The Financial Times has an interesting story discussing the impact of recent US tariffs on Chinese exports to the US:

Donald Trump’s first sally in the skirmish was to impose a 25 per cent tariff on 818 Chinese product lines, including electrical equipment, machinery and vehicles, in July 2018. This wave purportedly covered an annual $34bn of Chinese exports, although analysts at Standard Chartered calculated they amounted to just $16.4bn in 2017.

Mr Trump then followed up with a 25 per cent levy on a further $16bn of annual US imports in August and slapped a 10 per cent tariff on another $200bn of products, a figure that is due to rise to 25 per cent in April if the two countries are unable to resolve the dispute by then.

StanChart’s analysis of the initial tranche of targeted goods (the “$34bn” list) found that China’s US-bound exports of the 818 products fell 27 per cent in August-October 2018 compared with the same period a year earlier. China accounted for just 6.9 per cent of US imports of these 818 lines, down from an average of 10.4 per cent during the August to October periods of 2015-17.

It seems that the recent tariffs have reduced Chinese exports of the specific goods being targeted. But what about overall Chinese exports?

This is despite China’s overall exports to the US appearing to have held up well last year, amid expectations they hit a record $550bn, up from $505bn in 2017.

That’s a bit odd, unless you think about what sort of factors determine trade balances. Trade experts believe that tariffs have relative little impact on overall trade balances, which reflect saving/investment imbalances.

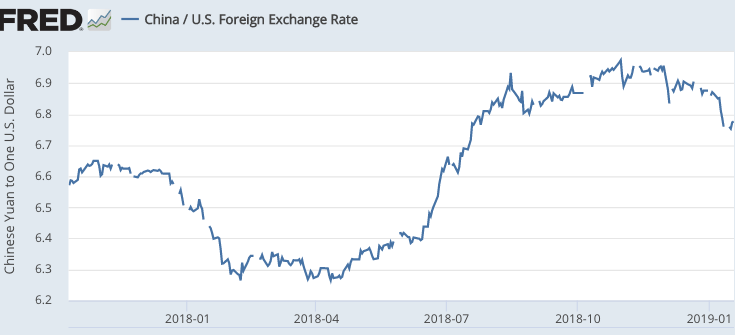

So why did Chinese exports hold up, once the tariffs were applied? The imposition of tariffs on Chinese goods may have contributed to a sharp fall in the foreign exchange value of the yuan during the second half of 2018. (Note that on this graph a bigger number means a weaker yuan):

The vast majority of Chinese exports were not impacted by the 25% tariff. Either there was a 10% tariff, or no tariff at all. Thus the roughly 10% depreciation of the Chinese yuan prevented the 10% tariff from having much impact on $200 billion worth of exports, and actually boosted Chinese exports of the $300 billion worth of goods that were not hit with any tariff.

The vast majority of Chinese exports were not impacted by the 25% tariff. Either there was a 10% tariff, or no tariff at all. Thus the roughly 10% depreciation of the Chinese yuan prevented the 10% tariff from having much impact on $200 billion worth of exports, and actually boosted Chinese exports of the $300 billion worth of goods that were not hit with any tariff.

This is not to say that a sufficiently high set of tariffs would not impact US/China trade—it would. But the impact can be very complex. Tariffs might also reduce US exports, leaving the trade balance unaffected. The weaker yuan might boost Chinese exports to third parties, while reducing Chinese exports to the US. There are lots of possibilities. The key point is that these policies need to be examined from what economists call a “general equilibrium” framework, which means considering all of the unintended side effects on other markets and other countries.

READER COMMENTS

Pierre Lemieux

Feb 7 2019 at 5:23pm

That’s an important point you are making, Scott–and making well, as usual. General equilibrium is like a system of simultaneous equations where every variable is (in a sense) both a cause and an effect. If one does not adopt a general-equilibrium approach, much care must be taken about what is included in the necessary ceteris paribus. (I discussed some related points in a post at https://www.econlib.org/tariffs-and-the-trade-deficit/.)

Gordon

Feb 7 2019 at 7:34pm

Scott, as so many people make the mistake of confusing changes in the nominal exchange rate with changes in the real exchange rate, I think there is some value in pointing out that there was a considerable weakening of the yuan on a nominal basis as China was working to contain economic fallout from its credit crackdown which should not be confused with an attempt to gain trade advantage. And the change in the real exchange rate is due to the tariffs that Trump introduced.

Benjamin Cole

Feb 7 2019 at 7:40pm

The nice thing about macroeconomics is that no one is ever wrong. There is always a study to cite, or one can rest on a untestable but widely accepted theory.

Here is a study that concluded China is “eating” the US tariffs by effectively cutting prices, so there is no harm to (the ever-exalted) US consumers.

http://www.econpol.eu/sites/default/files/2018-11/EconPol_Policy_Brief_11_Zoller_Felbermayr_Tariffs.pdf

But overall, I agree with Sumner. The Trump tariffs have been built into a mountain, but are really something of a molehill.

There are much larger structural impediments in the US economy today than international trade issues, notably local property zoning and the routine criminalization of push-cart, motorcycle-sidecar and truck-vending.

In this regard, the US macroeconomics profession has left the rails. I realize global trade is more sexy than, “We need better provisions for push-cart vendors.”

Worse, the IMF (!) concludes large US current-account trade deficits feed bloated asset values, and risk Hyman Minsky moments—as the one triggered when the Fed tightened up in 2008. Oh, that.

http://www.imf.org/en/Publications/ESR/Issues/2018/07/19/2018-external-sector-report

Thaomas

Feb 7 2019 at 8:25pm

One should not forget that an import tariff is the equivalent of an export duty. One would expect the trade balance to remain the same but at a lower level of imports and exports.

Scott Sumner

Feb 7 2019 at 10:59pm

Pierre, That’s an excellent post, I should have linked to it.

Gordon and Thaomas, Good points.

blink

Feb 8 2019 at 2:01am

Can you explicate the mechanism through which tariffs alter exchange rates? Moreover, how could tariffs focused on a small fraction of goods cause such a large overall change in exchange rates? I am not yet seeing the potential.

Relatedly, I worry that a connection could also be used as a tool to combat perceived currency manipulation — Yuan deemed over-valued? Impose tariffs. Yuan deemed under-valued? Tax exports.

Scott Sumner

Feb 8 2019 at 4:09pm

blink, Current account balances are probably determined by saving/investment imbalances. Because tariffs don’t have much effect on those imbalances, any effect of tariffs on exports and imports will be offset by a move in the exchange rate that is large enough to leave the overall balance unchanged.

I don’t know how much of the Chinese yuan depreciation was due to the tariffs and how much was due to other factors. But I suspect that enough was due to tariffs to negate the impact of tariffs on trade balances.

My post is an argument against tariffs imposed to retaliate for currency manipulation, as it suggests they won’t work—the currency will simply adjust again.

Comments are closed.