With the rise of social media (especially Twitter), it has becomes easier to observe changes in the zeitgeist. Over the past few years, I’ve seen the following trends:

1. Claims that increases in the minimum wage do not have negative side effects.

2. Claims that we don’t have to worry about big budget deficits when the interest rate is low.

3. Claims that changes in the money supply don’t impact inflation.

4. Claims that neoliberalism no longer works, and that we need an industrial policy.

In each case, trendy pundits rejected long established economic principles. And now the chickens are coming home to roost.

1. In a recent post, Kevin Corcoran discussed a study by Seth Hill, which found that minimum wage increases led to more homelessness. Can we be certain that this study is correct? Clearly not; social science has a replication crisis. But that’s equally true of studies claiming that the minimum wage did not reduce employment. Other studies by highly respected researchers found that the minimum wage does reduce employment. In my view, all of these studies miss an important point. The worst effect of wage, price and rent controls is that they make society more cruel. With rent control, landlords have an incentive to be mean to tenants. With minimum wage laws, bosses have an incentive to become jerks. Anyone who ever visited a communist country quickly discovers that “customer service” abysmal. (I was married in a communist country.) I have enough problems; please don’t make our society even more annoying.

2. I have some sympathy for those who suggested that we didn’t need to worry about budget deficits when interest rates were low. At the time, I argued against this view on the basis that interest rates might rise in the future. But even I did not expect rates to rise as sharply as they have over the past few years. Now we are discovering that debts incurred at a very low interest cost in the late 2010s and early 2020s must be rolled over at a much higher rate. Yes, it is true that we never actually pay off the national debt. But we do pay off individual Treasury securities, and refinance this debt at current market rates.

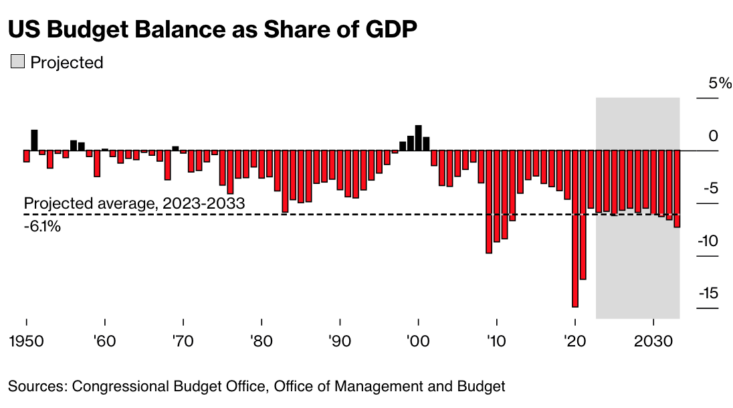

The other reason I have some sympathy for those who discounted the danger of budget deficits is that there had been so much “crying wolf” over previous decades. Throughout almost my entire life, I’ve heard the budget deficit called a ticking time bomb. And yet for the most part the national debt remained relatively low as a share of GDP. Something changed in the late 2010s, when the US went from being a responsible nation to something akin to a banana republic. There were no more “grownups in the room” to scold Congress when reckless fiscal policies were adopted. The budget deficit doubled during an economic boom, a period where it would normally be falling as a share of GDP. These policies (spend more and tax less) proved popular with the general public and were maintained (and even extended) when a new administration took power in 2021. And now the wolf is here, we really do have a debt problem. Unlike during the Reagan years, this really is unsustainable:

Future generations will face some very unpleasant choices due to the irresponsible behavior of the Federal government over the past 6 years. I would not wish to be elected president in 2024.

3. The money supply is not an ideal indicator of the stance of monetary policy. Velocity can change over time. But many pundits drew the wrong inference from those facts, completely discounting the importance of monetary policy. Now we are seeing the high inflation from the reckless decisions made by the Federal Reserve back in 2021 and 2022, which led to a surge in the money supply. And don’t be fooled by the recent drop in the headline inflation rate—the problem is far from over. It would not surprise me to see headline inflation begin moving higher again.

Inflation and excessive borrowing share one common feature—the longer we wait to address the problem, the more painful the cure.

4. After the 2008 financial crisis, neoliberalism seemed to go out of style. Perhaps people just got bored with it. “You say it was the biggest ever reduction in world poverty seen, by far? Yawn, what have you done for me lately?” The US, Europe and China all began moving in a more statist direction. Pundits assured us that we needed to copy China’s industrial policy, least we fall behind that nation of 1.4 billion people. (Left unsaid is why the US should copy a nation that has a per capita GDP roughly equal to that of Mexico.)

