Andrew Batson recently asked me for my thoughts on Chinese macro policy:

Could you write another post summarizing the argument of your talks in Beijing, about fiscal vs monetary policy for China right now? Conventional wisdom is favoring fiscal so interested in your perspective.

First, we need to be clear about what it means to use “fiscal policy”. There is a sense in which governments are always doing fiscal policy, as they always have some level of spending and taxation. But when people discuss the issue of whether fiscal or monetary policy is more appropriate, they have something more specific in mind. The real question is whether fiscal policy should be used for the purpose of controlling the level of aggregate demand.

In my view, monetary policy should always be set at a position where the expected growth in aggregate demand is equal to the policy objective. (That objective might be 4% NGDP growth in the US, although other objectives are certainly possible.) If the central bank enacts an appropriate monetary policy, then there is no role for discretionary fiscal policy. Full stop.

China should enact the tax and spending policy that makes sense from a cost-benefit perspective, without any consideration of the impact on nominal spending. Monetary policy should then take that fiscal policy into account when policymakers adjust their policy instruments (monetary base, interest rates, reserve requirements, exchange rates, etc.)

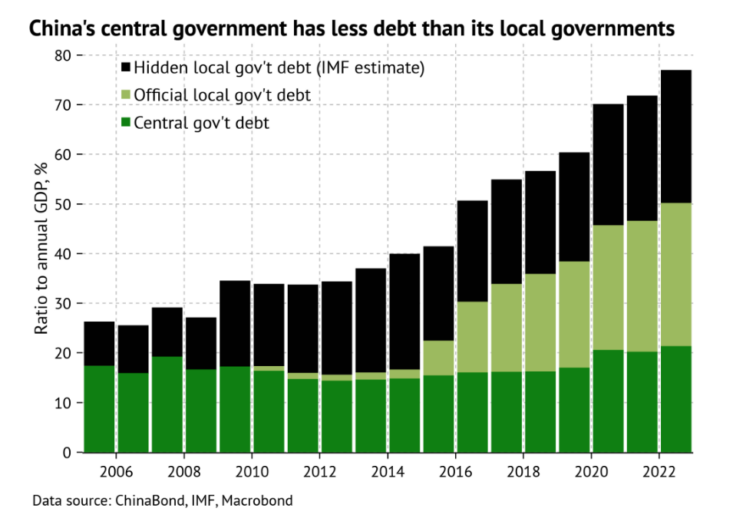

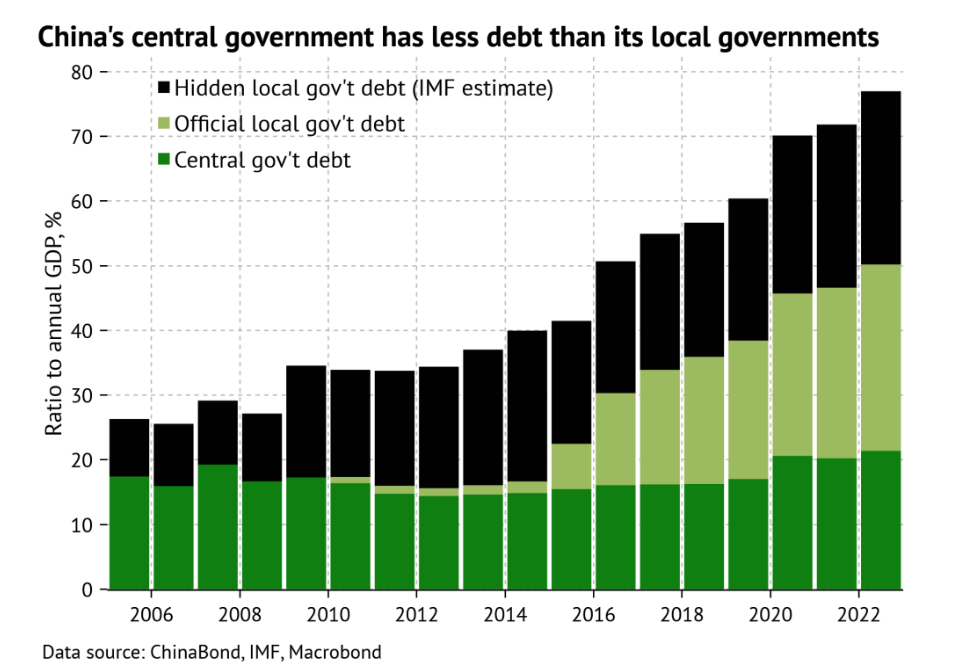

Western countries like the US have foolishly used fiscal policy to boost spending, and this has helped to create a public debt time bomb that will cause economic distress in the decades ahead. It is true that China’s central government debt is relatively low as a share of GDP, but as Batson points out in a recent blog post, China’s local government debt is implicitly a liability of the central government:

Such a distinction would make sense if China were a federal state: if the central and local governments were independent entities with clearly defined constitutional and legal roles and separate finances. But China is not a federal state, and local governments are not separate from the central government. There is only one government throughout China; local governments are merely the authorized agents of this state.

