In a recent post, I pointed out that how we define words doesn’t matter when considering substantive issues. Thus whether addition addiction is defined as a mental illness should have no bearing on how we treat addiction.

An old Noah Smith Bloomberg column reminds me of how definitions can lead us astray. Smith points out that (in 2018) Bitcoin prices had recently crashed, after previously soaring to a peak of $19,000. He acknowledges that Bitcoin prices might boom again in the future, but nonetheless defines this as a “bubble”:

But for ordinary investors, who don’t tend to get in early on potentially revolutionary new technologies or to have the savvy or luck to time the market, the Bitcoin bubble should serve as a learning experience. The most important lesson is: Financial bubbles are real, and they will make your life’s savings vanish if you aren’t careful.

Formally, an asset bubble is just a rapid rise and abrupt crash in prices.

I don’t have a big problem with Smith’s claim, but it seems odd to view this as a “lesson”. We didn’t need Bitcoin to know that asset prices often rise sharply and then fall.

This is not the definition of bubble that I prefer, but it’s pointless to argue about definitions. I’d rather debate substantive issues. So let’s consider this remark:

Bubbles are extremely hard to spot — if it was easy, they wouldn’t exist in the first place.

I’m confused. Why is it hard to spot a sharp rise and fall in price? I could imagine that it’s hard to predict a big rise and fall in price, but why would it be hard to spot a bubble?

A generous reading of Smith’s comment is that I’m interpreting “spot” too literally. He presumably means something like the following (from the same column):

Instead, it seems overwhelmingly likely that Bitcoin’s spectacular rise and fall was due not to rational optimism followed by sensible pessimism, but to some kind of aggregate market irrationality — a combination of herd behavior, cynical speculation and the entry into the market of a large number of new, poorly informed investors.

When Smith says bubbles are hard to spot, it seems like he is saying something like the following:

“It’s hard to spot situations where as asset is clearly overpriced relative to any sort of rational appraisal of fundamentals.” (My language, not his)

And that’s a perfectly fine definition of “bubble”; indeed it’s the definition that I would prefer. A bubble is a situation where an asset price is clearly overvalued, and likely at some point to fall back toward a more rational valuation. If that’s what Smith meant, then his comment:

Bubbles are extremely hard to spot — if it was easy, they wouldn’t exist in the first place.

would make perfect sense.

But if he’s defining bubbles as merely a sharp rise and then fall in price, then it makes no sense to say that bubbles are hard to spot. If the price has risen, but not yet fallen, then it is (by Smith’s first definition) not a bubble at all. To be a bubble you need sharp rise and fall in price.

Some readers might think I’m getting too cute—“Surely I know what Smith meant”. Yes, I think I know exactly what Smith meant. And that’s why I suspect his claim that a bubble is just a rise and fall in price is incomplete. He seems to have something more in mind. I believe that Smith (like me and most other people) implicitly defines a bubble as a situation where an asset is clearly overvalued relative to fundamentals. That’s why they are hard to spot—they haven’t crashed yet.

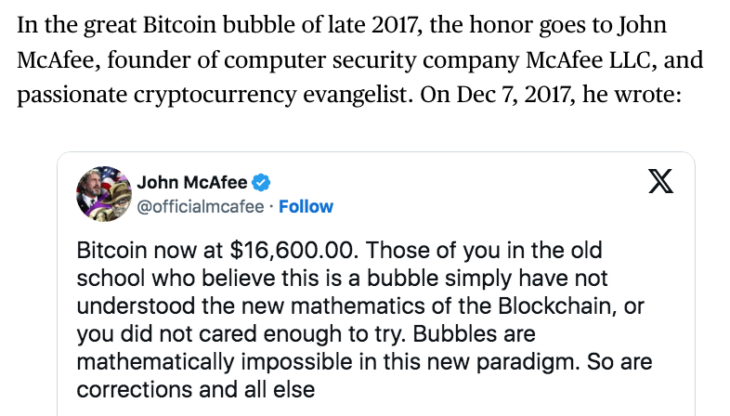

Why does any of this matter? Consider this sarcastic comment (the price of Bitcoin had fallen below $4000 at the time Smith wrote his column):

Now it suddenly makes a big difference how one defines “bubble”. Using Smith’s definition (a bubble is simply a big rise and fall in price), McAfee’s comment seems ridiculous. But if we use the more common definition that I prefer, and which McAfee probably prefers, and which Smith seems to implicitly have in mind in other portions of his column, then McAfee’s comment seem eminently defensible. I don’t know if Bitcoin was overvalued at $16,600 in 2018. But given its current price, McAfee’s 2018 claim certainly doesn’t look ridiculous. I interpret McAfee as saying Bitcoin prices are highly volatile, but we cannot predict where they will move over the long run. And that’s true! In contrast, an asset in the midst of a speculative bubble is a poor long-term investment, more likely to fall in the long run.

