JP Morgan is one of America’s most important investment banks. So what should we make of the following claim?

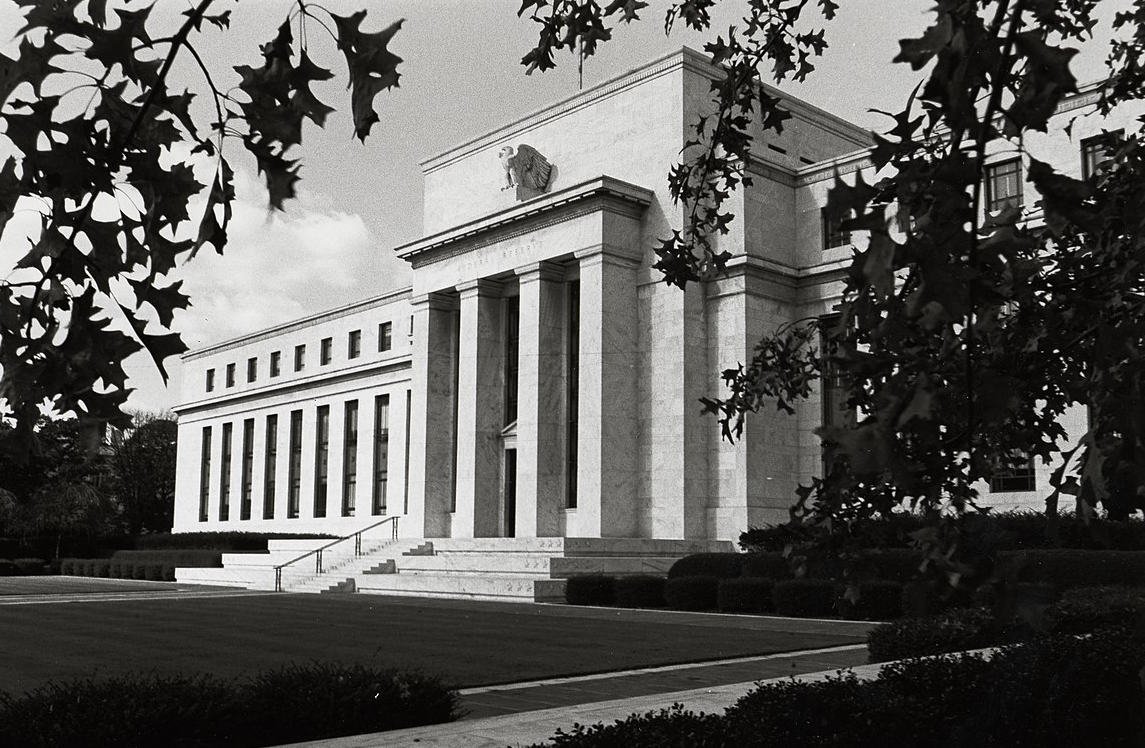

The Federal Reserve raised rates the most in decades to bring down inflation. High borrowing costs are supposed to put the brakes on the economy to keep consumer prices from rising too quickly.

But Jack Manley at JPMorgan Chase argues that the Fed’s current rate range of 5.25% to 5.5% are actually inflationary at this point, and that prices won’t stabilize more until the central bank starts cutting. . . .Manley’s idea is a provocative one. It also shows how little agreement there is on how to understand the economic cycle we’re in.

The same Bloomberg piece suggests that most conventional economists have a very different view:

This is pretty radical thinking, and flies in the face of a lot of economic thought. (When asked her take on this issue more broadly, Nationwide Mutual Insurance’s Kathy Bostjancic flatly disagreed with the thesis.)

I find all of this to be quite depressing (although see update at the end of the post.) Macroeconomists are still stumbling around, engaging in elementary economic errors—in this case, reasoning from a price change. Is it actually possible that in 2024 we are still debating whether higher interest rates are inflationary or deflationary (or don’t matter either way)?

Here’s the case for making fun of JP Morgan’s analyst: It makes no sense to speak of the effect of interest rates on inflation. Interest rates change for many reasons. Some of those reasons lead to higher inflation, and some of those reasons lead to lower inflation.

Here’s the case for not making fun of the JP Morgan analyst: Conventional economists often make the exact same error (reasoning from a price change), but in the opposite direction. They assume that higher rates are tight money, and will lead to lower inflation. Again, it depends on why interest rates increased. Thus the sharp rise in interest rates during 2022 mostly reflected the Fisher and income effects, not the liquidity effect resulting from tighter money.

