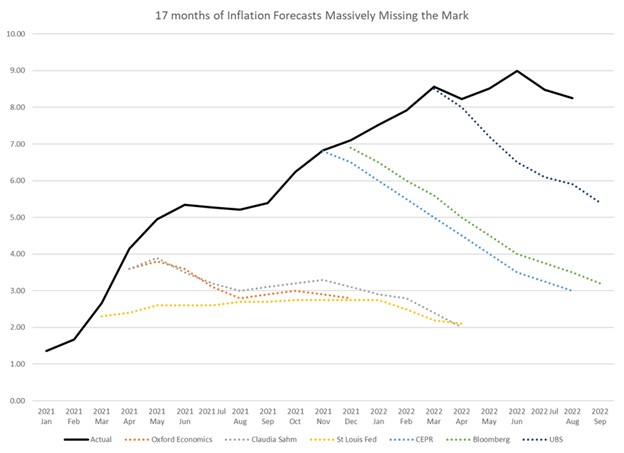

My Mercatus Center colleague Jack Salmon put together this nice chart. It compares the inflation forecasts of different institutions and economists to what has actually happened since early 2021. Jack has followed closely the predictions of many institutions and economists and has tracked many more than are shown on this chart. Along with these projections came analyses, nearly all of which proclaimed, time and time again, that “Inflation has peaked.” These predictions were also expressed with terrific confidence.

Yet the performance of these models against reality goes to show that, while such models can be useful, we always must be careful not to put too much faith in their ability to predict the future. When it comes to modeling, projecting, and forecasting, more humility is better than less.

When Salmon and I were talking about why and how this seems to happen regularly, he emailed me a possible explanation.

Models/forecasts are often based on historical trends and so assumptions about inflation or interest rates always show variables falling back to trend (which is what the flawed forecasts in my chart demonstrate nicely). For example, economists who have observed low and stable inflation for 4 decades are biased into believing that inflation will quickly return to this trend, so these assumptions are often baked into their models.

The same goes for interest rates—last year the CBO forecast that 10-year treasury yields would rise to 1.9% in Q3 2022. In reality, 10-year treasury yields are sitting at 3.4% in Q3.

The same is true of believing that the path of this inflation and of fixing it will look exactly like the 1970s and 80s. It could be that this time around the hike in interest rates needed to tame inflation will be much lower than was needed in the 80s. This is what the Federal Reserve seems to believe. I am personally more concerned that this won’t be the case because the administration continues to spend like a drunken sailor with a death wish.

More broadly though this set of model failures is one more data point that adds to my skepticism of such models and I feel compel once again to warn against the perils of economic forecasting in other context too. For instance, the optimism bias in in both public and private forecasts for economic data has been well documented for a while. Consider these two revealing paragraphs from a Financial Times article of a few years ago:

So economists who tend to predict near the consensus are, by definition, unlikely to anticipate extreme events, while those who correctly predict the occasional Black Swan tend to get everything else wrong (or most everything else).

Unfortunately, when it comes to economic forecasting, there’s really nowhere to turn, as the consensus view tends to miss even cyclical, non-Black Swan recessions.

That certainly is true in budget projections.

The bottom line is that predicting the future with models is hard.

Veronique de Rugy is a Senior research fellow at the Mercatus Center and syndicated columnist at Creators.

READER COMMENTS

Matthias

Sep 19 2022 at 12:46am

Forecasts derived from market prices have fewer problems. At least in principle.

In this case, the TIPS spreads are the ones to look at.

They aren’t perfect forecasts, but prices in financial markets are the closest we have to prediction markets.

nobody.really

Sep 19 2022 at 11:29am

Interesting. In The Myth of the Rational Voter, Bryan Caplan disparages the public’s rejection of economic reasoning, and blames four dynamics for this–including the dynamic of pessimistic bias.

nobody.really

Sep 19 2022 at 11:31am

The only function of economic forecasting is to make astrology look respectable.

Ezra Solomon, Burmese-born American economist (1920–2002), The Bulletin (1984), Reader’s Digest 1985; wrongly attributed to J. K. Galbraith following a humorous piece in U.S. News & World Report (March 7, 1988)

nobody.really

Sep 19 2022 at 11:34am

Maybe. In college I tried to date a model. My roommates predicted the outcome of my efforts pretty accurately.

Knut P. Heen

Sep 20 2022 at 11:57am

Did anyone see someone roll a die and get the expected outcome 3.5?

There are at least two components to predictions, long-term trend and short-term variance. Short-term variance comes from what we may call news updates, for example “covid is here” or “covid is gone”. News are by definition unpredictable, otherwise it would not be news (same information as yesterday is not news). Long-term trends are to some extent predictable. Hard work, saving and investment lead to economic growth. If everyone produce 10 percent more, we expect 10 percent growth in production. The point is that, short-term variance often totally dominates the long-term trend. The problem is that people keep on making short-term predictions based on long-term trends. A 100-year trend of 5.0 percent growth does not imply that 5.0 percent growth is a very likely outcome for next year. Zero growth or 10.0 percent growth may be almost as likely as 5.0 percent growth.

Predicting inflation is even harder because inflation is a more potent tool when it comes as a surprise.

Thomas Lee Hutcheson

Sep 20 2022 at 10:08pm

The problem is that few predictors are transparent about what they are predicting. Are they predicting exogenous events? future policy changes? results of past policy changes?

Comments are closed.