I often wonder if the human brain is wired to look for monocausal explanations. Think about how often you hear the phrase, “The real problem is . . . “

Why assume there is just one real problem? Most macroeconomic problems are somewhat complex. Here’s a typical situation:

1. A negative real shock slows economic growth, lowering the natural rate of interest.

2. Central banks are slow to react, and thus the policy rate moves above the natural rate.

3. This tightens monetary policy, slowing nominal GDP growth.

4. Because nominal wages are sticky, this slows economic growth by even more than the original negative real shock.

A recent Bloomberg article discusses Xi Jinping’s attempt to address China’s recent economic problems. The focus is entirely on non-monetary factors.

It’s true that China faces a number of structural problems. Xi Jinping inherited a highly flawed economic model, made a few improvements, but also created a new set of problems. In particular, China has moved in the direction of authoritarian nationalism, which is not good for economic dynamism:

As Xi’s corruption campaign rolls on after more than a decade of purges there’s a growing reticence to take chances among officials increasingly focused on security and studying Xi Jinping Thought. Bureaucrats “lying flat” is a problem even recognized by the top leader. At a key economic meeting in December, Xi criticized local officials for procrastinating or misinterpreting the party’s orders.

“Sometimes you have to give people the room to make mistakes. But right now that’s not there,” said Liqian Ren, director of Modern Alpha at WisdomTree Inc., a New York-based asset management firm. “That’s a problem for China. You need the local officials to be willing to try things.”

Of course, the Western world has also become more nationalistic. Thus China’s problems are partly due to factors beyond its control. But in my view a country’s performance is at least 90% determined by home grown policies, and at most 10% explained by external factors.

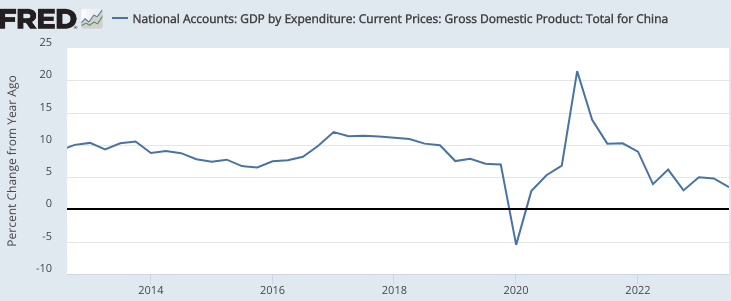

In addition to the structural problems in China, their monetary policy has recently become much more contractionary. In the short run, this has a bigger impact on growth that all of the various supply side problems:

A NGDP growth rate of roughly 4% might seem fine for a country like the US, but it represents a sharp slowdown from the roughly 8% to 10% figure seen during most of the past decade. This likely explains why the Chinese public is currently so pessimistic about the state of their economy. In contrast, long run growth is almost 100% determined by supply-side factors, as money is roughly neutral in the long run.

So what’s the real problem in China? Is it structural or monetary?

Why not both?

PS. I also agree with Adam Posen’s views on China’s structural problems.

READER COMMENTS

Thomas L Hutcheson

Mar 3 2024 at 7:29am

Why are central banks that use FAIT slow to raise the rate of inflation temporarily to deal with shocks? Don’t we need new indicators like Treasury issuing a NGDP security and more intermediate-tenor TIPS?

Todd Ramsey

Mar 3 2024 at 11:27am

YES on NGDP security!

Do you have ideas on how we can move from talk to action?

Thomas L Hutcheson

Mar 4 2024 at 6:30am

Talk it up in comments. I mention it frequently on my Substack. https://thomaslhutcheson.substack.com/

It’s something I’m pretty sure Treasury could do w/o Congressional action. TIPS definitely.

Scott Sumner

Mar 3 2024 at 1:54pm

I’m told that in late 2021 the Fed knew they’d overshoot NGDP’s trend line, and simply choose to ignore the warning.