Now we are being told that China’s economic model is sputtering. And the recent so-called Inflation Reduction Act is creating a set of grotesque distortions and inefficiencies. Even worse, the massive subsidies will also boost the national debt, forcing future tax increases that will further slow economic growth. Statist policies are like a time bomb; the most pronounced negative effects occur down the road.

But what about global warming? Didn’t something need to be done? Here it’s worth noting that the approach most favored by economists (a carbon tax) would have actually reduced our budget deficit. That would have been the logical approach. Instead we went with a set of open ended subsidies that boosted the budget deficit. Even worse, we favored local producers over imports, even if imported goods could address global warming more effectively. We were told that global warming was such a big problem that we could no longer rely on a free market economy, but then implemented mercantilist policies that prioritized subsidizing domestic special interest groups over addressing global warming.

Apparently global warming was merely a pretext for industrial policies that were being implemented for other reasons. The same is true of industrial polices aimed at competition with China. If we were serious about this issue, we’d bring thousands of Taiwanese and Chinese engineers to America to help us rebuild our chip industry. Instead, these projects are floundering due to a lack of skilled labor. Trump and Biden have an instinctual preference for mercantilism—China and global warming are handy excuses to exercise those preferences.

To summarize, stay away from trendy economic fads. The eternal verities never change:

1. Price controls are bad (whether on wages, prices rents or interest rates.)

2. Large budget deficits are bad, even if interest rates are low at the time.

3. Persistent inflation is always and everywhere a monetary phenomenon.

4. Free market economies do better than statist economies. Emulate Denmark, not Argentina.

PS. Veronique de Rugy recently discussed the Foxconn fiasco in Wisconsin, a previous attempt at industrial policy that occurred during the Trump administration. Hope springs eternal.

READER COMMENTS

Michael Sandifer

Aug 27 2023 at 9:04pm

I think it’s more likely that the economy’s running somewhat hot right now, but that we’re also seeing the beginning of a productivity boom. Inflation expectations are very tame, despite what appears will be a very high RGDP growth rate during this quarter. That means we can expect the Fed to engage in pro-cyclical policy, if the boom becomes more pronounced. This is possibly a case of NGDP growth being too high, despite tame inflation expectations and falling inflation.

Scott Sumner

Aug 27 2023 at 11:13pm

When NGDP and inflation conflict, always go with NGDP.

Michael Sandifer

Aug 28 2023 at 12:32am

Yes, of course, unless it is not a productivity boom, but a permanent increase in productivity. Even if it is a permanent increase in productivity, it doesn’t necessarily mean an NGDP level target should be raised, but a big enough increase in productivity could cause too much deflation if the target is not raised. The key is obviously to avoid necessary unemployment, due to a rise in real wages.

Richard W Fulmer

Aug 28 2023 at 12:28pm

Why would wage increases stemming from increasing productivity lead to rising unemployment? Yes, a company might be able to produce more stuff with fewer workers, but if workers are more productive, someone is going to hire them – absent, of course, laws and regulations that make labor too expensive to hire.

Michael Sandifer

Aug 29 2023 at 12:00pm

The answer to your question has to do with sticky wages. I was referring to real wages, which you could simply view as something like total nominal wages or total nominal compensation over NGDP.

Under NGDP level targeting, a typical productivity boom will just lead to higher RGDP growth and lower inflation, ceteris paribus. If the boom is large enough though, NGDP growth can outstrip nominal wage growth enough to lead to unnecessary unemployment. Even a little deflation can be fine, and even optimal, but if there’s too much, the unemployment rate starts to rise, without a speed up in the production of money.

Richard Fulmer

Aug 29 2023 at 3:35pm

I think we’re talking past each other; you’re at the macro level, and I’m at the micro. At the micro level, why would increasingly productive workers have trouble finding jobs? People who can produce more stuff per hour are every employer’s dream.

Aren’t sticky wages an issue only in a down market? In your scenario – a market in which productivity is rising and the money supply is stable – real prices are dropping and sales volumes are increasing. In such an environment, demand for labor is rising, not falling.

Workers may lose their jobs at a particular company, but they should be able to quickly find a new job, albeit at a lower nominal, though higher real, wage. Sticky wages, under such conditions, would be a problem only if a significant number of workers demand higher nominal wages in the face of declining prices.

This could happen if they have made long-term commitments (e.g., home mortgages), though (1) rising productivity and the resulting fall in prices tends to be gradual, and (2) people can refinance their homes and renegotiate other commitments.

