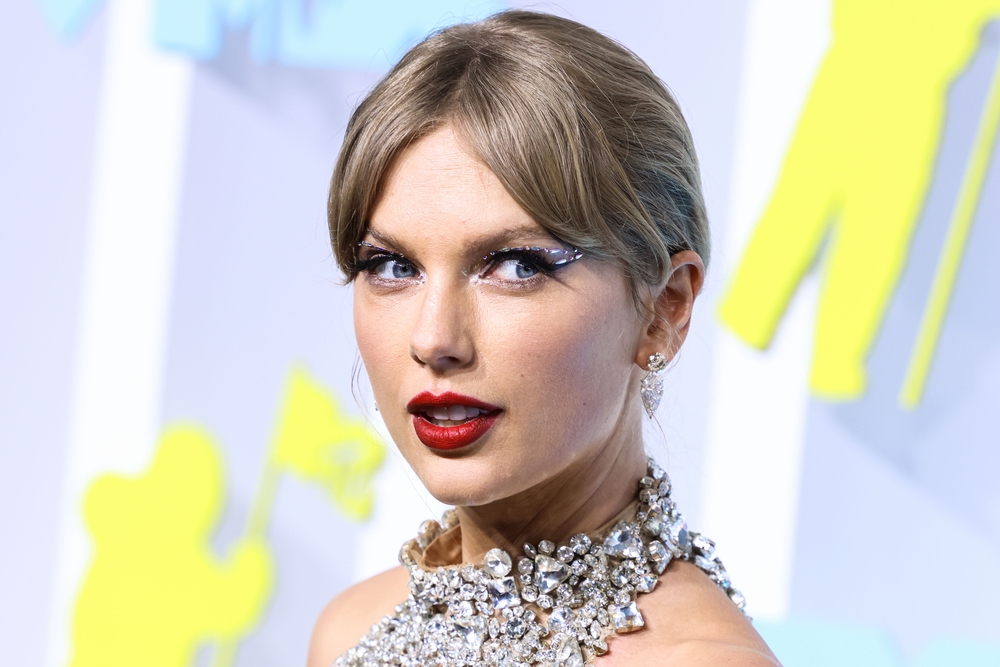

What’s the deal with Ticketmaster and concert fans? Taylor Swift fans were upset at Ticketmaster when the company canceled the general sale of tickets for the first leg of her U.S. tour. And then they were equally frustrated with the inability to get tickets. Fans seemed to have two major complaints. One, people are upset they could not get tickets to the event. Two, people feel service fees charged are too high. The assigned culprit? The greed of Ticketmaster and parent company Live Nation. Does this culprit make sense?

At least for Taylor Swift, the demand far outstripped the supply of tickets. Far more individuals signed up for pre-sale than tickets available. For the first U.S. leg of Taylor Swift’s tour 3.5 million individuals registered for the pre-sale while 2.4 million tickets were sold. And in many locations hundreds of fans gathered in the parking lot to simply hear the concert. But this explanation doesn’t seem to satisfy hungry fans upset that they didn’t get tickets to the show. It is the greed and monopoly of Live Nation that seems to be the issue.

Fans argue Live nation owns the venues and the ticketing system, thus creating a monopoly. Who then has the power in this market? Live Nation argues they own only 5% of venues, but others estimate they control up to 70% of ticketing. I believe the bigger issue is one that is unavoidable due to the nature of the market.

Let’s consider for a moment the fast food market. If I really want a McDonald’s hamburger, but they are sold out or unavailable for some reason, I can simply have a Wendy’s or Burger King sandwich. Are they completely interchangeable? No, but they are close enough substitutes that it is reasonable to interchange them.

Now back to Taylor Swift. If I live in Denver and all the tickets are sold out for the night she comes to Denver, what are my options for that night? There is no comparable substitute for Taylor Swift. There is no ‘Wendy’s’ equivalent to Taylor Swift. By the nature of the market, Taylor Swift has created a monopoly for her concert that night. Even if the best singer in the area came to a competing venue saying she was going to sing all the Taylor Swift songs in a concert for everyone that didn’t get tickets, this is not a comparable substitute. So who really has the power? Is it Live Nation or Taylor Swift? I would argue it is Taylor Swift. And also her fans.

So what is the solution? Suing Ticketmaster? Getting the government to come in and break up Ticketmaster? 26 fans are suing Ticketmaster and Live Nation for anti-competitive practices, saying the companies use their power to charge above market prices. Yet, they must not be charging above market prices because people are reselling their tickets for well above the sticker price. This indicates to me that the initial price of the ticket was ‘too low’ according to supply and demand.

In fact, artists including Taylor Swift, price “below market” to try to make their concerts accessible to all fans. Pre-sales and verified fans are systems put in place to try to get tickets into the hands of actual fans planning to attend the concert and not scalpers. But selling concert tickets at below the market value creates other problems. We have established that demand far exceeds supply. There has to be some way to allocate this scarce resource. One way is allowing prices to dictate who values them the most monetarily, one is to have a verified fan process and lottery system. But whatever the system, some set of fans will be disappointed in not being able to buy tickets.