Thomas L Hutcheson

Mar 4 2024 at 8:14am

And that is when TIPS was predicting over target inflation. My guess about when inflation stopped being facilitative of recovery from the pandemic and became excessive is around September ’21 then IPS went significantly over target.

Todd Ramsey

Mar 3 2024 at 11:33am

Another great insight as an offhand comment: “I often wonder if the human brain is wired to look for monocausal explanations.”

If true, why might that be? It’s plausible that we evolved in a less complex world where people who made quick analysis and took quick action were more likely to survive than people who paused to consider second and third order consequences.

Just a possibility.

Matthias

Mar 3 2024 at 7:00pm

Humans are perfectly capable of entertaining multi-causal relationships when it about technical problems.

As a stereotypical example, picture what a car mechanic might tell you why your clunker has problems. Or picture listening to your doctor telling you that you need to both lose weight and give up smoking and drink less alcohol and pick up some exercise (because all four are causal factors).

Human thought seems to switch into dumb mode when (tribal) politics are involved. You can easily spin some evolutionary story about our ancestors having to navigate shifting alliances.

Jim Glass

Mar 4 2024 at 2:05am

For multiple ideas about what’s troubling the Chinese economy here are three views, from Posen, Zongyuan Zoe Liu, and Michael Pettis, at Foreign Affairs.

(I read elsewhere that you don’t like videos, but perhaps others will be interested. And the algorithm being what it is, as I was copying that link it delivered a new one to the Center for Strategic & International Studies presenting five more varied views that seem pretty well informed. Those of Yanmei Xie and Logan Wright sound credible to me, FWIW, but I’m not the one to judge.)

Richard W Fulmer

Mar 4 2024 at 11:50am

Is it possible that at least some of the trend toward nationalism in the West is a reaction to China’s hostility and weaponization of trade (e.g., IP theft, forced technology transfers, engineering backdoors into electronics, cyber espionage and sabotage, preventing expats in China from leaving the country, and creating “debt traps” through its Belt and Road initiative)?

Scott Sumner

Mar 4 2024 at 1:14pm

I don’t agree that China has weaponized trade—that’s mostly Western propaganda.

“creating “debt traps” through its Belt and Road initiative)?”

When I was younger, Marxists made similar claims about multinational investment in the third world. Now the claims are made by those on the right, and they are equally wrong.

Richard W Fulmer

Mar 4 2024 at 1:49pm

Fair point about the debt traps. What about my other examples (IP theft, forced technology transfers, engineering backdoors into electronics, cyber espionage and sabotage, preventing expats in China from leaving the country)?

Scott Sumner

Mar 6 2024 at 6:53pm

Some of those might play a role, but in general I think the problems are overstated. IP theft is normal for developing countries, and probably desirable from a global perspective. The US did the same when we were a developing country. Spying is something all great powers do. I’m not defending China (I strongly oppose the Xi regime), but we’ve done a lot to provoke China through our anti-Chinese policies.

Jim Glass

Mar 6 2024 at 3:13am

Another opinion about China’s problems: Japan’s recent Ambassador to China, Hideo Tarumi, is creating a ruckus with a just published memoir. He reports a *big change* in Xi Jinping, who in 2009 was “remarkably humble … displaying both humility and generosity” — but who by 2015 had transformed into a completely different person, “totally changed … unrecognizable”.

It’s not available in English yet but here is a video report, and an article in Radio Free Asia, covering different parts of it.

So what’s the real problem in China? Is it structural or monetary?

My own opinion is worth little except to the extent it is informed by Douglas North, who got a Nobel for his work on how institutions influence economic development, and Stephen Kotkin, the definitive biographer of Stalin and top expert on Leninism and Russia.

