The Dismal Economics of Drug Development

By Charles L. Hooper

We’ve come to expect technology to improve each year. Moore’s Law is justifiably famous, with its remarkable ability to explain the past and predict the future. It states that the number of transistors squeezed onto integrated circuits doubles every two years; this pattern has held true for half a century. More transistors on chips allow computers to perform faster mathematical calculations.

Moore’s Law is optimistic and reflects the ability of humans to “chip” away at a problem, making sequential, cumulative advances. Much of technology fits this pattern. One glaring exception, tragically, is the drug development conducted by pharmaceutical companies. It is hugely expensive and has gotten more so each year. If costs continue to grow at 7.5 percent per year, real costs will more than double every 10 years. The pharmaceutical industry seems to be operating under a reverse-Moore’s Law, which has been referred to elsewhere as Eroom’s Law (Moore spelled backwards).1 Eroom’s Law looks at four factors for the decline in R&D productivity. Here, I will focus on one: the U.S. Food and Drug Administration (aka, the ‘cautious regulator’) is steadily increasing the cost per clinical trial participant and the number of required participants per clinical trial. Here’s the short version: Drug development costs double every decade. Why? Simple: the U.S. Food and Drug Administration is steadily increasing the cost per clinical trial participant and the number of required participants per clinical trial.

Technology and Moore’s Law

The Cray 1 supercomputer that I used at NASA in the early 1980s cost an inflation-adjusted $28 million. Today’s iPhone 7, at a cost of $650, is equal to 2,000 Cray 1 supercomputers. Per dollar, the iPhone 7 performs 90 million times as many calculations as the Cray 1. And for that price, you get a phone too.

“The field of drug research and development seems immune to the powers that drive Moore’s Law.”

Why shouldn’t drug research and development fit this pattern? Every year scientists learn more about biology, physiology, pharmacology, and the natural history of diseases. They study what has worked and what hasn’t. Their tools become more precise and more powerful. And yet the field of drug research and development seems immune to the powers that drive Moore’s Law.

Drug Development is Expensive

Each year, to launch a certain number of new medicines, companies plow more and more money into research and development. Joseph DiMasi, Henry Grabowski, and Ronald Hansen, in a study performed for the Tufts Center for the Study of Drug Development, have estimated that the cost of bringing a new drug to market, in 2013 dollars, is $2.558 billion ($2.69 billion in 2017 dollars).23 Further, as a condition for approval, the FDA often requires drug companies to conduct post-marketing clinical trials to answer some remaining questions. Those post-marketing studies add $312 million, on average, to a drug’s cost, raising the overall price tag to $2.87 billion in 2013 dollars ($3.02 billion in 2017 dollars).

Why is this number so large? One reason is that much of R&D is spent on the roughly 95 percent of drugs that fail along the way. The 95 percent failure rate is an average; some drugs have a 50 percent chance of success and others have a 1 percent chance. It depends on the drug, the therapeutic area, and the stage of the drug’s development. A 2014 study by researchers at Cleveland Clinic found that 99.6 percent of more than 400 Alzheimer’s clinical trials had failed.4 The $2.558 billion tab accounts for those “dry holes.”

Is this estimate realistic? DiMasi, Grabowski, and Hansen have, over the years, refreshed their analysis regularly. Back in 2003, their figure was $802 million. In 2006, Christopher P. Adams and Van V. Brantner, an economist and a research analyst, respectively, at the U.S. government’s Federal Trade Commission, tried, using different data, to replicate DiMasi et al.’s 2003 estimate. They found the cost to be slightly higher—$868 million versus $802 million.5 For that reason, therefore, DiMasi et al.’s methodology for reaching the latest estimate of $2.558 billion appears reasonable.