Michael Sandifer

Aug 30 2023 at 2:02pm

Richard,

No, sticky wages are an issue when growth is accelerating, or decelerating. If that weren’t true, higher inflation would have no real effects. Inflation only matters, because wage adjustment lags.

You can easily see this empirically:

Here’s ECI versus NGDP:

https://fred.stlouisfed.org/graph/fredgraph.png?g=18faw

Here’s some average hourly earnings data versus NGDP:

https://fred.stlouisfed.org/graph/fredgraph.png?g=18faC

And here’s core PCE inflation versus real GDP:

https://fred.stlouisfed.org/series/GDPC1#0

Core inflation measures are also sticky, largely because wages are sticky. Core price changes are limited in the short-run by sticky wage-constrained budgets.

Creigh Gordon

Aug 28 2023 at 12:16am

“2. Claims that we don’t have to worry about big budget deficits when the interest rate is low.”

Ok, but because interest rates don’t really have anything to do with whether we a should worry about budget deficits. It’s true that individual bonds have to be repaid, but the debt as a whole will by and large be rolled over indefinitely.

Deficits do have effects, but the debt in and of itself has defied decades of “chickens coming home to roost.”

It seems to me that the mistake national debt Chicken Littles are making is an aspect of the fallacy of composition. Money is legitimately a store of value for individuals, but it’s not for a society, and by the same token debt is a burden for individuals but not for society. (Saving up a pile of green paper is not the way for a society to prepare for its future, nor will a pile of debt harm it.)

That’s not a long established economic principle, but at some point we have to come to terms with a conspicuous lack of chickens…

Jon Murphy

Aug 28 2023 at 8:39am

I suggest you check out the couple of paragraphs in this post where Scott addresses your points.

Perhaps, but that’s irrelevant. Individuals are the entities that matter.

(I’d also dispute the factual nature of the claim. History is full of societies that found it problematic that their money no longer was a store of value. But that’s separate from my point here).

Creigh Gordon

Aug 28 2023 at 10:48am

#2 correctly points out that higher interest rates will cause a larger national debt. The implication is that a larger public debt is more dangerous than a smaller one. That argument appeals strongly to common sense and personal experience, but it has never proved true. There is a fatal flaw in the logic: common sense and personal experience simply don’t encompass the fact that money is a social construct, and not a limiting factor for society.

It is true that some societies have used commodity money, which is not a social construct. We don’t do that.

Jon Murphy

Aug 28 2023 at 12:07pm

It does not logically follow that a social construct is not a limiting factor for a society. Social constructs exist for a reason.

But it is good to know that money, being a social construct, is not a limiting factor for society. Further, that large debt is irrelevant. I guess the examples of Venezuala, Argentina, Germany, the PIIGS, Russia, China, the East Asian countries, and Zimbabawe all don’t matter (and that’s just in my lifetime!).

Oh, and point of fact, commodity money is also a social construct.

Creigh Gordon

Aug 28 2023 at 2:53pm

Commodity money, taking gold as a prime example, is not a social construct. It is a physical fact, with limits imposed by the ability to find and mine it. Fiat money is not limited that way. We print it at will.

Taking the examples of Zimbabwe etc, there are factors not relevant to Prof. Sumner’s #2 point, for example in the case of Zimbabwe a near total collapse of the economy due to civil war, and in the case of Argentina large debts payable in USD, which Argentina does not print at will.

Richard W Fulmer

Aug 28 2023 at 12:18pm

The implication is that money is just something that someone made up and that we can change it at will. But money wasn’t invented. Rather it evolved, as did the institutions that grew up around it. Changing evolved systems is dangerous, not least because we are not capable of fully understand them and, therefore, cannot accurately predict the effects that any particular change will have.

Moreover, while money isn’t “real wealth,” it commands real wealth. Altering the money supply, interest rates, and financial regulations alters the way in which people allocate very real resources.

Scott Sumner

Aug 28 2023 at 12:25pm

There are a lot of fallacies in your comment. To begin with, you confuse money and debt. In addition, you ignore the deadweight burden of taxes. A larger public debt requires higher marginal tax rates to pay the interest on the debt.

Creigh Gordon

Aug 28 2023 at 2:39pm

I confuse money and debt? Surely you’re aware that every financial asset has a corresponding liability? That Federal Reserve notes and reserve deposits are liabilities (debts) of the Fed, and T bonds are liabilities (debts) of the Treasury? That bank deposits are liabilities of the respective bank? Ask any accountant, this is the very basis of double entry accounting.