Perhaps we can have the government come in and allow other sellers to sell tickets. The government can create competition in the selling of tickets. But what makes us think multiple sellers would make the market any different? If I know I am selling a ticket to a unique event with excess demand, I would have no incentive to try and undercut my competitor because I know the tickets will sell regardless.

What about service fees? What is the purpose of fees? I previously would have had to stand in line to get tickets. For a massive concert, I might have had to sleep overnight or stand in line all day for a ticket at the actual box office. Online services allow me to save that time in line. I may have to ‘wait in the queue’, but it is virtual. I could continue working, watch a show, or tweet my favorite Taylor Swift lyrics while waiting. I no longer have to brave the elements to get my tickets. The service fee is me paying for the convenience to purchase my tickets at home.

Service fees are relatively unavoidable. Typically, box office fees are less than online but not always. So, what is the solution to this? Well, I have the power in this case. I can simply stop giving the online providers my business. I can buy my tickets at the box office. Occasionally, I will have to forgo a show if I feel the service fees are too much. Taylor Swift still has all the power as the monopoly artist. She could negotiate different fees with Ticketmaster.

And if I genuinely feel prices and fees are too much, there is an alternative. It doesn’t feature the live Taylor Swift, but it does feature other dedicated fans. Some companies are hosting Taylor Swift themed parties, dances, and sing-alongs. Even in a market with a monopolist artist, individuals have found ways to create alternative experiences for fans to connect with one another and the artists music.

This situation is representative of broader implications of how markets work. People are quick to assign greed as the reason for various issues, but greed is ever-present. Issues with access to products in the market always come back to scarcity, which is also ever-present. There are various ways to deal with scarcity. Individuals can demonstrate their willingness to pay through money, time, or other means. The government coming in to dictate the way to run a particular market ignores the underlying issues with that particular market and the desires of the individuals involved.

Amy Crockett is a PhD Candidate in the Department of Economics and a Graduate Fellow in the F.A. Hayek Program at the Mercatus Center, both at George Mason University.

READER COMMENTS

Peter Gerdes

Nov 2 2023 at 4:23pm

I used to see this as a weird case of anti-capitalist attitudes ruining an efficient market too – however, I now realize it’s more complicated than that. In effect Taylor Swift is offering fans a discount to advertise her music.

A band interested in maximizing revenue needs to be far more concerned about the risk of becoming unpopular than it does failing to profit maximize at a venue. Experiments have shown that the quality of the music matters less than our perceptions about who else is listening to that music.

So imagine if Swift sold tickets at something near the clearing price. She’d end up with a stadium full of middle aged lawyers, programmers and spoiled rich kids. Sure, she’d maximize revenue short term but she losses all the word of mouth from teens who went to the show and loved it and risks creating the perception she’s not the music for hot hip teens but old fogeys.

Now she’d like to choose who she pays to advertise the show – and to a degree she can by withholding tickets for giveaways, promotions etc, but short of demanding everyone who wants a ticket apply and using ML on their social media (generating a backlash) this is the best move.

And ticketmaster exists to absorb the anger.

Matthias

Nov 3 2023 at 12:05am

This is plausible, and crucially does not require musicians to actually be aware of what’s going on.

MarkW

Nov 3 2023 at 7:15am

What about service fees? What is the purpose of fees? I previously would have had to stand in line to get tickets. For a massive concert, I might have had to sleep overnight or stand in line all day for a ticket at the actual box office. Online services allow me to save that time in line.

Yeah … except when you live near the venue and can easily go by the box-office, you still have to pay the Ticketmaster service fee even when buying in person. Owning both the major ticketing system and controlling the major concert venues does give them monopoly power. And they do seem to abuse it. This is completely apart from the issue of their not being enough Taylor Swift tickets to go around. Many other artists don’t have this excess demand problem. But Ticketmaster tacks on the same fees. There are very few companies I have to deal with that I can’t stand and would love to never do business with again if I could. My local cable internet provider is #1, but Ticketmaster is also on the short list. That said, my interest in arena-sized concerts generally is pretty much over (and you’d have to pay me to go to Taylor Swift show), so personally it’s not much of an issue any more.

Dylan

Nov 4 2023 at 7:26am

Yeah, that part kind of confused me as well. After all, Pearl Jam vs. Ticketmaster was a thing before buying tickets online was a thing. Like you, my desire to go to any big venue to see a show these days is pretty much nil, so not something that gets me really worked up. But, I remember how much dealing with Ticketmaster sucked back in the day, and it seems to have only gotten a worse reputation since then.