Drug Development is Getting More Expensive

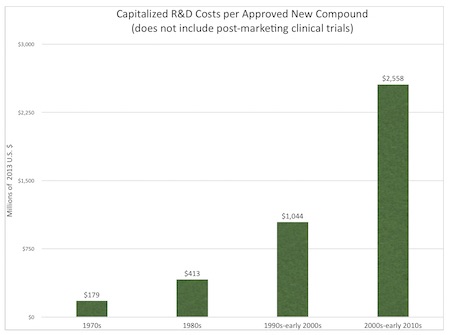

Capitalized drug development and approval costs have increased at 7.5 percent per year in real terms: $179 million in the 1970s, $413 million in the 1980s, $1,044 million in the 1990s through early 2000s, and $2,558 million in the 2000s through early 2010s (2013 dollars).6

If this 7.5 percent annual growth rate persists, costs will more than double every 10 years. The annual growth rate over the last decade has been 8.5 percent.7 Figure 1. summarizes capitalized pharmaceutical R&D costs from the 1970s through the 2010s.

If you want a new drug, pony up $3 billion now. In ten years, it will likely cost you $6 billion.

Reasons for Expensive Clinical Trials

Why have drugs become more expensive to develop? Some examples illustrate why.

When I worked at Merck in the early 1990s, one of its biggest drugs was Vasotec (enalapril). It was tested in 2,987 patients before FDA approval. Mevacor (lovastatin), another of Merck’s big drugs at the time, was tested in 6,582 patients in the EXCEL Study. At the time, that was thought to be a massive trial.

Now the situation is different.

Orexigen Therapeutics was conducting clinical trials on the obesity compound Contrave (naltrexone/bupropion). In 2011, the FDA asked the company to conduct a trial on between 60,000 and 100,000 patients. This clinical trial would have been enormously expensive, especially considering the resources available for a small company like Orexigen. In response to this request, Orexigen discontinued the development of Contrave and all of its other obesity drugs.8 During this period, the firm’s stock price dropped 70 percent, and Orexigen laid off 40 percent of its staff.

Later, after negotiations with the FDA, Orexigen eventually ran a clinical trial on fewer than 10,000 patients. While this reduced requirement enabled the trial to proceed, this was still a huge and hugely expensive clinical trial.

The REVEAL trial, in which Merck is currently testing the experimental drug anacetrapib, includes a whopping 30,000 subjects and is being conducted at 430 hospitals and clinics in the United Kingdom, North America, China, Germany, Italy, and Scandinavia.

Between 1999 and 2005, the average length of a clinical trial grew from 460 days to 780 days, while the number of procedures on each patient (e.g., blood draws, scans) grew similarly, from 96 to 158.9 Comparing the 2001-2005 period to the 2011-2015 period, one study found that the number of study participant visits to care providers (e.g., hospitals, clinics, doctors’ offices) increased 23-29 percent; the number of distinct procedures increased 44-59 percent; the total number of procedures performed increased 53-70 percent; and the cost per study volunteer per visit increased 34-61 percent.10

The protocols for clinical trials—those written recipes for how patients are to be recruited, dosed, and evaluated—have become more complex, as well. Dr. Gerry Messerschmidt, chief medical officer at Precision Oncology, reports, “When I was writing protocols 20 years ago, they were one-third the size that they are now. The change has really been quite dramatic.”11

Clinical trials are more expensive now because the cost per participant has increased at the same time that the number of participants has grown. Why? Again, the answer is the FDA.

This fact was not lost on former FDA Commissioner, Margaret Hamburg, who said, “Timelines are long, costs are high, and rates of failure are distressingly high.” Janet Woodcock, head of the FDA’s Center for Drug Evaluation and Research, admitted that the size and length of clinical trials had grown substantially in recent years but argued that it was necessary for regulators to better identify risks. “We’re smarter now [but still] humbled by what we don’t know.”

Pharmaceutical companies typically estimate the future expenses and revenues for each prospective drug, looking forward 20 years. In some cases I know of intimately, they hire consultants to estimate expenses, revenues, and probabilities of success at each phase of development. They use these data to compute the financial value of each pharmaceutical project and, if the expected value (probability-adjusted value) of the project is negative, the consultants recommend discontinuing development.

