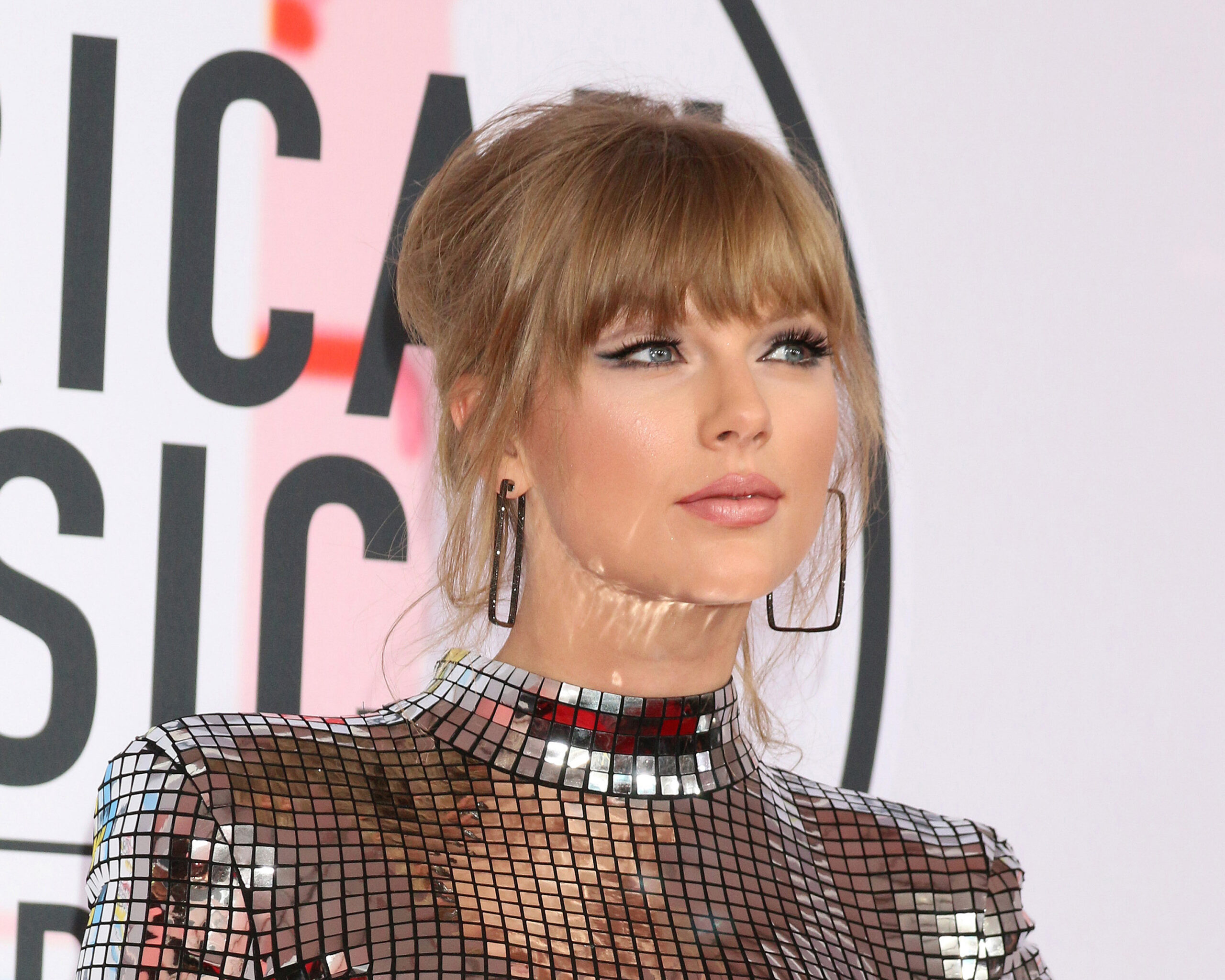

The editorials of the Wall Street Journal are often very good and economically literate. Not so much this one, whether one agrees or not with its conclusions: “Taylor Swift’s Carbon Allowance” (January 16, 2024). It criticizes carbon-offset markets, which offer the very rich (such as Taylor Swift) and large corporations a way to buy virtue. The offsets do not necessarily offset anything because the activity they represent (not cutting trees to offset carbon spitting from a private plane, for example) may not have been carried out anyway.