Scott Sumner

Aug 28 2023 at 4:09pm

What’s the interest rate that the Treasury has to pay on currency? How much of a burden is that on taxpayers?

Creigh Gordon

Aug 28 2023 at 6:28pm

What is the interest rate on currency?

The interest rate on a $20 in my wallet is zero. But the $20 is documentation of a debt: that is, that the issuer, the United States of America, owes me a benefit worth $20. That benefit used to be that the Government would either exchange my note for gold, or it would expunge a $20 tax liability if I returned the note to the Treasury. Now of course it’s only the tax thing.

Expunging a tax liability is a benefit that many people would like to have, so the note is widely accepted as payment for goods and services.

Incidentally, the $20 wound up in my wallet because someone accepted it as payment for a good or service provided to the US Government, and through some chain of payments it came to me.

Not all debts involve interest.

On your other question, what is this costing taxpayers, let me refer you to a paper by Beardsley Ruml, former president of the NY Fed, “Taxes For Revenue Are Obsolete.” The subject is really too long for a comment.

Jon Murphy

Aug 28 2023 at 7:34pm

Nope. Not in the least.

Scott Sumner

Aug 29 2023 at 2:50pm

Creigh, “Beardsley Ruml, former president of the NY Fed, “Taxes For Revenue Are Obsolete.””

Stay away from MMT; it’s all nonsense.

Creigh Gordon

Aug 28 2023 at 4:04pm

You show me money and I’ll show you debt.

Thomas L Hutcheson

Aug 28 2023 at 9:26pm

#2 is wrong, but it does have a kernel of truth. Deficits are bad because they shift resources from investment to consumption. Low real interest rates say that the return on investment are lower than when they are higher. So deficits are less harmful during periods of low real interest rates than high real rates

Scott Sumner

Aug 29 2023 at 2:51pm

The problem is that the debt will still be around when high interest rates return.

robc

Aug 28 2023 at 10:06am

Although Andrew Jackson got pretty close.

1/1/1834: $4,760,082.08

1/1/1835: $33,733.05

1/1/1836: $37,513.05

Its been pretty much all uphill since then.

robc

Aug 28 2023 at 10:09am

on 1/1/1829, just before he took office, it was over $58 million.

I would be happy with a 7 year period where the debt was reduced by over 3 orders of magnitude. Get it from trillions to billions sounds good to me.

Thomas L Hutcheson

Aug 28 2023 at 9:28pm

It would depend on which expenditures were reduced and which taxes increased.

Richard W Fulmer

Aug 28 2023 at 12:07pm

I don’t think that people got bored with the free market after the Great Recession, I think that many of them (incorrectly) blamed the free market for the recession.

David S

Aug 28 2023 at 1:48pm

Based on recent news, Xi Jinping seems determined to prove #4. He could make the silly argument that he’s preparing his nation for a long struggle with the United States, but he’s denying the lessons of history, particularly the past 4 decades in China. Granted, we’re doing some dumb stuff right now, but we’re not close to being a centralized economy that can fabricate statistics and ignore reality.

Scott Sumner

Aug 28 2023 at 4:11pm

Yes, things are much worse in China. But we are moving in that direction.

steve

Aug 28 2023 at 2:43pm

Minimum wage laws cause people to be paid above market rates. In general, employers will end up with fewer, but more highly paid workers. I dont think this necessarily means they treat them badly. They likely get rid of their zero marginal workers so the remaining workers arent necessarily working harder, which isn’t the same as being mean. So I am just not seeing the incentive for being mean. What am I missing? (As background, I think being mean is generally not productive if you are in charge of people and often counterproductive. Bosses who are mean are generally that way due to personality flaws. Can work well over a short period but not so much long term.)

Steve

Jon Murphy

Aug 28 2023 at 3:14pm

Since minimum wage creates a surplus of workers, it reduces the cost of bosses being unpleasent. Unlike in a competitive market, workers do not have as easy recourse to leave in a minimum wage market; if they leave, it is more difficult to get another job. So, bosses can be meaner. For example, lots of economists (like Gary Becker, Thomas Sowell, and Walter E. Williams) have shown how minimum wage leads to increased discrimination in the workplace.

steve

Aug 29 2023 at 4:30pm

Could work that way. Seems like the other possibility is that if you are going to have fewer workers due to paying them more you are going to more highly value people who are able to do the work of say 1.3 cheaper workers. It would depend upon how harmful turnover is for your work. If there are essentially no costs to turnover then I can your outcome. If turnover has high costs then I think you value your workers even more.

Steve

Scott Sumner

Aug 28 2023 at 4:14pm

“Bosses who are mean are generally that way due to personality flaws.”