Thomas L Hutcheson

Nov 3 2023 at 10:22am

Personally, I’m more worried by the lack of popular enthusiasm for correct pricing of the CO2 emissions externality than for the correct pricing of Taylor Swift tickets. YMMV

Mike Hammock

Nov 3 2023 at 12:20pm

Nitpicking:

Demand didn’t outstrip supply, because demand and supply are functions–they’re relationships, not numbers.

Quantity demanded outstripped quantity supplied.

More generally, so long as Taylor Swift sells a particular number of seats, and so long as demand is high, prices will be high, either in the primary market or the secondary market. Price is just the messenger here, and the messenger is saying “these seats are greatly valued and very scarce”. Getting angry at the messenger will not make more seats available, nor will it make them less expensive. Even if Congress got involved and imposed a price ceiling of $50 per ticket, this would only 1) create a massive shortage of tickets due to the increased quantity demanded, and 2) create an even larger secondary market (possibly a black market). Government can force tickets to be cheap, but it can’t force them to be abundant.

Unless…

Maybe the government could require Taylor Swift to perform a show every day, or even two shows a day. That might bring the price down.

Monte

Nov 3 2023 at 1:23pm

Is Ticketmaster and unfair monopoly, or just another convenient rectum for government to meddle in the market with? Also, wouldn’t selling non-transferrable tickets solve most of the underlying issues?

Michael Stack

Nov 4 2023 at 12:08pm

Respectfully I think you all misunderstand what is happening here.

Ticketmaster exists to maximize revenue for performers like Taylor Swift. Keep in mind that the majority of the Ticketmaster revenues get kicked back to the performers and the venues. The venues and performers are the resource in relatively fixed supply, so it wouldn’t make sense otherwise for Ticketmaster to be able to charge such large fees. After all, wouldn’t the performers prefer to keep those high fees for themselves?

Ticketmaster actually negotiates the terms of the fees collected, but I believe it is all under NDA.

I’m not going to provide links here (otherwise my comment will likely get flagged as spam), but if you Google for it, you’ll find interviews with the ex CEO of Ticketmaster confirming that upwards of 80% of fees collected get sent back to the artist & venue.

Obviously Ticketmaster would prefer to keep this quiet. They’re not really even a ticket provider (a trivially easy service to provide), they’re the blame-takers in this market. That’s what they get paid for.

Monte

Nov 4 2023 at 3:30pm

I see. So…artists and venues are sort of like Mrs. Kissel in the movie, 10. Whenever Mrs. Kissel breaks wind, we beat the dog. Whenever artists and venues get their kickbacks, we blame Ticketmaster.

Michael Stack

Nov 4 2023 at 3:48pm

Yes, exactly. They take the blame for the higher ticket prices, and insulate the artist.

It reminds me of what the Chicago Cubs did about 10 years ago – they sold tickets at face value to a 3rd party who then sold the tickets at market pricing. The catch was, this 3rd party was a company owned by the Tribune, just like the Cubs were.

It was a shell game designed to (a) fool the public and potentially (b) move revenue away from MLB and revenue sharing agreements.

In the case of concert tickets, it’s just about fooling the public.

MarkW

Nov 5 2023 at 12:48pm

This makes perfect sense. And it also makes sense why they would have to keep the kickback deals secret. I wonder what the limit is to what Ticketmaster could charge as a ‘service fee’ before it becomes too obvious to everybody what”s going on?

robc

Nov 6 2023 at 5:25pm

Okay, now explain Pearl Jam.

What you are saying makes sense, but why didn’t Pearl Jam get their cut?

MarkW

Nov 7 2023 at 6:27am

My guess would be that at the point of the Pearl Jam tour, Ticketmaster hadn’t yet completely consolidated their control or fully worked out their business model. Note that AFAIK, we haven’t seen any more bands repeat Pearl Jam’s attempt to do a tour without Ticketmaster. Maybe that’s possibly because now Ticketmaster knows how to buy them off with kickbacks from the fees?

I’m reminded of British health minister Aneurin Bevan explaining how he’d warded off criticism from MDs when forming the NHS — he said he’d ‘stuffed their mouths with gold’.

johnson85

Nov 7 2023 at 9:57am

I’m a little skeptical this is the case. We have a local venue that hosts, among other things, independent minor league hockey (basically semi-pro as I don’t think any of them can survive off of what they are paid). Tickets will be as low $5, but ticketmaster will tack on $15 in fees if you buy online, and those fees aren’t charged at the venue. Why would the venue staff the gate and give such a discount if they are getting a kickback on the fees? Same thing with the local minor league baseball team. Ticketmaster fees will be >30% of the ticket sales online, but you can avoid them at the gate. Unless there is a belief that people lining up to buy tickets is basically advertising (which would be sort of plausible for the baseball stadium but not really for the venue with hockey), it seems unlikely that ticketmaster would be sending a lot of those fees back to the venues if they are paying staff to provide an inperson option to avoid them.

Comments are closed.