Today’s disappointing inflation report is another reminder that we have not yet achieved a soft landing, despite all the premature “mission accomplished” statements we’ve seen over the past year in the financial press. High interest rates did not cause the recent bout of high inflation, but they also did not solve the problem.

Inflation depends on monetary policy, not interest rates.

Update: I listened to the video, and his comments are more ambiguous than I first thought based on the Bloomberg piece. Manley is not saying that lower interest rates cause lower inflation, he’s saying we should not expect lower inflation until we are in a period of lower interest rates

READER COMMENTS

MarkLouis

Apr 10 2024 at 2:12pm

I think what he is trying to convey is along the lines of “interest rate hikes do not tighten monetary policy.”

Not saying I agree, but that’s the assertion that should be debated.

Scott Sumner

Apr 10 2024 at 3:10pm

Yeah, it’s more ambiguous than I first thought. I added an update.

MarkLouis

Apr 10 2024 at 3:24pm

The underlying debate remains. Is there any world where an interest rate hike (all else being equal) loosens monetary policy?

Some are suggesting a world where lots of debt is termed out at fixed rates and government spending is insensitive to borrowing costs might be one such scenario.

Scott Sumner

Apr 10 2024 at 6:37pm

Sure, if the rate hike is caused by higher inflation.

MarkLouis

Apr 10 2024 at 7:16pm

Let me rephrase. Let’s say FOMC has a certain set of facts in front of them and decide to raise rates. In an alternate universe, a central bank is staring at the exact same set of facts and decides not to raise rates. Has the FOMC definitively tightened relative to the other central bank?

Scott Sumner

Apr 11 2024 at 1:31pm

I’d put it this way:

Raising IOR is a contractionary policy tool. So is reducing the monetary base.

2. The fact that interest rates are rising doesn’t mean policy is getting more contractionary. The fact that the monetary base is falling doesn’t mean policy is getting more contractionary.

Tapping the brakes on a car is a way of slowing down. But cars don’t always slow down when you are tapping the brakes—sometimes they speed up (on a deep downslope.)

There was a day in January 2015 when the Swiss National Bank sharply cut interest rates. But they also did other things on that same day, and as a result policy got much more contractionary that very day.

Craig

Apr 10 2024 at 2:36pm

Used to spend way too much time down at 4 NY Plaza. Prisonesque brutalist architecture befits Chase for sure. Turning into residential now! Laugh? No. Variables can be both headwind and a tailwind and I suspect tge comment deals with Chase getting paid more to deposit money at Fed? Perhaps instead of laughing one might suggest consider the world beyond Chase?

Knox

Apr 10 2024 at 3:00pm

I kinda agree that inflation depends on Monetary Policy. But M2 has been flat or even declining over the last two years. Shouldn’t that be reducing inflation?

Craig

Apr 10 2024 at 3:06pm

It has come down. Yes, last few months we see an upward trend potentially developing. But things didn’t go up in a straight line nor will they go down in a straight line. For instance one month in May or June 22 saw a 1.3% increase, the following month was 0.0

Scott Sumner

Apr 10 2024 at 3:09pm

M2 is not very reliable, except over the very long run.

John Hall

Apr 10 2024 at 3:21pm

When you say income effect, you mean higher incomes boosting real yields. Like more demand for investment. Correct?

Scott Sumner

Apr 10 2024 at 6:38pm

Yes.

HL

Apr 12 2024 at 2:13am

Extra insult: He has a bachelor’s degree from U Chicago (though in history).

spencer

Apr 12 2024 at 12:55pm

If the FED halves QT volumes, as now planned, then inflation may accelerate.

The FED is afraid to let interest rates rise in response to a scarcity of bank reserves. I.e., the FED discounts disintermediation of the nonbanks.

Ivan Tcholakov

Apr 13 2024 at 4:25am

If the Congress continues to borrow with its current apetite, yes, in the long run higher interest rate would drive higher inflation. Explicit Government failure does not exist by design, nobody is concerned by the “soft budget limit”, the Fed is here to give bailouts (this is the actual “monetary policy”), so… the guy is right to expect inflation ahead.

Thomas L Hutcheson

Apr 13 2024 at 7:12am

I think one should distinguish between monetary policy and specific instruments that the Fed uses to affect macroeconomic variables.