Brad DeLong recently made an interesting observation about interest rates:

It was Milton Friedman who insisted, over and over again, that in any but the shortest of runs high nominal interest rates were not a sign that money was tight–that the central bank had pushed the market interest rate above the Wicksellian natural rate–but rather that money had been and probably was still loose, and that market expectations had adjusted to that.

There are thus two puzzles in trying to understand the internal deviation of the Federal Reserve from Wicksellian orthodoxy today: Why have commercial bankers been able to maintain what looks like outsized influence? Why did the lessons Milton Friedman taught the establishment right now [not?] stick?

I assume the word “now” in the final sentence was a typo, so I added “not.” This is a point I’ve made dozens over times over the past few years—we’ve forgotten the lessons that Friedman taught us. But in response to Brad DeLong, Paul Krugman argues that Milton Friedman was wrong:

Friedman did in fact make that claim. But if “the shortest of short runs” means weeks or months, he was wrong.

Consider the Volcker disinflation. The Fed clearly announced its intention to reduce inflation, and temporarily changed its operating procedure by switching to money supply targeting; in short, it did everything one might imagine to make it clear that there was a regime shift that would lead to disinflation. As I and others have pointed out, the fact that this policy change nonetheless led to a severe recession is conclusive evidence against both the Lucas notion that only unanticipated monetary policy has real effects, and the Prescott view that business cycles reflect real shocks.

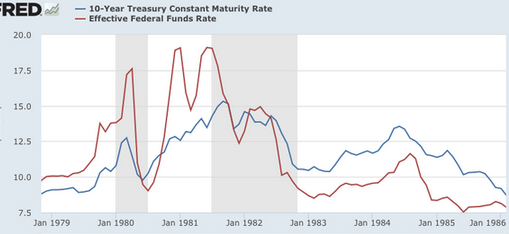

But the episode also undermines the Friedman claim on interest rates. Yes, short rates ended up lower than before once the disinflation was complete. But they were sharply elevated for three years — and while you might have expected long rates to fall due to reduced expectations of inflation, in fact they rose along with short rates and stayed high for several years.

Paul Krugman provides this graph to support his claim:

This is the conventional view of the Volcker years, but it’s actually not correct. Volcker did adopt a tight money policy in late 1979 and early 1980, but it wasn’t very credible. And for good reason, in mid-1980 the Fed suddenly switched to a highly expansionary monetary policy. As a result, by late 1980 and early 1981 NGDP growth was running at 19.2%. You read that right, 19.2%. And no, we are not talking about Venezuela or Zimbabwe; we are talking about the United States of America. I’m not sure what happened, but recall that the initial tight money policy drove the US into a steep recession in early 1980. Unemployment soared. Also recall that Volcker was a Democrat and the Democratic president that appointed him faced a difficult re-election battle in the fall. I don’t know whether this fact influenced the Fed, but for some reason the Fed slashed short term interest rates to single digits, even as CPI inflation averaged over 13% in 1980. That policy shift made no sense. The easing immediately ended the recession, which was (I think) the shortest on record. The economy began to recover in the second half of 1980.

As the explosive NGDP data for late 1980 and early 1981 came in, the Fed realized that its earlier anti-inflation policy had failed. Bond markets saw this failed effort, and became even more skeptical. Long-term yields soared to new peaks. So Volcker tightened again in the spring of 1981 (a policy supported by Reagan, but opposed by many of Reagan’s aides.) In mid-1981 the economy went into a steep recession, and interest rates fell sharply, just as in the spring of 1980. But this time the Fed persevered through high unemployment, and we had a long recession. This time they did squeeze inflation out of the economy. When the markets saw that this time the Fed was serious, there was another sharp drop in rates in late 1982.

When the Fed does a tight money policy and reduces NGDP growth, interest rates often fall very quickly, within weeks or months. For instance, interest rates started plunging almost immediately after the Fed raised their target interest rate to 6.5% in the late summer of 1929.

Just to be clear, I’m not arguing that it’s easy to predict the movement of interest rates. I believe in the EMH, and hence that bond price movements are mostly unforecastable. Rather I’m claiming that it is possible to make reasonably accurate predictions about the direction of interest rates conditional on NGDP growth. If monetary policy is tight it will reduce NGDP growth within weeks or months, and interest rates will tend to move at roughly the same time. Like Ben Bernanke, I believe that NGDP growth/inflation is a better way of judging whether money is easy or tight than interest rates—which to a large extent reflect the condition of the economy.