The problem is that the editorialists use arguments that economists have proven invalid a couple of centuries ago. Consider this one:

But unlike, say, oil, carbon allowances don’t inherently possess an economic value.

“Inherent economic value” is a meaningless expression in economic analysis. Value comes from supply and demand. Anything (1) demanded by somebody willing to pay a price that covers at least its cost, and (2) whose production requires the use of scarce resources that have a value because they can serve to produce something else—any such stuff, material or not, has an economic value. The fact that something is freely exchanged for money on a market proves that it has a value, and it has nothing to do with any “inherent value.”

This is true for bubble gum, Picasso paintings, bitcoins, and the services of fortune tellers. Oil has value only because some people are willing to pay for it and suppliers use resources that could have been used to produce something else of value. If no consumer wanted anything made with oil, its “inherent” value would fall to zero.

Ignorance of these elementary economic truths can lead to other errors—for example:

[Allowance] credits generated from not logging can be even more profitable than timber sales.

What is that supposed to prove? Innumerable examples exist of higher prices and profits generated from not producing something else, a simple consequence of economic scarcity. A resource has a price precisely because it has alternative uses and one use prevents another. Hunters or even tree huggers (tree huggers are people, too) who buy a piece of forest land generate utility (that is, what they prefer to do with their money) for themselves and, for the land seller, something “even more profitable than timber sales.” There is nothing wrong with private environmental associations buying land with private money (see my “Producing Public Goods Privately,” Regulation, Fall 2012). Mortgages generated from building houses instead of planting something on the land can even be more profitable than potato sales. And so forth.

I am agnostic as to whether carbon offsets do anything good for the future of mankind (or humor). But, to the extent that the allowances are not purchased or sold under government coercion or threat thereof, pieces of paper that certify whatever and have a market price must respond to a demand from users (say, Taylor Swift) at a price at which suppliers are willing to produce them, even they only certify some presumed virtue. If somebody wants to buy holy water at a price a supplier is happy to accept, let him or her do it. Laissez faire!

Perhaps, as the WSJ editorialists suggest, carbon offsets or some of them are a scam, but the people who buy them are presumably adults. If the scam originates in the intervention or participation of governments or in some other form of coercion or obvious fraud, this and not something else is what needs to be criticized and with valid economic arguments.

If a cause needs a nonsensical economic argument, it is not a good cause. But why not throw another argument in the balance in case it’s the one that sticks? Well, rational analysis in the search for the truth does not work that way (although the shock of bona fide arguments is useful). I am reminded of an old joke: A guy is sued by his neighbor for returning with a big hole a beer mug he had borrowed. “Your Honor,” the defendant’s lawyer tells the Court, “our case rests on three facts. First, my client never borrowed the mug. Second, when he borrowed it, the hole was already there. Third, he returned it in perfect condition.”

READER COMMENTS

Craig

Jan 20 2024 at 12:43pm

“If somebody wants to buy holy water at a price a supplier is happy to accept, let him or her do it. Laissez faire!”

Indeed….but*

Before my children were born my business colleague was planning a trip to Israel and I asked if it wouldn’t be too much of an imposition to get a bottle of Jordan River water so that I could baptize my children with water from the Jordan River. So yes, he filled up a plastic bottle, carried it back in his luggage on the plane back to the US and on the next shipment to my business the bottle made its trip to me. Receiving the bottle, the water is river water and it was obvious it had particulate matter floating around in it. So first step is I put it through the last use of my water pitcher filter. Added 2 oz of rubbing alcohol, then I brought it to a boil knowing all of the alcohol would boil off, then I froze it, boiled it again upon which I salted it and then froze it one more time and then I pulled out the ice leaving behind a fair amount of briny water. And for good measure I brought the ice to a boil one more time because honestly at that point I was just playing. As Adam Sandler was wont to say in the Waterboy, “That there is some high quality H2O”

I’m not sure how much it would’ve cost to Fedex a bottle of water from the Jordan River to the US. Likely hundreds of dollars. The majority of the cost of this particular bottle of water which, by the time I baptized my children with it, had whittled down to about 4 oz of water, was simply incidental to trips and business expenses already being incurred, the bottle piggybacked our commerce.

