 11 2017 at 6:08pm

Scott wrote:

But the net debt is closer to 90% of GDP. Here is the explanation in Forbes from 2014 for those interested:

https://www.forbes.com/sites/mwakatabe/2015/01/18/japans-fiscal-situation-is-not-as-bad-as-many-assume/2/#701bc4594e07

Scott Sumner

May 12 2017 at 9:19am

Bill, I believe that in the steady state all one needs is for the interest rate to be lower than the GDP growth rate.

John, I wonder how much Greek debt was in drachma prior to 2000.

Todd, Does the net debt figure exclude debt held by the BOJ? If so, then I question its usefulness.

Floccina

May 12 2017 at 2:17pm

So if the USA eliminated the Corporate tax and the other developed countries did in order to compete what would happen to Luxembourg?

Don Geddis

May 13 2017 at 4:32pm

Sumner: “Does the net debt figure exclude debt held by the BOJ?”

The article takes Japan’s gross debt, and then subtracts:

in order to arrive at their “net debt” estimate.

Alex S.

May 15 2017 at 8:52am

Michael Darby’s paper “Some Pleasant Monetarist Arithmetic” may offer some clues as to what to look for. It stipulates that fiscal policy is sustainable so long as the growth rate of real NNP exceeds the real interest rate on the debt (I.e. Your tax base grows faster than your interest on the debt). Whether those conditions hold up for Japan, Brazil, and Greece though I’m not sure.

Bahrum Lamehdasht

May 15 2017 at 5:24pm

@jay, totally agree with you. The problem that Greece face is not so much the level of debt but how they will repay it … and the main issue they have now is a demographic that wont hold up to a policy of heavy taxation.

Comments are closed.