One other point. I’m much less confident making this claim for small changes in monetary policy, such as a 1/4% increase. Over the years I’ve seen long yields respond in many different ways to unexpected changes in short term yields—with the liquidity effect sometimes dominating and the Fisher/income effects sometimes dominating. As they like to say in academia, “more research is needed.” So even if Krugman is wrong about the Volcker disinflation, it’s possible he’s right in claiming that a Fed rate increase today would persist for 3 or 4 years. We just don’t know.

READER COMMENTS

Alex Tabarrok

Sep 21 2015 at 3:26pm

Kevin Grier’s paper, Congressional Influence on Monetary Policy, JME 1991 explains why Fed policy only changed substantially after the 1980 election, i.e. in 1981 when the leadership of the relevant banking committees changed hands.

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.477.6537&rep=rep1&type=pdf

Steve Fritzinger

Sep 21 2015 at 4:15pm

[Comment removed. Please consult our comment policies and check your email for explanation.–Econlib Ed.]

marcus nunes

Sep 21 2015 at 4:47pm

Almost everyone says mon policy is highly accomodative. Since Yellen took over and began conducting monetary policy according to “dates and time spans”, it has been tightening!

https://thefaintofheart.wordpress.com/2015/09/20/for-more-than-one-year-monetary-policy-has-been-tightening-but-the-fed-thinks-its-highly-accommodative/

Jeff

Sep 21 2015 at 6:30pm

The fact that Volcker blinked in mid-1980 probably cost him and the Fed a lot of credibility and made the length and depth of the subsequent recession worse. Chuck Norris he wasn’t, at least not until he withstood the heat that came with the 82 recession.

Scott Sumner

Sep 21 2015 at 9:25pm

Thanks Alex, That information is very interesting.

Marcus, That’s plausible. Although to be honest it doesn’t seem much different than under Bernanke—depends which metric you use.

Jeff, That’s right.

B Cole

Sep 22 2015 at 1:26am

Great post, but the historian in me quavers a bit at the description of Reagan as supporting Volcker. In their meetings Volcker recounts Reagan a cipher. Also Reagan gave speeches to real estate groups questioning why interest rates were so high. Treasury Secretary Donald Regan advised putting the Fed into the Treasury Department in public statements, and was not rebuked in any way.

However outside of my blogging, yours is the most true depiction of the Reagan-Volcker years I have read in a blog. At least you are close.

g

TallDave

Sep 22 2015 at 2:51pm

Dynamic and self-reinforcing interactions of credibility and expectations often seem to make monetary policy totally inscrutable, but market monetarism is definitely getting us closer.

Bob Murphy

Sep 24 2015 at 10:21am

Scott, I’m honestly not trolling you. I’m just (again) pointing out that it’s hard to learn your framework, because it seems you often flip back and forth between your unorthodox views versus more mainstream views (in order to make your point accessible to your readers). Nothing wrong with that, except I think you often don’t announce what you’re doing, when.

Two examples from this post:

When the Fed does a tight money policy and reduces NGDP growth…

Here, are you saying those are cause and effect? Because I thought you viewed them as definitionally the same, or more accurately, that market prediction of future NGDP growth was how we *defined* looseness or tightness of monetary policy.

Similarly you write:

If monetary policy is tight it will reduce NGDP growth within weeks or months…

Here, it sounds like you are offering your view on the empirical lag time between changes in, say, money growth and consequent changes in market prices. But that’s not what you mean at all, right?

Instead, doesn’t the above statement, in a Sumnerian framework, equal the following?

“If the market expects future NGDP growth to be below target, then NGDP growth will slow within weeks or months.”

So you’re not really making a claim about printing presses and prices, you’re making a claim about the accuracy of market forecasts right? Yet I don’t think most readers would have realized you were really talking about market forecasts, rather than anything the central bank does.

Anand

Sep 26 2015 at 12:34pm

I generally agree with the post.

I have an observation regarding permahawkery. I was reading about the Rehn-Meidner model, the model that dominated Swedish policy from the 1950-70s. This was very much a social-democratic left-wing model.

I was surprised to learn that they considered inflation to be the key to the implementation of the model. They explicitly aimed for tight macroeconomic conditions, and considered uncontrolled wage growth to be the unraveling of the model. See for instance the retrospective by Meidner here: http://socialistregister.com/index.php/srv/article/view/5630/2528#.VgbGcbahBdc

They kept inflation in check by what they called “solidarity policies”, essentially wage suppression and demand supression by unions/management collaboration, especially at the high-end of the wage distribution (this is a simplification, see the paper for more details). While the US and some others relied on high interest rates/unemployment to bring down wages/inflation.

This might be a clue to why permahawkery is so ingrained in policy and perhaps explains some of Sweden’s policies in the aftermath of the recession. It is not just right-wing forces which have this mentality.

Comments are closed.