North, in his book Violence and Social Orders (a *must read* for every Libertarian!) details among many other things a critical ‘quantitative requirement’ to develop a modern a first-world economy: a huge increase in the number of ‘organizations independent of the control of the central government.’ These may be local governments, businesses, unions, banks, non-profits, churches, schools and universities, social clubs, whatever. Their growth in number institutionalizes broad productive local economic and social activity, competition, innovation, finance, independent education, diverse thought, etc., all necessary for a first-tier productive economy. And their growing number brings with it the increased distribution of political power, driving the growth of democracy.

The numbers are striking. In 2000, nations with over $20,000 per capita income ($37,000 today) had 83% of the world’s total of such organizations against 17% of population … those with income from $5,000 to $20,000 had 10% versus 24% of population … those with income under $5,000 had 7% versus 59% of population.

Yet almost all states start authoritarian. They can grow their economies up to a point, but to continue past the $20,000 level the ruling regime must choose to liberalize their institutions. Some do, some don’t. See North and South Korea, which started out as sibling dictatorships. Moreover, regimes can choose to preserve their power by going backwards — see the 1930s (and more recent examples.) When regimes decide to become more authoritarian, the first thing they do is crack down on “independent” organizations — unions, businesses, schools, banks, all become “state…” Independent no more! Economic growth flatlines or reverses.

North didn’t consider China’s future in V&SO (in 2009), but it is clear that by the book’s logic China’s CCP regime would have a big decision to make at some point ahead of it. North said elsewhere that he was optimistic.

Kotkin, the authority on Leninism, was not optimistic. He said that while authoritarian regimes sometimes cede power for productive reforms, Leninist regimes never do. When the Czechs started reforming in 1968 and the Soviets invaded (I was there), Brezhnev said: “Reform is counter-revolution”.

Communist parties are brittle because they are *one* party states. If a “reform wing” starts to arise in the Party, that is an incipient second party – and an existential threat that must be purged. “Reform is counter-revolution”.

If increasing economic prosperity reaches the point of creating new independent “organizations” and social movements that may drain away political power from the Party, they will be crushed. (Jack Ma disappears, the private education industry is destroyed in a day, CCP members are appointed to corporate boards, the stock market falls $6.5 trillion…)

The great brittleness of the Leninist regime model of course is shown by the result of the one real attempt to reform it — Gorbachev’s, tried only when the economy was up against the wall, with immediate total collapse the result. Xi Jinping is totally fixated on never allowing that to happen in China. Kotkin’s books on the fall of the Soviet Union are taught at the CCP’s Central Party School. (They don’t pay him royalties — more IP theft!)

This also explains the CCP’s institutional fixation-addiction to “GDP by excessive capital investment”, never increasing the household share of GDP, which is a world-low.

Of course! Leninist regimes never want “the people” to have buying power – and the political power that goes with it. That’s why the Soviets put Cosmonauts into space before they had toilet paper, literally.

One more point: Kotkin shows that Stalin was not a paranoid sociopath murderer when he got the top job in the USSR. If he had been, he’d never have been given it by his peers. (On the way up he volunteered to resign several times, they all said “nyet, we need you!” each time.) He was not a terrible guy who happened to get the job, bad luck for Russia. He was a reasonable guy (by the standards of his peers) who became the historically terrible guy because of the requirements of the job. This squares exactly with what we see about Xi. In 2009 he was “humble and generous”, and at the time he got the top CCP job he was described as a moderate, compromise candidate. By 2015 he was “totally changed, unrecognizable”.

So … “Is the real problem in China monetary or structural?” Neither. It’s the CCP.

IMHO, FWIW.

sam

Mar 8 2024 at 7:07am

Interesting. And dovetails to Sumner’s starting point: multi-variant causal models are superior. Singular causal models are over-simplified.

In a confusing world that threatens the ‘me’, I project the ‘anti-me’ : a singular threat – the devil, the scapegoat.

Everyone who disagrees with me is Hitler.

And then it is hard to trade (compromise) when status gets involved.

BTW –

” Most macroeconomic problems are somewhat complex. ” Standup worthy line.

Comments are closed.