The graph he provides shows a worrisome trend:

When the public debt becomes excessive, governments are forced to raise distortionary taxes, or engage in other inefficient options such as hyperinflation. In contrast, monetary stimulus does not lead to an increase in the public debt, and hence is less costly than fiscal stimulus.

Now let’s consider three cases where people have argued for fiscal stimulus. In each case, the arguments are faulty:

Case 1: An economy not at the zero lower bound.

In China, interest rates are still well above zero. In that case, there is no plausible argument that monetary policy is ineffective at boosting nominal spending. Even so, most Western experts seem to recommend fiscal policy. I have no idea why.

Case 2: An economy where nominal interest rates are at zero, and expected to stay there forever.

In that case, the central bank should buy back any existing government bonds that are still paying positive interest rates with newly created zero-interest base money, and then begin buying other assets to boost nominal income. As Ben Bernanke once pointed out, such a policy would clearly be effective:

To rebut this [pessimistic] view, one can apply a reductio ad absurdum argument, based on my earlier observation that money issuance must affect prices, else printing money will create infinite purchasing power. Suppose the Bank of Japan prints yen and uses them to acquire foreign assets. If the yen did not depreciate as a result, and if there were no reciprocal demand for Japanese goods or assets (which would drive up domestic prices), what in principle would prevent the BOJ from acquiring infinite quantities of foreign assets, leaving foreigners nothing to hold but idle yen balances? Obviously this will not happen in equilibrium.”

Case 3: An economy where nominal interest rates are zero but expected to rise above zero in the future.

In that case, a central bank should engage in “level targeting”, by committing to return to the target path for nominal spending once interest rates rise above zero. Research by people like Paul Krugman, Michael Woodford and Gauti Eggertsson has shown that this sort of forward guidance is the optimal policy at the zero lower bound for interest rates, when the liquidity trap is not permanent.

Once again, however, this is all a moot point for China, where nominal interest rates are still positive. Chinese policymakers should look at the mistakes made in the US and Europe, and avoid going down the same road.

READER COMMENTS

Thomas L Hutcheson

Dec 17 2023 at 11:05pm

Absolutely correct, but I’d make one amendment: The cost benefit analysis that governments do is affected by monetary policy and whether it is or is not at the moment achieving its target. If the economy is in recession and the central bank has not yet managed to get inflation (or NGDP, if that is one target variable) up to a level to restore full employment, some spending will pass a cost benefit test (I prefer to think of a NPV>0 test) that would not pass when employment and inflation are on target. [And vice versa. If inflation is over target some things will fail the test that would pass when inflation and employment are on target.]A government that acted in this way would appear to be doing “Keynesian” economics.

Robert EV

Dec 18 2023 at 2:53pm

Given the lag time in appropriations to actual dollars in pockets isn’t spending typically a guess as to what will be needed at various points in the future?

Monetary policy would thus be more flexible and should thus be the part of the system which adapts to fiscal policy, regardless of what’s actually going on.

Robert EV

Dec 18 2023 at 2:55pm

Though I guess when taken to an extreme this would be a recipe for an eventually complete government-driven demand economy.

Thomas L Hutcheson

Dec 23 2023 at 8:41am

Yes, but that is implicit in the NPV analysis of any expenditure. It would not be wise to undertake an expenditure with a long build out period just because today’s borrowing cost and MC/price differential are “favorable.” Put the laid-off policeman back to work, not build another Hover Dam.

Matthias

Dec 18 2023 at 7:31am

Yes, the thought experiment of buying up all the assets in the world really shows why monetary policy can always raise inflation. (And that the inability to raise inflation would actually be an awesome ability for any money issuing institution to have.)

Scott Sumner

Dec 18 2023 at 4:10pm

Yes, just imagine if sub-Saharan countries in Africa had that ability!

vince

Dec 18 2023 at 3:55pm

The fact that there aren’t infinite quantities of foreign assets?

vince

Dec 18 2023 at 3:58pm

Is that a first-best policy?

Scott Sumner

Dec 18 2023 at 4:09pm

The first best policy is probably a NGDP growth target that is high enough where they don’t have to buy back the entire stock of public debt. Say at least 4%, with level targeting.

Comments are closed.