Some seem to be morally opposed to the bottled water industry, generally on environmental grounds. I don’t share that sentiment but I am surprised by how much people are willing to pay for bottled water. I do use bottled water, I get whatever is on sale and that tends to be ‘Great Value’ or Publix or this brand ‘Niagara’ in TN which the stores sell for $8.88 for 3 cases during their ‘crazy eights’ sale. I use them for bicycling and going to the gym and I actually do refill the bottles, but there’s obviously still turnover. My wife enjoys ‘SMART’ water which is not too smart if you ask me. I try to buy it for her on BOGO at Publix, but ounce for ounce its still relatively expensive. And yes, I do surreptitiously partially refill her SMART bottle water with filtered if I see it sitting around. Yes, I do this.

* can I ban my wife from buying SMART water? 😉

Pierre Lemieux

Jan 20 2024 at 3:12pm

Craig: You thought that the water was still holy after all these chemical manipulations?

Craig

Jan 20 2024 at 3:43pm

Of course, I boiled out the vibrio cholerae bacteria not the holiness!

Andrea Mays

Jan 20 2024 at 1:24pm

How far have we come since the church sold indulgences?! (Not very far, and for similar reasons— raising $$ in exchange for virtue.)

Craig

Jan 20 2024 at 1:27pm

You win econlib today for that comment.

Matthias

Jan 21 2024 at 11:37pm

It’s not clear to me that indulgences by themselves are a bad idea.

Of course, there were some excesses.

The protestants say that faith alone gets you salvation (or something like that). The Catholics say it’s faith and good works. Everything is fungible, so giving money to the ‘best’ charity, the Catholic church, should surely count as a good work.

Dave

Jan 23 2024 at 11:17am

Not Catholic but I understand the Catholic Church still gives them out. You can’t buy them but they are given for good works, etc…

Jose Pablo

Jan 20 2024 at 1:43pm

Central planners know the “inherent economic value” of every good and human activity. In fact, “inherent economic value” is, precisely, the value that “central planners” assign to every good and service (and services are always looked with suspicion) in a planned economy.

One key issue for GWW (Global Warming Warriors) is that the economy should be “more planned” because, at the end of the day, “markets” are the main culprit of the dire state the planet is in now.

Markets are what destroy us. Precisely because they lack the key concept of “inherent economic value”.

Don’t you get it? If there is not space in your model for the “inherent economic value” concept, then, what is wrong is your model (and as proof of that, your “model” is going to cause the grilling of Planet Earth).

Craig

Jan 20 2024 at 1:52pm

Economic calculation should give leftists pause. It doesn’t.

“Central planners know the “inherent economic value” of every good and human activity. In fact, “inherent economic value” is, precisely, the value that “central planners” assign to every good and service (and services are always looked with suspicion) in a planned economy.”

They will eventually concede the point but the next frontier will be AI and the argument will be out fought along the lines of ‘well we couldn’t then, but we can now’ <– its coming

Pierre Lemieux

Jan 20 2024 at 3:22pm

Craig: Interesting point about AI. (And then, instead of blaming “the supply chain,” the government could blame the shortage of potatoes on an AI hallucination!)

Craig

Jan 20 2024 at 3:59pm

Look at the bright side, the AI will know we need tampons before we do.

Pierre Lemieux

Jan 20 2024 at 3:16pm

Jose: I did open the door to the possibility that central planning might be good for the future of humor.

Dave

Jan 23 2024 at 11:28am

Inherent value? Is this Econ 101? Value is subjective which means it takes a human in the loop to determine how determine value. It’s built into the meaning of the word.

BC

Jan 20 2024 at 4:15pm

“Guyana is generating millions of carbon offsets for preserving rain forest that is unlikely to be cleared anyway….The South American country in 2022 sold 37.5 million carbon offsets…for at least $750 million”

I am willing to agree to not spend every dollar I have buying and running machines to deliberately release as much CO2 as possible into the atmosphere. How do I sell carbon offsets to get properly compensated for my willingness to cut CO2 emissions?

Pierre Lemieux

Jan 20 2024 at 10:44pm

BC: That’s a good question. Perhaps you could by forming (or joining, if it exists somewhere) an environmental association that sells carbon offsets on behalf of its prudent, low-breathing members. But then there would be a collective action problem: the free-riders in the association might cancel your own efforts. Another way perhaps: get a job at a corporation that is buying tens or hundreds of millions of dollars of carbon offsets. Your salary will be a fraction of one percent lower than if you had got a job at a corporation that does not spend so much on carbon offsets. On the other hand, your own carbon savings are infinitesimal.