So there are lots more personality problems in communist countries?

TGGP

Aug 30 2023 at 11:53pm

Why do you think those countries became communist? 🙂

Thomas L Hutcheson

Aug 28 2023 at 9:31pm

Claims that increase in the minimum wage do not have negative side effects.2. Claims that we don’t have to worry about big budget deficits when the interest rate is low.3. Claims that changes in the money supply don’t impact inflation.4. Claims that neoliberalism no longer works, and that we need an industrial policy.”

Like Scott, I am unsympathetic to these trends, no always for Scott’s reasons, at least partly because they are vague and interfere with ideas that _I_ wish were trendy.

Minimum wages are a poor method of transferring income to low-income workers. Even if the elasticities of demand are so low as to make the amount of unemployment negligible, it would still be unfair to effect the transfer at the expense of owners, customers, and other workers of the employing firm. An improved EITC, reformed to make it more like a wage subsidy, would be a superior instrument for redistribution as the incidence of the tax would be more widely spread.

Deficits are the difference between revenue and expenditure so in a sense one should not “worry” about “deficits” at all. If “deficits” are bad it must be because either some of the spending is excessive or some of the revenue collection is insuffinet. I come at wanting to see smaller deficits (at full employment, like now; recessions are a different story) from a different direction. While I’m sure that there are some expenditures that are bad (technically that do not have positive net present values, NPV <0) — crop subsidies, ethanol subsidies, subsidized hazard insurance, etc. — I don’t think there are very many of them. So, in practice we chose either to tax a dollar or to borrow a dollar to make an expenditure. I think that when we borrow the dollar that mainly reduces private investment. When we tax the dollar somewhat more of it comes out of consumption. It depends on the tax of course, but I think the borrowed dollar (deficit) reduces future growth and growth benefits “all” of us not only the investor. Translating this back into politics speech, I say things like “deficits are a drag on growth” or that “higher taxes to reduce deficits promote growth” (more or less the opposite of the Republican claim that lower taxes promote growth.)

I’m actually not aware of this claim and am rather more destressed by the persistence and growth of the idea that inflation, or deflation or recession and recovery are fiscal Uncle Milton had it exactly right; they are monetary phenomena and the Fed controls monetary phenomena.

As far as I can tell “neoliberalism” has never been tried. Carter deregulated airlines and trucking and Clinton reduced some obstacles to international trade and investment with very good effects. Regan/Bush/Trump reduced tax revenues with very bad effects (deficits, see above), but where were regulation according to cost-benefit principles, elimination of employer purchase of health insurance, merit-based immigration reform, and the Pigou taxes and subsidies? If you put those missing pieces together, they would make a very good “industrial policy.”

Jim Glass

Aug 29 2023 at 11:40pm

With rent control, landlords have an incentive to be mean to tenants

And tenants have incentive to be really nasty to landlords. Landlords have a rational economic resentment of freeloading tenants. But those tenants can have an animal, emotional hostility to their landlords. You’d think someone who lucked into a deep bargain rent deal would be happy about it. And some are.

But others can’t accept the thought that they are getting something for nothing. “I’m owed this. This is my right!” To prove that point they demand ever more somethings-for-nothing, special services, extra maintenance. Anticipating the landlord might try to get them out, they rally other tenants against the landlord, file harassment legal complaints to show the landlord they aren’t afraid of court, they know the system!

Meanwhile, across the hall another tenant voluntarily paying 5x as much for the same apartment is happy to be there, loves the landlord, handles all his problems himself. During my many years in NYC as a tenant, landlord, observer and lawyer, I saw this bizarre juxtaposition over and over.

Never underestimate the evils of rent control!

Scott Sumner

Aug 30 2023 at 2:55pm

Good points.

TGGP

Aug 31 2023 at 12:04am

I remember years ago when Noah Smith was an economist/blogger who was just a little too online, but recently he’s been very disappointing in boosting things like industrial policy simply because it’s trendy. For him the logic is opposing China, and while your fave Earl Thompson might have agreed that could justify some government policies, it’s clearly become an excuse to do lots of stuff because laissez faire isn’t popular.

I don’t know of Argentina doing industrial policy. I thought their weakness was in their monetary policy. Although Garett Jones would say their generally poor policies are downstream from taking in a lot of lefty labor activist immigrants from Italy & (to a lesser extent) Spain in the early 1900s.

Floccina

Aug 31 2023 at 11:25pm

Does the above mean that we may get by without much damage from the huge deficits?

Comments are closed.