[To be clear, while I agree with McAfee that bubbles don’t exist, I find his explanation to be flawed. They are not “mathematically impossible in the new paradigm”; rather they don’t exist for Efficient Market Hypothesis reasons.]

Of course, if you define “bubble” as merely a sharp rise and fall in price, then bubbles do exist. But I doubt that McAfee would deny that assets rise and fall in price.

PS. When I do a post arguing that bubbles don’t exist, I sometimes get commenters telling me they disagree with me because a bubble is nothing more than a sharp rise and fall in price. But then exactly what are they disagreeing with?

PPS. Smith spends a good portion of his column discussing why he doesn’t believe the big swings in the price of Bitcoin are justified by changing fundamentals. I can’t comment, because I don’t really understand Bitcoin fundamentals. But his claim has no bearing on the point I’m trying to make in this post—that it’s important not to let definitions distort a debate over substantive issues.

PPPS. Commenters almost always ask me how I would test for the existence of bubble. I’d look for evidence that, in the long run, the class of mutual funds that invest using “bubble theory principles” outperform index funds. I define bubble theory principles as the buying of assets that the market currently prices at irrationally low levels and shorting assets that the market prices at irrationally high levels.

You say that’s hard to do? I agree!!

READER COMMENTS

Lizard Man

Mar 11 2024 at 8:23am

If there are bubbles, wouldn’t the most rational response be to purchase an index fund and hold onto it? I think one of the things you would expect to see if there are bubbles is a lot of volatility in the stock market. So one response to that volatility is to buy a diversified portfolio and hold onto it, in order to avoid losses caused by reacting to volatility.

Scott Sumner

Mar 11 2024 at 11:53am

No, I think you’d want to go long on undervalued stocks and short overvalued stocks. That would produce the largest gains in the long run.

Andrew_FL

Mar 11 2024 at 8:27am

Come on, this is nonsense bordering solipsism. Obviously if one defines “bubble” Smith’s way, a sharp rise and fall in price was a bubble when it rose, it didn’t only suddenly become a bubble when it fell.

Nor is it hard to understand Smith’s statement that a bubble, by his definition, is “hard to spot”. It is hard to spot a price rise that will subsequently sharply fall ex ante. It is easy ex post.

Scott Sumner

Mar 12 2024 at 4:58pm

“Obviously if one defines “bubble” Smith’s way, a sharp rise and fall in price was a bubble when it rose, it didn’t only suddenly become a bubble when it fell.”

That not at all obvious to me. Lots of goods rise sharply in price and don’t fall—are they bubbles?

robc

Mar 11 2024 at 8:34am

Using your definition, wouldn’t any arbitrage opportunity be due to a bubble, albeit an increasing smaller bubble [insert obvious song link here] due to the EMH becoming more and more true? And isn’t the EMH mostly true only because of investors taking advantage of arbitrage opportunities?

Scott Sumner

Mar 11 2024 at 11:54am

“And isn’t the EMH mostly true only because of investors taking advantage of arbitrage opportunities?”

Yes, that’s a reasonable way to think about it. I’ve always regarded the EMH as being close enough to the truth to be more useful than bubble theories.

robc

Mar 12 2024 at 9:16am

But isn’t that an admission that bubbles exist?

Its just that, due to the EMH being close to true, the bubbles are popped before they get very large, in most cases. In fact, they are usually tiny, tiny bubbles. The large bubble that most people think of as a bubble is very rare (but not nonexistent).

But I agree that EMH is much more useful than bubble theory, for that reason.

Scott Sumner

Mar 12 2024 at 4:57pm

“But isn’t that an admission that bubbles exist?”

The important question is whether bubbles are a useful concept.

robc

Mar 12 2024 at 11:14pm

To be a useful concept they have to exist, so that is the primary question.

If people make money via arbitrage and arbitrage is due to tiny bubbles, then of course it is useful.

spencer

Mar 11 2024 at 10:12am

I forecast the high in Bitcoin in Nov. 2021. And the next high is likely to coincide with the emptying of the O/N RRP facility.