But you do illustrate how the market for carbon offsets is far from perfect.

David Seltzer

Jan 21 2024 at 12:48pm

Pierre wrote, “But you do illustrate how the market for carbon offsets is far from perfect.” Alas, In 2003 Richard Sandor Founded the Chicago Climate exchange (CCX). It was a voluntary contractual system for for trading carbon credits in North America and Brazil. By 2010, the CCX ceased trading carbon credits due to inactivity in the U.S. carbon markets.

A market failure? I’m not sure.

Pierre Lemieux

Jan 21 2024 at 9:25pm

That’s an important piece of information, David. There is a Wikipedia entry on CCX. Perhaps carbon-offset markets are indeed just super-holy-water markets.

Dylan

Jan 23 2024 at 5:19am

Note, voluntary carbon offset markets are still active and now we have an insurance product for voluntary carbon offsets. Markets in everything.

BC

Jan 20 2024 at 4:54pm

Here’s how one might steelman the case against carbon offsets. When Taylor Swift pays (indirectly, through carbon markets) Guyana not to cut down trees, she is spending her own money on behalf of others, e.g., “humanity”. (Google “milton friedman four ways to spend money”.) Because the purported benefits are externalized, she is unlikely to seriously scrutinize whether Guyana would have likely cut down the trees without the carbon offsets, i.e., to determine whether the purported environmental benefits really justify the cost to her of the carbon credits. Instead, she may buy the credits for PR purposes. So, carbon offsets are unlikely to lead to efficient resource allocations re CO2 due to externalities.

Externalities seem to be a problem for carbon policy more generally. Policymakers impose costs on external parties, e.g., carbon taxpayers, for purported benefits for yet other external parties, e.g., “humanity” or “the planet”. Far from addressing externalities left unaddressed by markets, carbon policy just adds even more externalities to the mix.

Pierre Lemieux

Jan 20 2024 at 11:04pm

BC: I am not sure I understand your last sentence. The purchase of carbon offsets by Taylor Swift and her ilk would still reduce the externalities compared to what they would otherwise be–even if not by much.

Perhaps the argument or the hypothesis is as follows. These environmentalists who live off government (and industry) sinecures generated by the carbon scare pushed by the government itself illustrate mutatis mutandis an argument of Anthony de Jasay: by taking charge of the production of public goods (change for: the reduction of externalities), the state creates new opportunities for free riders to redistribute to themselves the tax money paid by others. (De Jasay develops his public good arguments mainly in Social Contract, Free Ride and Against Politics.)

TaxHaven

Jan 20 2024 at 5:27pm

“Markets” are arenas in which freely-performed and mutually beneficial transactions occur. Without either of those there can be no “market”: a “free market” is something of an oxymoron. There is no such thing as a “carbon offset market” because the entire scheme is a creation of government coercion: because governments set rules and require monies to be spent or certain actions to be performed, there can be no “market”. Aren’t these called “perverse incentives”? Bitcoin and physical gold trade in a true market, while there is no market in…driving schools or auto insurance…

Pierre Lemieux

Jan 20 2024 at 11:27pm

TaxHaven: I think your last sentence illustrates how your argument goes too far. By repeating the crux of my argument, perhaps I can show this. The crux of my argument is simply that “inherent” or “intrinsic” value is a useless concept to understand human interactions. But this does not mean that only perfect markets are markets or only perfect freedom is freedom. Consider the two following cases.

(1) A quick online search suggests that holy water from Lourdes can be purchaced for $1.23/oz. Assume, for the prupose of this discussion, that this is the average price of holy water. (Top holy water blessed by the pope, albeit at a distance, seems to be about $24/oz.) It makes no more sense to say that this holy water has no inherent value than to say that bottom-of-the-line but (real French) Bourgogne purchased at Trader Joe’s for $0.40/oz has no inherent value.

Now suppose that US government propaganda, instead of focusing on “Buy American,” starts preaching “Buy Holy Water.” (“It might not make America great, but it helps for eternal life.”) As a consequence of increased demand, the price of holy water doubles to $2.46/oz. It makes no more sense to say that holy water now sells for twice its inherent value. “Inherent” or “intrinsic” value is just somebody’s say-so. Given their subjective preferences, consumers now assign to holy water a value $2.46. (In reality, this is the marginal value; with consumer surplus, we have to say “a value of at least $2.46/oz.”) Government intervention has (arbitrarily) changed the allocation of resources with one effect being that holy water is now valued at $2.46/oz.