Many new medicines are discarded for reasons that have nothing to do with safety and efficacy. Consultants have, for example, where the prospects looked poor, suggested killing drugs for brain cancer, ovarian cancer, melanoma, hemophilia, and other important conditions.12 Even though millions of dollars may have already been spent, these consultants would never recommend that a company knowingly proceed on a path toward losing more money unless some other crucial non-financial objective was being achieved.

For more information about the pharmaceutical industry, see the EconTalk podcast episodes Angell on Big Pharma, Robin Feldman on Drug Patents, Generics, and Drug Wars, and Richard Epstein on Property Rights and Drug Patents. See also “Pharmaceuticals: Economics and Regulation” by Charles L. Hooper in the Concise Encyclopedia of Economics.

This is where the FDA becomes important: the more stringent the FDA’s requirements, the more drugs cost to develop and the lower their probability of approval becomes, meaning that more of them end up on the cutting room floor.

Joseph Wu, a professor of cardiovascular medicine and director of the Stanford Cardiovascular Institute, said about the FDA’s requirements that pharma companies test all drugs for cardiac safety, “[T]he screening is so sensitive that it’s killing a lot of potentially good drugs.”13

Moore’s Law

Moore’s Law is optimistic, with costs dropping 30 percent each year. What we are actually seeing is dismal, and my calculations show costs increasing 7.5 percent per year. Moore’s Law looks at technology without government interference, and yet it is clear that pharmaceutical companies are being hampered by stiffer and stiffer government regulation.

Unless FDA requirement trends change, for each dollar invested in R&D, expect fewer drugs to be discovered, developed, and marketed. Compared to what we could have, expect fewer therapeutic choices, less competition, higher prices, and some Americans dying unnecessarily.

The title of this article was changed from “Hooper’s Law of Drug Development” to “The Dismal Economics of Drug Development” after a reader pointed out that the insight about pharmaceutical R&D costs increasing over time had been described by Jack W. Scannell, Alex Blanckley, Helen Boldon and Brian Warrington in March, 2012. In that paper, “Diagnosing the decline in pharmaceutical R&D efficiency,” published in Nature Reviews Drug Discovery 11, 191–200 (2012 ), the relationship was termed ‘Eroom’s Law,’ or ‘Moore’s Law’ backwards.

Joseph A. DiMasi. Tufts Center for the Study of Drug Development, “Innovation in the Pharmaceutical Industry: New Estimates of R&D Costs”, 18 November 2014. PDF file.

Joseph A. DiMasi, Henry G. Grabowski, and Ronald W. Hansen, “Innovation in the pharmaceutical industry: New Estimates of R&D Costs”. Journal of Health Economics, Vol. 47, May 2016: 20-33.

Charley Grant, “Alzheimer’s: Pharma’s Great White Whale Is Still Worth Hunting,” The Wall Street Journal, 20 February 2017.

Joseph A. DiMasi, Henry G. Grabowski, and Ronald W. Hansen, “Innovation in the pharmaceutical industry: New Estimates of R&D Costs”. Journal of Health Economics, Vol. 47, May 2016: 20-33.

Joseph A. DiMasi, “Innovation in the Pharmaceutical Industry: New Estimates of R&D Costs”. Boston, MA, November 18, 2014. PDF file.

Joseph A. DiMasi, “Innovation in the Pharmaceutical Industry: New Estimates of R&D Costs”. Boston, MA, November 18, 2014. PDF file.

“Orexigen Halts Development of Anti-Obesity Therapies”. Genetic Engineering and Biotechnology News, June 3, 2011.

“A Doctor to Heal the FDA,” The Wall Street Journal, 13 March 2017.

Kenneth A. Getz and Rafael A. Campo, “Trends in clinical trial design complexity,” Nature Reviews Drug Discovery, 16, 307 (2017), 18 April 2017.

Denise Myshko, “Trends in Protocol Development, PharmaVOICE, March 2017.

See Charles L. Hooper, “Confessions of a Drug Killer,” TCS Daily, May 8, 2007.

Greta Lorge, “Finding the Cures Within Us”. Stanford Alumni Magazine, March/April 2017.