Warren Platts

Mar 11 2024 at 2:15pm

I should say not because addition and addiction are completely different domains!

steve

Mar 11 2024 at 4:22pm

This still seems like fussy pedant arguments. There are clearly events where an asset’s price increases not due to any of its fundamental use in an economy but due to speculation about future value. That speculation may have some rational basis or it may not. When that speculation is wrong the price decreases. It’s also pretty clear that investors engage in groupthink. To paraphrase a quote I read long ago, “a banker will never be fired for being wrong if he is wrong in the same way that everyone else is wrong”.

Steve

Matthias

Mar 11 2024 at 9:00pm

There’s, almost by definition, no use in today’s economy for the 2025’s wheat crop. It’s all about anticipating future value.

Yet people trade claims on not yet existing crops all the same via futures. I don’t think that has anything to do with bubbles one way or another.

steve

Mar 12 2024 at 11:08am

Disagree. There is a long history of trading futures on wheat crops based upon past information and blending that with the predicted future. That is much different than the kind of speculation that is not based upon any real data but rather just exaggerated claims or FOMO. Sometimes we have had instances where prices rose because it was believed that the price of an asset could not drop, which has never been true of any asset ever in the history of the world, but people decided it had to be different this one time.

Steve

Scott Sumner

Mar 12 2024 at 5:04pm

“Sometimes we have had instances where prices rose because it was believed that the price of an asset could not drop”

I’ve never seen any evidence that this has ever occurred, in all of world history. Example?

Scott Sumner

Mar 12 2024 at 5:01pm

I’d encourage you to reread the post, I think you missed the point. Focus on Smith’s criticism of that bubble denier in late 2017. Is Smith correct?

Matthias

Mar 11 2024 at 9:05pm

Any discussion of bitcoin and (more) efficient markets via shorting should probably mention the two big events that made shorting bitcoin a lot easier:

The futures trading on the CME introduced at the end of (I think) 2017. And the recent legalisation and introduction of bitcoin ETFs in the US.

Weirdly enough, bitcoin’s price dropped a lot just after the introduction of futures trading. I don’t know whether that was a coincidence.

spencer

Mar 12 2024 at 9:46am

I changed my forecast. ISDA is recommending a permanent exemption of Treasuries from Basel III leverage calculations.

Dr. Daniel L. Thornton, May 12, 2022:

“However, on March 26, 2020, the Board of Governors reduced the reserve requirement on checkable deposits to zero. This action ended the Fed’s ability to control M1.”

James Picerno

Mar 12 2024 at 10:31am

Great article, Scott. On the topic of bubbles, they are indeed hard to spot, except ex post. Real time is something else entirely. I don’t have a silver bullet, but one tool is an econometric model I use as a first step, per the chart below. I wrote about it here, with a link for details in how I’m calculating bubble risk: https://www.capitalspectator.com/bubble-watch-sp-500-edition-05-march-2024/

Craig

Mar 12 2024 at 5:43pm

Wow, look at the dollar, it can buy 800+ argentine pesos today! I don’t care of course, I care about the dollar since I live in a place where everything is already denominated in dollars. Indeed Bitcoin has appreciated against the dollar? Is that saying something about Bitcoin or the dollar? I don’t know honestly, but I’d suggest Bitcoin wins the day you no longer care how many dollars Bitcoin can buy.

“The important question is whether bubbles are a useful concept.”

Difficult to time the market with that short play of course, but let’s look at housing for a brief moment. Let’s say people are buying by leveraging up. 30 year fixed rate mortgages are normal. What about 5 year ARMs as the income/mortgage payment ratios start increasing? And now you have a good case of FOMO and you start thinking, “I gotta get a house and I’ll even take an adjustable interest rate mortgage because after all, housing can only go up, right?” Now its 3 years later the interest rate adjusts upward, your wife is out of work because its a recession and now you GOTTA sell because now you NEED to deleverage. Many people get caught upside down.

I forget who its attributable to at the moment but when the tide goes out we all get to see who was swimming naked, right?

Bitcoin? No idea, its opaque to me, I have no idea how much leverage is or isn’t behind it. None, zero. I could see it go to 150k or to 1k, or $10. I have absolutely no idea.

Scott H.

Mar 14 2024 at 8:26pm

If we accept that bubbles are irrationally priced assets vis-a-vis their fundamentals, then the problem is that now you must predict the future course of irrationality in order to make money. Good luck with that. To make matters worse, as a society gets richer, irrationality can expand in scope, scale, and timeframe.

Bitcoin, baseball card, and painting valuations all qualify as automatic bubbles by this definition. I’m not sure this is where all the bubble lamenters had wanted to go (probably Dr. Sumner’s main point wrt most bubble talk).

Comments are closed.