(2) Consider corn, which currently sells for $4.45/bushel. Since 40% of the US crop goes to manufacturing ethanol and related products, essentially because of a federal mandate, a certain proportion of the price of a bushel comes from a government-created market. Suppose that without this intervention, a bushel would sell for $4.00. (This estimate is from my blind crystal ball; don’t bet anything on it. It may look low because I suppose that the price of corn is an international price and that demand is not very elastic; yet, one might say, we should not forget that US corn production is about one-third of world production.) There is no clear sense in saying that the price of corn is 11% above it’s real value because of government intervention. And of course it is meaningless to say that it is 11% above it’s “inherent” value. The price of corn is what it is given supply and demand and all the factors that determine them; and so is the value of corn.

In both cases, we can or could–and should–criticize the government, but the concept of “inherent value” remains meaningless and useless.

Jose Pablo

Jan 20 2024 at 11:35pm

There is no such thing as a “carbon offset market” because the entire scheme is a creation of government coercion:

By the same token, then, there is not a market for “tax advisors”.

Government coercion creates an unbelievable number of markets. Think lawyers for instance. Almost any kind of them. HHRR regulation compliance. Migrant smuggling. The list goes on forever.

Pierre Lemieux

Jan 21 2024 at 1:22am

Jose: No kidnapping insurance market? No real estate market? No financial market? No black market?

Jose Pablo

Jan 21 2024 at 4:56pm

I did say “the list goes on forever”. I am sorry for my lazyness.

Pierre Lemieux

Jan 21 2024 at 9:21pm

Jose: I meant the contrary of how you seem to interpret my comment. If only perfect markets are markets, there is no market anywhere and there will never be. Idem if only perfectly free markets are free markets. Imperfect markets are often a way to get around imperfections. Black markets are an example.

Mactoul

Jan 21 2024 at 2:45am

Suppose I derive satisfaction in letting my tap run all day–perhaps i like the sound. Supposing the tap water is paid for-no subsidy.

Then does my behavior is economically efficient or not.

If not, why not?

Pierre Lemieux

Jan 21 2024 at 9:15am

Mactoul: If you pay the free market price of water, yes, of course–just as if you listen to Bach or to a Hare Krishna chant.

Pierre Lemieux

Jan 21 2024 at 9:26am

PS: I just checked that one can listen to Hare Krishna on Apple Music. Annual subscription: about $100/year.

Jose Pablo

Jan 21 2024 at 5:09pm

If letting your tap run all day is the better use you can think of for the resources (priced at market price) required to provide you with such satisfaction, what alternative use of these resources would be more economically efficient for you?

Now, if you think there is a more satisfactory alternative use of these resources then you will devote these resources to that alternative use.

Maybe you think that somebody else should / could “decide/prescribe” a better use of these resources for you. My father used to play this role in my case, but that was a long time ago and I don’t let him make these decisions for me anymore.

Matthias

Jan 21 2024 at 11:40pm

Your throwaway joke at the end actually has a basis in judicla proceedings: https://en.wikipedia.org/wiki/Argument_in_the_alternative

It’s not as crazy as it sounds.

Pierre Lemieux

Jan 22 2024 at 11:42am

Matthias: Thanks for your interesting comment and link. One relevant difference is well explained at the end of the Wikipedia entry:

It is the difference between affirming a counterfactual (the beer mug joke) and explaining the implications of an alternative hypothesis (“argument in the alternative”).

The case of supporting a valid (or proposed-as-valid argument) with a non-sensical one is not identical to either. The WSJ claim against which I argued is closer to this third sort of argumentation.

Ron Browning

Feb 4 2024 at 8:28am

An art patron commissions a portrait of themself and pays an artist $1000 for the completed work.

The artist has created $1000 of value.

The patron puts the painting in the attic without ever looking at it. 10 years later at the estate auction of the now deceased patron’s possessions, the portrait draws no bids and is thrown in the dumpster.

How is this value issue to be described?

Has $1000 of value somehow been destroyed? presumably $1000 of value is still considered to have once been created. If $1000 of value has been destroyed, how and when did this take place?

Comments are closed.